"Will I be able to manage my workload?" "Will I get along with my supervisor?" "What will my workstation be like?" These are probably just a few of the questions you've had when anticipating starting a new job.

While you may not be able to anticipate what exactly will happen on your first day of work, you can expect to complete some paperwork.

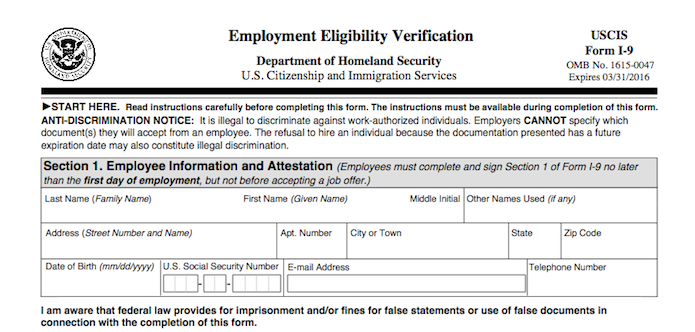

For every new employee hired to work in the United States, employers are responsible for completing Form I-9 (Employment Eligibility Verification) and keeping it on file. Issued by the Immigration and Naturalization Service (INS), this form verifies that employers have verified the employment eligibility and proper identification documents presented by each employee.

For more information, go to Employment Eligibility Verification on the U.S. Citizenship and Immigration Services website.

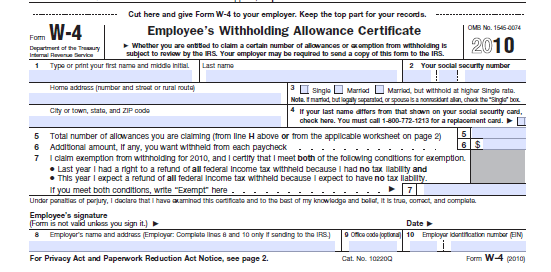

If you work in the United States, you are required by federal law to pay federal income tax. Unless you are hired as an independent contractor, your employer will use information you provide to fill out the W-4 form and withhold the correct amount of income tax from your pay. Issued by the Internal Revenue Service, Form W-4 includes three types of information your employer will use to determine your withholding:

Learn more at IRS.gov or review this sample W-4 form.

W4 Form

W4 FormYou will also file a state income tax withholding form. Using the information you provide, your employer uses this form to determine the correct amount of state income tax to withhold from your pay. Types of information that are used to determine your withholding may include your marital status, age, and number of dependents.

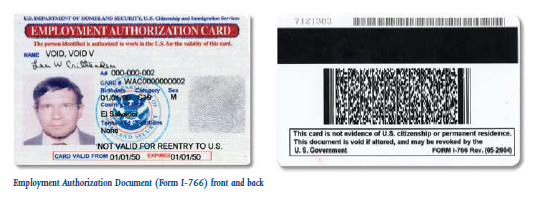

In order to complete this paperwork, many U.S. citizens wishing to work in the United States bring a state-issued driver's license or identification card and a Social Security card. However, there are several forms of verification that can be used.

Go to Part 8 of the USCIS Handbook for Employers (M-274) to see more forms of acceptable documentation.

Sample I9 Acceptable Identification

Sample I9 Acceptable IdentificationBe prepared to produce other personal information such as your maiden name if applicable, Social Security number, driver's license number, current address and phone number, and the name and information of an emergency contact.

/en/workplacebasics/workplace-safety/content/