This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 47,246 times.

If you run a business or provide services, you want to be able to accept payment from your customers in as many different ways as you can. Just imagine how many potential sales are lost if you have to post a sign that says, “Sorry, Cash Only.” So, learning how to accept Visa credit cards, which are a worldwide form of payment, helps your business become part of the global market.

Steps

Choosing an Acquirer

-

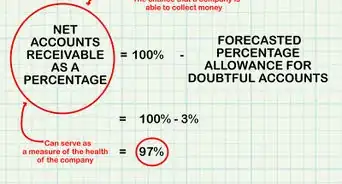

1Find an acquirer. In the credit card business, an “acquirer” is the bank that processes your credit card transactions. When a customer buys from you with a Visa card, you forward the credit card transaction to the acquirer. The acquirer then sends all your transactions to the Visa company. Visa collects the payment from the card holder (your customer), transfers the cash to your acquirer, who in turn pays you.[1]

-

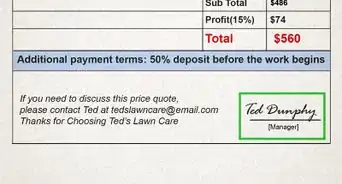

2Compare rates. In exchange for this service, the acquirer collects a fee. This fee is typically called the “merchant discount.” The merchant discount is a small percentage out of every sale you make.[2] You want to shop around and find an acquirer that charges the lowest merchant discount.[3]Advertisement

-

3Research authorized acquirers. The official Visa web site, https://usa.visa.com/, has a list of authorized acquirers, along with the states in which they are licensed to do business. Most of them authorized nationwide.

- From the Visa home page, select the link to “Run Your Business.”

- Then select the link to “Accept Visa Payments.”

- Scroll to the bottom of that screen, beneath “Ready to Get Started,” and you will find the list of approved acquirers and the states where they operate.[4]

-

4Find the best match for your business. Finding an acquirer with a low merchant discount rate is part of your goal, but you also want someone who will understand your business and be able to work with you. Ask about rates, but also take the opportunity to ask about several other details as well.

- Find out how many other businesses they work with that are similar to yours.

- Make sure that they can turn around your payments according to a schedule that works for you.

- Find out what services they will provide you in the nature of recording transactions and monthly reports.

- Ask how they deal with problems and how supportive they will be when something goes wrong.

- Ask what types of equipment and marketing materials they will provide to help you advertise your association with Visa.

Preparing to Get Started

-

1Get your own information ready. When you are ready to start a contract with a Visa acquirer, you will need to have some basic information ready at hand:[5]

- Your name, business identity, contact information

- Processing information – estimate the number of transactions you expect and the totals in sales that you anticipate

- Sales methods – be prepared to describe how you will conduct most of your business, either face-to-face in the store, online, via telephone, or some combination

- Bank information – you will need to provide your bank routing number and account number.

-

2Interview several acquirers. Remember that you need them, but they also need you. They are called "acquirers" because it is their job to "acquire" new businesses to do business with Visa. Remember that they are getting paid out of a portion of your ongoing sales, so you need to be satisfied that the match is right and that you have found someone who will truly be a strong partner for your business.[6]

-

3Sign a merchant contract. In the end, after you are satisfied that you have found an acquirer that will work well for your business, sign the contract and get ready to start.

Doing Business With Visa

-

1Decide your business style. Working with your acquirer, you need to decide how to proceed. Will you be an “on-the-go” kind of business, so you want to accept Visa cards through an app on your smartphone? Or are you a more traditional business, with a cash register at the counter and a stationary card reader? There are numerous sources available online to buy the equipment you need, or you may be able to get some of it provided directly from your acquirer. This is all part of your business plan.[7]

-

2Consider your transaction options. Working with the Visa company, or your merchant acquirer, you can discuss the variety of transaction options that are available to you. Choose one or more that will best serve your business:

- Traditional – If you have a single, small shop, you may just need a single card reader at the counter to be able to swipe your customers’ Visa cards.

- Smartphone – newer technology allows you to use smart phone apps to scan your customers’ Visa cards to complete the sale. This may be good if you have a more active, mobile sort of business.[8] [9]

- Online transactions – Visa offers a program called Visa Checkout. This lets you set up a system on your company’s website to accept online Visa transactions.[10] There are also numerous other platforms available.[11] You need to research the service that will best fit your company’s needs, your costs, and your sales methods.

-

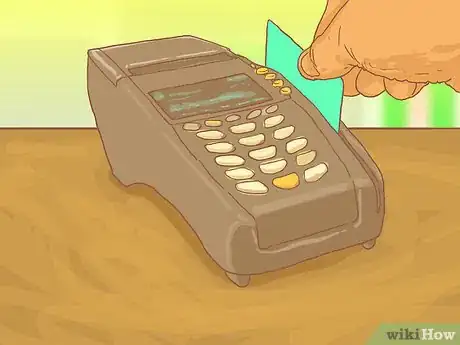

3Accept Visa card payments. Whatever method you decided to use, you will accept the buyer’s card, swipe the magnetic strip or use the new RFID chip reader, and enter the amount of the transaction. Verify the amount and push "enter." The transaction is complete.

-

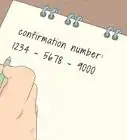

4Settle your accounts. Typically at the end of the business day, after you accept a number of Visa payments, you must "batch" your transactions and do a credit card "settlement." There are buttons on the credit card terminal with these options. Follow the instructions for sending the transactions through to the acquirer. Follow through until the acquirer confirms your settlement. You will see the credit card payments in your bank account within 1 to 3 days.

References

- ↑ https://www.creditcards.com/credit-card-news/assets/HowACreditCardIsProcessed.pdf

- ↑ https://usa.visa.com/content_library/modal/find-an-acquirer.html

- ↑ https://www.creditcards.com/credit-card-news/assets/HowACreditCardIsProcessed.pdf

- ↑ https://usa.visa.com/run-your-business/accept-visa-payments.html

- ↑ https://usa.visa.com/content_library/modal/find-an-acquirer.html

- ↑ http://www.accumulus.com/content/choosing-merchant-account

- ↑ https://usa.visa.com/run-your-business/small-business-tools/payment-technology/visa-checkout.html

- ↑ http://www.businessbee.com/resources/profitability/point-of-sale/the-5-best-mobile-credit-card-reader-apps-for-your-small-business/

- ↑ http://www.digitaltrends.com/mobile/square-vs-intuit-gopayment-vs-paypal-here-mobile-credit-card-processors/