This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 38,268 times.

Governments, corporations and other entities sometimes issue bonds to raise money for capital projects or public activities. It's a loan made by an investor to the issuer of the bond. The price paid (the amount loaned) is called the bond's face (or "par") value. The investor is paid interest, typically twice a year, that's called the bond's coupon rate. At the end of a pre-determined period of time, the bond is said to mature, and the issuer is then required to pay back the bondholder the original amount of the loan. Under IRS rules, investors and businesses have the option to amortize bond premium, but are not required to (unless they are tax-exempt organizations). Bond market values move contrarily to interest rates. When rates go up, bond market values goes down, and vice versa. This leads to market premiums and discount to par value. To record these amounts, bondholders should understand how to amortize a bond premium.

Steps

Using the Constant Yield Method

-

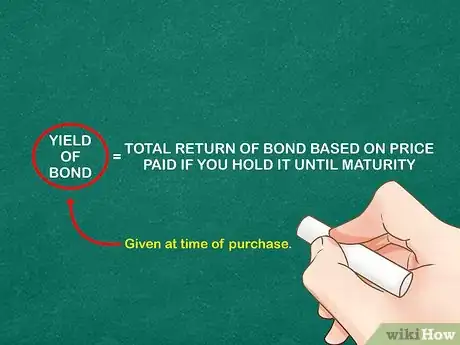

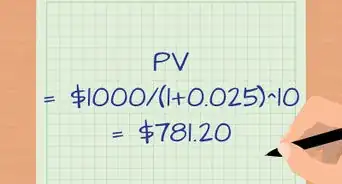

1Get the yield of the bond at the time you purchased it. The yield is effectively the total return that you'll receive on the bond, based on the price you paid, if you hold it until maturity.[1] This will be easy to retrieve because you'll be given the yield at time of purchase.

- You can also calculate current yield by dividing the annual cash flows earned by the bond (coupon payments) by the market price.[2]

-

2Calculate the bond premium. This is also easy to retrieve because it's the price you paid for the bond minus the bond's face value[3] . For example, if the you bought a bond for $104,100 with a face value of $100,000, then the premium is $4,100 or $104,100 - $100,000.

- The bond premium is the amount you'll amortize over the life of the bond.

Advertisement -

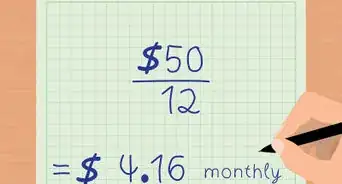

3Calculate the amount of interest you'll earn per payment. You'll need to know how much money you'll receive with every interest during the life of the bond. Remember, though, you'll use the face value of the bond to calculate the interest payments, not the amount that you paid for the bond.[4]

- For example, if you bought a bond for $104,100 with a face value of $100,000 and a 9% interest rate, you'll use the face value to calculate the interest rate. In this case, the annual interest rate is $9,000 or $100,000 x 9%. However, that's the annual interest rate and interest payments are typically paid twice a year, so each interest payment is $4,500 or $9,000 / 2.

-

4Record the book value. When you first purchase the bond, the book value is the same as the amount you paid for it. For example, if you purchased a bond for $104,100, then the book value is $104,100.

- The book value will decrease (or amortize) every time you receive an interest payment. If you hold the bond until maturity, the book value will be the same as the face value when you receive your final interest payment.

-

5Calculate the current interest expense based on the book value. To get the current interest expense, you'll use the yield at the time you purchased the bond and the book value. For example, if you purchased a bond for $104,100 at an 8% yield, then the interest expense is $8,328 ($104,100 x 8%). Remember, though, that interest is paid twice per year so you need to divide that number by two, giving you $4,164.

-

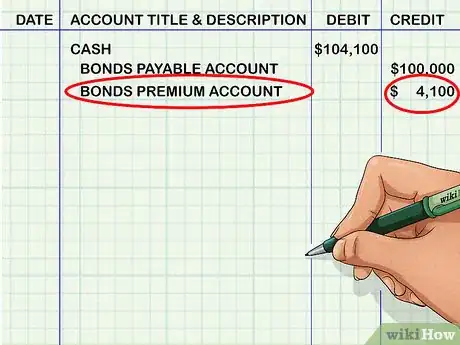

6Debit cash the amount you paid for the bond when you buy it. For example, if you buy a bond for $104,100, credit the cash account for $104,100.

-

7Credit the bonds payable account the face value of the bond. For example, if you bought a bond for $104,100 that has a face value of $100,000, you would credit the bonds payable account for $100,000.

-

8Credit the bond premium account the value of the bond premium. That's the amount you calculated in Step 2 above. In this case, you'll credit bond premium account for $4,100.

- Note that the complete accounting from this step and the previous step keeps your books in balance. You've debited cash for $104,100 and you've credited two accounts for $104,100 ($100,000 + $4,100).

-

9Credit cash when you receive your interest payment. For your interest payment, you'll credit cash because you're receiving an increase in cash. That's the amount you calculated from Step 3 above, or $4,500.

-

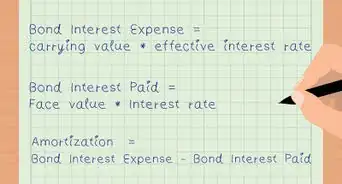

10Debit interest expense. Calculate the interest expense based on the book value of the bond. That's the amount you calculated in Step 5 above, or $4,164.

-

11Calculate the difference between the interest you received and the interest expense. In this example, that difference is $336 or $4,500 - $4,164.

-

12Debit the bond premium account the amount of the difference. In this case, you'll debit the bond premium account $336.

- After the first interest payment, the bond premium account value should be $3,764 or $4,100 - $336. Remember, you credited the bond premium account $4,100 when you bought the bond.

-

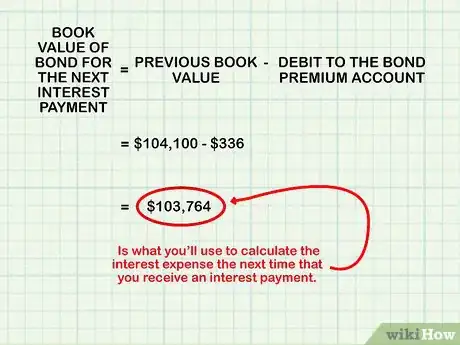

13Recalculate the book value of the bond for the next interest payment. The new book value of the bond is the previous book value minus the debit to the bond premium account. So, for your first interest payment, the previous book value of the bond was $104,100 in the current example. The new book value is $103,764 or $104,100 - $336.

- The new book value is what you'll use to calculate the interest expense the next time that you receive an interest payment.

Using the Straight Line Method

-

1Determine if you can use the straight line method. The straight line method can only be used for bonds issued before 1985. The IRS determined that all bonds issued after that year must use the constant yield method described in the other method in this article.

-

2Calculate the bond premium. It's easy to calculate the bond premium because it's the price you paid for the bond minus the bond's face value[5] . For example, if the you bought a bond for $104,100 with a face value of $100,000, then the premium is $4,100 or $104,100 - $100,000.

- The bond premium is the amount you'll amortize over the life of the bond.

-

3Determine the number of interest payments left. Interest is typically paid twice per year, at the end of June and at the end of December. However, check with the specifics about your bond.

- If there's five years left until the bond matures, and you bought the bond at the beginning of the year, then there are most likely 10 interest payments left (5 years x 2 interest payments per year).

- The brokerage house you used to purchase the bond should be able to provide you with all the information you need about how often, and when, interest payments occur.

-

4Calculate the amount of interest you'll earn per payment. You need to know how much money you'll receive with every interest during the life of the bond. Remember, though, you'll use the face value of the bond to calculate the interest payments, not the amount that you paid for the bonds.[6]

- For example, if you bought a bond for $104,100 with a face value of $100,000 and a 9% interest rate, you'll use the face value to calculate the interest rate. In this case, the annual interest rate is $9,000 or $100,000 x 9%. However, interest payments are typically paid twice a year, so each interest payment is $4,500 or $9,000 / 2.

-

5Record the book value. When you first purchase the bond, the book value is the same as the amount you paid for it. For example, if you purchased a bond for $104,100, then the book value is $104,100.

- The book value will decrease (or amortize) every time you receive an interest payment. If you hold the bond until maturity, the book value will be the same as the face value when you receive your final interest payment.

-

6Calculate the total amount of interest you'll receive if you hold the bond until maturity. You can do that by multiplying the interest payments times the number of payments left. For example, if there are 10 payments left and the interest is $4,500 per payment, then the total value of the interest payments is $45,000 or $4,500 x 10.

-

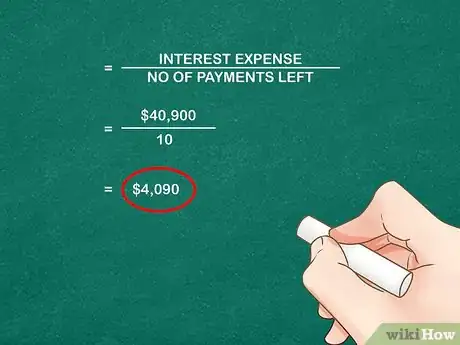

7Subtract the bond premium from the total interest payments. The bond premium is the amount you calculated in Step 1 above. In this case, that's $4,100. So the difference here is $40,900 or $45,000 - $4,100. That value is the interest expense used in the straight line method..

-

8Divide the interest expense by the number of payments left. Simply put, divide the number you calculated in Step 6 from the number of interest payments you determined in Step 2. In this case, that value is $4,090 or $40,900 / 10.

-

9Debit cash the amount you paid for the bond when you buy it. For example, if you buy a bond for $104,100, debit the cash account for $104,100.

-

10Credit the bonds payable account the face value of the bond. For example, if you bought a bond for $104,100 that has a face value of $100,000, you would credit the bonds payable account for $100,000.

-

11Credit the bond premium account the value of the bond premium. That's the amount you calculated in Step 1 above. In this case, you'll credit bond premium account for $4,100.

- Note that the complete accounting from this step and the previous one keeps your books in balance. You've debited cash for $104,100 and you've credited two accounts for $104,100 ($100,000 + $4,100).

-

12Credit cash when you receive your interest payment. For your interest payment, you'll debit cash because you're receiving an increase in cash. That's the amount you calculated from Step 3 above, or $4,500.

-

13Debit interest expense. Use the amount you calculated in Step 7 above, or $4,090.

-

14Calculate the difference between the interest you received and the interest expense. In this example, that difference is $410 or $4,500 - $4,090.

-

15Debit the bond premium account the amount of the difference. In this case, you'll debit the bond premium account $410.

- After the first interest payment, the bond premium account value should be $3,690 or $4,100 - $410. Remember, you credited the bond premium account $4,100 when you bought the bond.

-

16Recalculate the book value of the bond. The new book value of the bond is the previous book value minus the debit to the bond premium account. So, for your first interest payment, the previous book value of the bond was $104,100 in the current example. The new book value is $103,690 or $104,100 - $410.

References

- ↑ http://www.investopedia.com/terms/b/bond-yield.asp

- ↑ http://www.investopedia.com/terms/c/currentyield.asp?layout=orig

- ↑ http://www.investopedia.com/terms/p/premiumbond.asp

- ↑ http://www.investopedia.com/ask/answers/04/070204.asp

- ↑ http://www.investopedia.com/terms/p/premiumbond.asp

- ↑ http://www.investopedia.com/ask/answers/04/070204.asp