This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 38,838 times.

Supplemental Security Income (SSI) is a United States government-funded program handled by the Social Security Administration (SSA). SSI offers financial assistance to individuals who are disabled, blind or over the age of 65. If you meet any of these criteria, you can apply to receive SSI benefits by scheduling an appointment with a local SSA office in your area. You can also start the process online. With a little guidance, applying to receive SSI benefits is a straightforward process.

Steps

Completing the Application Process

-

1Determine your eligibility. In the United States, you may apply for SSI if you are disabled, blind or 65 years or older (to receive the full amount).[1] In addition to these basic qualifications, the following must be true:[2]

- You must be a U.S. citizen or live in the United States with a different legal status.

- You must live in the U.S. or the Northern Mariana Islands.

- If you're disabled, you must accept vocational rehabilitation services.

- A wide range of disabilities may qualify a person depending on the specifics of his or her situation. You can find a comprehensive screening tool at: http://ssabest.benefits.gov/

-

2Know how much to expect. The amount you receive in social security depends on your “covered earnings,” which is the amount on which you've paid social security taxes over your life. This average is called your average indexed monthly earning (AIME).[3] The SSA uses this number differently between retirees and disability applicants to determine your monthly amount.

- In 2015, for instance, the average social security disability payment is $1,165 and the maximum benefit is $2,663.[4]

- For retirees, the amount is more difficult to determine because it's based on the exact age, amount paid into the social security system, and even year in which the person will retire since the system is expected to change before many Generation X and younger Americans retire. However, the SSA does have an estimator allowing you to plan your benefit amount, which you can find here.

Advertisement -

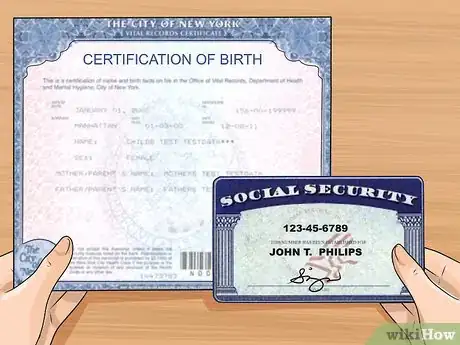

3Collect your personal documentation. Have the following original or certified documents available:

- Social Security card.

- Birth certificate.

- Information about your place of residence, such as your lease or mortgage papers.

-

4Collect employment and other income records. Current employment compensation and other income sources affect the SSI amount that you will receive. You will need to have all of your relevant employment records available, including:

- A list of detailed job descriptions and employment dates for your last five jobs.

- Information about your income, such as pay stubs, rental payments received, dividends from stocks and annuities, banking information, etc.

- Information about any workers' compensation or insurance claims you filed.

- Your W-2 Forms from the previous year. If you are self-employed, collect your IRS Form 1040 with Schedules C and SE.

- The Social Security numbers for your spouse and any minor children you have.

- Your bank account and routing number information (if you want your SSI benefit checks direct-deposited).

- Your military service discharge documents for any periods of active duty, if applicable.

-

5Collect medical records. Make sure your medical documentation is in order before calling or meeting with an SSA representative. You need documentation of all doctor's visits related to your disability if that is your grounds for seeking SSI benefits. You should include:

- The names and contact information of doctors who treated your disability.[5] Include the names of specific hospitals and doctors, your patient identification number(s), and the dates of each of your treatments.

- The names of prescription medications you currently take.

- The names and dates of all the medical tests you have had since you began experiencing your disability. You must also collect and have ready the name of each health care provider who advised you to take the tests.

- The contact information of the insurance company, the name of the claim, and its assigned claim number.

- Contact information for people who are familiar with your medical conditions, people like friends, family, and caregivers who may be able to supply information needed to complete your claim.

-

6Organize the documentation you have gathered. You'll need to be able to easily refer to it during your SSI application and interview process. You may want to organize your paperwork in chronological order or put your paperwork in a binder with labeled dividers or into folders that separate W-2 forms from health provider contact information and so on.

-

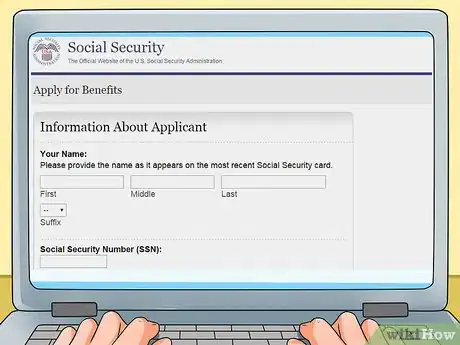

7Apply online. Most retirees can complete the application process online in less than an hour with all the documentation handy.[6] The online application process allows you to skip much of the wait, and the SSA will contact you if they need more information or to schedule an interview. You can find the online application for retirement benefits here.

-

8Contact your local SSA office about starting your application. If the SSA's website determines that you should apply in person instead, you will be directed to call your local office.[7]

- Call 1-800-772-1213 to get in touch with a local SSA office.[8] Provide SSA with your Social Security number over the telephone. Continue to follow the telephone prompts to locate the nearest SSA office.

- When you start your application, you'll need to give basic information about your situation. More detailed questions will be asked during a later appointment.

-

9Schedule an appointment with a Social Security representative. You will be asked to schedule an appointment with a representative to complete the application process. You may schedule a time to speak with the representative either over the phone or in person. During the appointment, you will answer detailed questions about your disability, your medical history and your financial situation.

- The purpose of this appointment is for the SSA representative to assess what level of disability you exhibit and what level of benefits you should receive as a result of your disability.

-

10Attend your interview. The SSA representative will ask you a series of questions related to the information you provide. This is considered a fact-finding process. After gathering the facts, the SSA will review your materials before making a decision. Be sure to answer as honestly and thoroughly as possible. You can anticipate being asked questions about:[9]

- What duties you performed at your last few jobs.

- What medical treatments you received for any disability.

- How your disability has affected your quality of life.

Following Up After the Interview

-

1Wait for your follow-up letter. You will receive a letter after your interview once the SSA verifies your application information and determines if you meet the eligibility requirements for SSI benefits. Review the letter to see if you are approved for SSI benefits.

- Review and record your payment amount and the date you will begin receiving payments if you were approved for SSI benefits.

- If you were not approved for SSI benefits, you will receive an explanation why along with information on how to appeal the SSA's decision if you disagree.

-

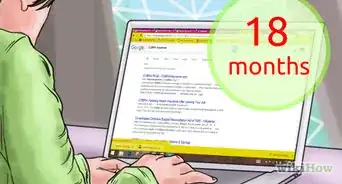

2Appeal the decision. If you're unhappy with the SSA decision regarding your application, you can appeal within 60 days of the date that you received the Notice of Decision. You can appeal in writing, or you can appeal online if the SSA denied the application for medical reasons.[10]

- For online appeals, visit: http://www.ssa.gov/disabilityssi/appeal.html.

-

3Understand the appeal process. Appeals to the SSA for a denial of SSI benefits can potentially go through four levels, including:

- Reconsideration by someone not involved in your first application.

- A hearing by an administrative law judge.

- A review by the Appeals Council.

- A federal court review.

-

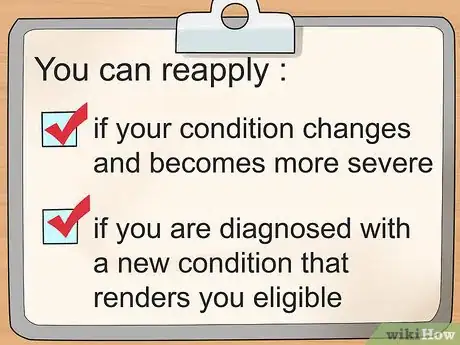

4Determine if you can reapply. If you lose your appeal, you can't reapply for SSI unless your condition changes and becomes more severe or if you are diagnosed with a new condition that renders you eligible.

- If this situation applies to you, you may reapply for disability 60 days after your denial (either the date of the original denial if you do not appeal the decision, or the date that you lost the appeal, if you appealed).

References

- ↑ http://www.ssa.gov/ssi/text-eligibility-ussi.htm

- ↑ http://www.ssa.gov/ssi/text-eligibility-ussi.htm

- ↑ http://www.disabilitysecrets.com/how-much-in-ssd.html

- ↑ http://www.disabilitysecrets.com/how-much-in-ssd.html

- ↑ http://www.disabilitysecrets.com/page5-45.html

- ↑ http://ssa.gov/retire/apply.html

- ↑ https://secure.ssa.gov/apps6z/radr/Controller?p=ent001

- ↑ http://www.ssa.gov/ssi/text-apply-ussi.htm

- ↑ http://www.disabilitysecrets.com/page5-45.html

About This Article

To apply for SSI, make sure you meet the requirements, which include being disabled, blind, or over 65 years old, and a U.S. citizen. Then, fill out the application on the Social Security Administration website with information found on your social security card, birth certificate, and employment records. Alternatively, call your local Social Security office to start your application and schedule an appointment with a representative. Once your application is complete, expect to receive a follow-up letter through the mail. For advice from our Legal co-author on how to appeal a denial of Social Security benefits, keep reading.