This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 42,354 times.

Learn more...

The ownership shares of a public company are called “stock.” You can buy stock from other investors and then hold onto it or sell it later when the stock price rises. Buying stock is easy. You can work with an individual broker or create an online brokerage account. Once you create and fund your account, you can place orders for stock. However, you should research stock so that you make a wise investment.

Steps

Creating a Brokerage Account

-

1Find an online broker. The easiest way to work with a broker today is online. You’ll open an account with the broker and then deposit money into the account. You can find online brokers by searching online. Some of the more popular include the following:[1]

- Charles Schwab

- E*Trade

- TD Ameritrade

- Optionshouse

-

2Identify if you want a full-service broker instead. Full-service brokers will meet with you in their office and talk about your financial goals. They can help you devise an investment strategy. You can find full-service brokers by looking online or in your phone book.

- Because they are full-service, they will also provide tax advice, estate planning, retirement planning, and budgeting.[2]

- A full-service broker is a good choice if you have a lot of money to invest or need help planning for the future.

Advertisement -

3Compare online brokers. Before signing up with an online broker, you should compare them and choose the one that best fits your needs. Compare the following:[3]

- Account minimum. Online brokers typically require some minimum amount for you to be able to set up an account. A few might allow you to create an account for $0.

- Commissions. You’ll have to pay for the broker to buy and sell your stock. Compare the fees. Commissions generally range between $5 and $10.

- Account fees. There are all kinds of fees an online broker can charge: inactivity fees, annual fees, and research fees.

- Support. You might need help finding stock. Accordingly, check to see if the online broker offers educational tools, stock research, and access to someone via email, phone, or online chat.

- Bonuses. Some online brokers provide cash bonuses for new users.

-

4Open an online account. To sign up, you’ll need to provide the broker personal information. Typically, you’ll need to provide the following:[4]

- driver’s license or government-issued ID

- Social Security Number

- address

- date of birth

- annual income

- net worth

- employment status

-

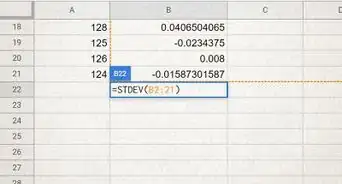

5Finish setting up your account. You might also be asked if you want a “margin account” or a “cash account.” With a margin account, you borrow money from the broker in order to complete the trade. You’ll have to pay interest on the loan. Because a margin account carries extra risks, new investors should stick with a cash account, which you will fund without borrowing money.

- Fund your cash account using an electronic funds transfer. The transfer can take a few days to go through. Once money is in your account, you can begin investing.[5]

Performing Basic Research on Companies

-

1Read the company’s quarterly statements. Every publicly traded company must publish quarterly financial statements, called 10-Q reports. They also file annual 10-K reports. You can find financial reports at the Securities and Exchange Commission (SEC) website.[6]

- If you use an online broker, then this information should be on the broker’s website as well.[7]

- Pay attention to the company’s revenues, which is the total amount of money the company brings in. You want to see that revenues have been growing.

-

2Calculate the company’s price-to-earnings ratio. This is a calculation investors use to check whether a stock is undervalued or overvalued. In essence, you check to see how much it costs to buy a share of the company’s profits.

- For example, a company’s share price might be $50 and its earnings could be $2.5 per share. The price-to-earnings ratio is 20. Essentially, you are paying $20 for each $1 in company profits.[8]

- Remember to compare the P/E for different companies. Generally, a company with a P/E of 10 is a better investment opportunity than a company with a P/E of 20. However, comparison works best when the companies are in the same industry.

-

3Find stocks that have momentum. The market price is itself a good indication of a stock’s potential. Check the stock price over the past year or two. Look for stocks that have a nice upward trend, and avoid stocks that show too much volatility.

- Also refer to the new 52-weeks high list that is in most newspapers and published online.[9]

- Of course, a company can’t trend upwards forever. However, there is no infallible way to pick a stock, and choosing a company with good momentum is a defensible strategy.

-

4Read expert commentary. There are many analysts online (and on television) offering their expert opinion on stocks. You should listen to what they have to say and take notes of what stocks they are most excited about. You can find expert commentary at Stockchase.com, Yahoo Finance, and Google Finance.

- However, you should avoid hype. Just because everyone on television is talking about a stock doesn’t mean you should buy it.[10] Instead, look for a company with an excellent earnings history.

-

5Consider diversifying across industries. If you want to buy stock in more than one company, then you should probably buy in different industries. Companies in a common industry tend to move up or down together. If you’re all in with tech stocks, for example, then you are exposed to more risk.

- A better strategy is to invest across at least three different industries.[11] For example, invest in retail, tech, and entertainment.

- Choose index funds like S&P 500 are great for diversification of your tock portfolio.

-

6Compare common stock to preferred stock. These are the two main types of stock. Although you want to buy common stock now, you might want to branch out in the future. Compare common and preferred stock:[12]

- Common stock creates income for you in two ways. The stock might become more valuable over time, so you can buy a share for $20 and sell for $30, thus pocketing the difference. Also, the company pays dividends. However, if the company goes bankrupt, common stock holders are the last to receive any value when the company liquidates.

- Preferred stock often pays regular dividends, so you can predict with more regularity the income it will generate. Also, in a bankruptcy, preferred stock holders will receive equity in the company before common stock holders.

- With common stock, you can vote for the company’s board of directors.

- By contrast, preferred stock usually doesn’t have voting rights. However, preferred stock comes in many shapes and sizes, so read up on the stock before investing in it.

Placing Your Order

-

1Choose the number of shares you want to buy. Don’t feel pressure to spend all of your deposited money at once. Instead, pick a number you are comfortable with. In the beginning, you may want to buy only one or two shares.[13]

-

2Place a market order. The easiest way to buy a stock is to put in a market order. This means you will buy the stock at the best price available. If you place your market order after hours, then you’ll get the price that prevails when the market opens in the morning.[14]

- You’ll be quoted a price. However, the price might change by the time the order goes through.

- Placing market orders is best if you intend to hold the stock for a while.

-

3Place a limit order instead. If you want more control, consider placing a limit order. For example, a stock might currently be selling for $50 per share. If you want to buy at $45 a share, then you can instruct your broker to buy when the share price drops to $45.[15]

- A limit order is a good bet when the market appears highly volatile, or if you think the stock price will fall for some reason.

- You’ll probably pay more in commissions for limit orders, so consider that factor as well.

- Don’t place a limit order if you must have a stock. In that situation, place a market order and pay the prevailing market price.

-

4Place an “all or none” order. There’s no guarantee that your limit order will be fulfilled completely. For example, you might request 50 shares at $45. However, only 35 shares might be available at that price. With an “all or none” order, you transaction will be executed only if all shares requested are available.[16]

Community Q&A

-

QuestionWhen was this article uploaded?

DonaganTop AnswererThis article was written in 2012.

DonaganTop AnswererThis article was written in 2012. -

QuestionWhat is buying stocks on margin?

DonaganTop AnswererThis amounts to borrowing money from a stockbroker. For a full description, go to Investopedia.com, and search "margin trading."

DonaganTop AnswererThis amounts to borrowing money from a stockbroker. For a full description, go to Investopedia.com, and search "margin trading." -

QuestionHas the best practice shared changed since this post was published, as it is now 6 years on?

DonaganTop AnswererNo, the markets and stock ownership have not changed since this article was written.

DonaganTop AnswererNo, the markets and stock ownership have not changed since this article was written.

References

- ↑ http://www.investopedia.com/ask/answers/05/042205.asp

- ↑ http://www.investopedia.com/ask/answers/05/042205.asp

- ↑ https://www.nerdwallet.com/blog/investing/what-is-how-to-open-brokerage-account/

- ↑ https://www.nerdwallet.com/blog/investing/what-is-how-to-open-brokerage-account/

- ↑ https://www.nerdwallet.com/blog/investing/what-is-how-to-open-brokerage-account/

- ↑ http://www.marketwatch.com/story/how-to-buy-stocks-2016-07-24

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ http://www.investopedia.com/terms/p/price-earningsratio.asp

- ↑ http://www.investopedia.com/university/fiveminute/fiveminute5.asp

- ↑ http://www.marketwatch.com/story/how-to-buy-stocks-2016-07-24

- ↑ http://www.investopedia.com/university/fiveminute/fiveminute5.asp

- ↑ http://www.investorguide.com/article/15593/common-stock-vs-preferred-stock-d1412/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

-Step-14.webp)

-Step-3.webp)