This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 16 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 20,332 times.

When you buy a business without a broker, the process is similar to buying a home without a realtor. You are responsible for finding a business and sorting through legal paperwork and financial statements. If possible, employ a good team of legal and financial advisors who can point you in the direction of a good business deal.

Steps

Expressing Interest to Sellers

-

1Identify the type of business you want. There are so many businesses for sale, you should narrow down the industry you want to work in. For example, do you want to own a retail establishment, restaurant, etc.?

- You might be excited to start as a business owner, but you shouldn’t jump into any business deal that doesn’t suit your interests and skills. Generally, you should avoid entering a business field in which you have no experience.[1] For example, you might have worked in retail, but this doesn’t necessarily mean you can run a restaurant.

- Also think about location. Some areas are booming, while others are in decline. Talk to business owners in an area to get some idea of how well your industry is doing in the region.

-

2Find businesses for sale. Without a broker, you’ll need to do some digging to find businesses on the market. After identifying the type of business you want, call around and ask people in the industry if they know anything for sale.[2] Often, owners who are thinking of selling don’t list the business publicly.

- Search online. Good websites include BizBuySell.com, which has over 100,000 listings, and Businessforsale.com, which has over 50,000 listings in 130 different countries.[3]

- Smaller business in your area might only advertise on Craigslist or in the newspaper.

- You can also contact your nearest Chamber of Commerce or local business organization. Ask if they know of any owners who want to sell.

Advertisement -

3Outline a letter of intent. This is the first communication you’ll have with the owner. You can identify yourself and make a general offer. A letter of intent only begins the negotiation process and isn’t a binding contract. However, it is an important document. Outline the following, which will go in your letter:[4]

- Your proposed price and the assumptions that price is built on. For example, you might assume the business has a certain sales volume. If that turns out to be wrong, then the price you ultimately offer will probably be lower.

- Whether you intend to acquire the business by buying assets or stock.

- How payment will be made. For example, you might want an all-cash deal or you might to trade stock.

- Whether you want an exclusivity clause. With this clause, the buyer agrees not to consider other offers while you do due diligence.

- Your timeline for due diligence. You’ll want time to thoroughly go through the business’ financial records. Tell the seller how much time you need.[5]

- Anything else that is important. For example, you might only want to buy if the seller signs a non-compete agreement. You also might want to have an appraiser look at the business. Include anything that might be a deal breaker for you.

-

4Submit your letter of intent. Type up your letter and identify which parts of the offer are binding and which are non-binding. For example, the proposed price should be non-binding, but the exclusivity clause will probably be binding.[6] Submit the letter to the seller and wait to hear back.

-

5Sign a confidentiality agreement. As part of buying a business, you’ll need to look at important financial documents. Business owners want to keep these details private, so you’ll probably have to sign a confidentiality agreement.[7]

- Read the agreement closely to see how long it lasts: one to two years is pretty standard.

- You’ll probably also have to agree to destroy business information after reviewing it.

-

6Hire a lawyer. If the sale is small—say, for ten thousand dollars or less—you might want to skip a lawyer’s help. However, you can’t learn the law overnight on your own, and you should consult with an attorney if you have any questions. If the business costs a lot, go ahead and hire the lawyer. Obtain a referral by contacting your nearest bar association

- Check that the lawyer has experience buying businesses. Not all lawyers do.

- A lawyer will also help you get your business off the ground after you buy it. For example, you might need to file reports or request licenses and permits. A lawyer should know where to look.

Conducting Due Diligence

-

1Hire an appraiser. A business appraiser can look at the business records and assets and come up with a realistic estimate of the business’ worth. Since you don’t have a business broker, an appraiser is an essential team member.

- A business appraisal can take up to 50 hours to complete and will cost between $3,000 and $35,000, though the exact amount will depend on the size of the business and its location. Small businesses will cost much closer to $3,000 to appraise. Get an estimate before hiring.

- Look to see that the appraiser has an appropriate professional designation, such as CBA (Certified Business Appraiser). This credential shows that the appraiser has sufficient experience and has passed exams.[8]

-

2Analyze financial records. Request balance sheets, cash flow statements, and accounts payable and receivable for the past three to five years.[9] The seller should provide audited statements, not just summaries. If the seller refuses to share financial records—or if you find errors—then this could be a sign not to go ahead with the purchase.

- Also request tax returns for the past three to five years.[10] Check whether taxable income has been increasing or decreasing.

-

3Hire an accountant to help you. Unless you know how to read financial records, you should hire an accountant. They can comb through the financial documents and identify whether the business is in sound shape or not.

- You can get a referral to an accountant by asking another business owner if they would recommend theirs.

- In the US, you can also contact your state’s accounting society.[11]

-

4Check business documents. Judge how favorable the business’ contracts are. For example, some contracts might be expiring soon or have cost increases built into them. Ask the seller for copies of the following and analyze them with your accountant:[12]

- Articles of Incorporation

- Lease agreements

- Real estate agreements, including whether the lease can be transferred to you

- Distribution agreement

- Union contracts

- Employment agreements

- Subcontractor agreements

-

5Inspect inventory. If the business sells goods, you’ll be buying everything on the shelves and in storage. You should take a look at it to see that the inventory is in good condition. Don’t simply accept the seller’s word for it.[13]

- If the inventory is in poor condition, you can lower the price you are willing to pay.

-

6Confirm that the business has a good reputation. Ask for the names of existing vendors, suppliers, and customers. Call them up and ask them about their relationship with the seller. You can also check with the Business Better Bureau to see if any complaints have been filed.[14]

- Request the company’s business credit report. The three business credit reporting agencies are Dun & Bradstreet, Experian, and Equifax.[15] Ask the seller to provide them to you.

-

7Review a complete list of liabilities. It’s the rare business that doesn’t come with liabilities. You need to include them in your analysis. Review the following with your lawyer and accountant:[16]

- Any assets used as collateral to secure a loan. The seller should provide you with this information, but you can also check for UCC filings with the Secretary of State.

- Liens against the business. For example, someone might have sued the business and won a court judgment. They can put a lien on the business assets.

- Employee benefit claims.

- Lawsuits. You can check court records in the county where the business is located. Many courts have databases you can search using the business’ name.

-

8Check the business’ safety record. An unsafe business could turn into a huge liability. Go over the following information with your lawyer:

- Environmental hazards. If you are buying real estate, then you typically bear the burden of any environmental clean-up. Check to see if an environmental site assessment has been performed on the property. You might not want to pay for an ESA to be done, but you should be aware of any known hazards.

- OSHA violations. Ask to see OSHA safety reports. If the seller hesitates, you can ask to inspect the business with an OSHA inspector.[17]

- Workers’ compensation claims. Check whether a lot of claims have been filed. Your lawyer can research what is typical for the industry.

Closing the Deal

-

1Identify what assets you will buy. You might want to take over the entire business by buying the stock outright, or you might want to buy only certain assets. Also, the seller might not want to sell all assets. Work toward identifying what you will buy.[18]

- By buying assets, you can avoid assuming the business’ liabilities. However, an asset purchase is generally more expensive than buying the busines’ stock.[19]

-

2Negotiate a fair price. Having dived into the business’ financials, you have a better idea of what the business is worth. You might want to offer more or less than you stated in your letter of intent. Negotiate with the owner to reach a price that is fair.[20]

-

3Set a closing date. Give yourself enough time to complete the transfer process. For example, you may need to re-title assets to transfer ownership, and it can take time to get documents prepared. You also will need to buy sufficient insurance and obtain financing.

-

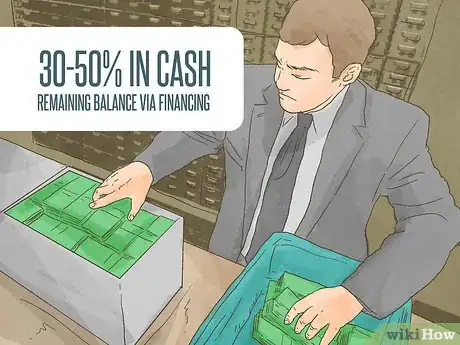

4Find financing. You should plan on paying 30-50% in cash and financing the rest.[21] You have different financing options, such as the following:

- Get a loan from a traditional lender. Stop into any bank you’ve done business with and explain you are thinking of buying a business. A loan officer can check whether you qualify.

- Get seller financing. The seller might be willing to finance 30-60% of the purchase price, which you pay back over five to seven years.[22] You cover the rest with cash or a loan from a bank.

- Use your savings. You might be able to use money in your retirement accounts to fund the purchase.

-

5Review the sales agreement. This contract contains the key terms of the sale. Your lawyer should review it thoroughly to protect your rights before you sign. The substance of the contract will depend on your agreement. For example, if the seller has agreed to stay on as a consultant, there should be an employment agreement.

- The agreement should list all assets included in the sale and identify any assets excluded from the sale.

- All liabilities that you assume should be listed. If you are assuming no liabilities, there should be a statement to that effect.

- Also look for any seller warranties. For example, the seller should warrant that they have clear title to all assets and that financial records were presented fairly.[23] If they weren’t, you can sue for compensation.

-

6Attend the closing. You’ll need to sign many documents at the closing to fully transfer the sale. Your lawyer should attend with you so that you can review the documents together. For example, you may need to sign the following:

- A bill of sale, which transfers the business assets to you.

- Your closing or settlement sheet.

- Tax forms that you file with the government to document the sale.

- A promissory note for your loan.

- A security agreement for any asset you are using as collateral for your loan.

Community Q&A

-

QuestionWhat are the right questions to ask when buying a business?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant The first thing I ask when somebody's trying to tell me to help them analyze a business is how much fringe benefits the owner is getting. Then, you want to start looking at the profitability, asking for three years tax return, for a balance sheet, and for three years profit and loss statements in a sheet so that you can do math and manipulate the numbers.

The first thing I ask when somebody's trying to tell me to help them analyze a business is how much fringe benefits the owner is getting. Then, you want to start looking at the profitability, asking for three years tax return, for a balance sheet, and for three years profit and loss statements in a sheet so that you can do math and manipulate the numbers.

References

- ↑ http://www.nolo.com/legal-encyclopedia/buying-business-what-you-need-29703.html

- ↑ http://www.nolo.com/legal-encyclopedia/buying-business-what-you-need-29703.html

- ↑ http://fitsmallbusiness.com/small-businesses-for-sale/

- ↑ https://www.strictlybusinesslawblog.com/2011/07/28/buying-a-business-here-are-6-items-that-should-be-in-your-letter-of-intent/

- ↑ https://www.forbes.com/sites/allbusiness/2015/07/30/how-to-negotiate-a-business-acquisition-letter-of-intent/#6f1444e11b2a

- ↑ https://www.forbes.com/sites/allbusiness/2015/07/30/how-to-negotiate-a-business-acquisition-letter-of-intent/2/#13f205a86229

- ↑ https://www.richardparker.com/signing-non-disclosure-agreements

- ↑ http://www.bizbuysell.com/seller_resources/choosing-a-business-appraiser/15/

- ↑ http://www.nolo.com/legal-encyclopedia/buying-business-what-you-need-29703.html

- ↑ https://www.sba.gov/blogs/how-buy-existing-business

- ↑ https://www.sba.gov/blogs/how-find-accountant-who-can-help-your-small-business-over-long-haul

- ↑ https://www.entrepreneur.com/article/79638#

- ↑ http://wealthpilgrim.com/buying-an-existing-business-7-steps-to-success/

- ↑ https://www.entrepreneur.com/article/79638#

- ↑ https://www.fundingcircle.com/us/resources/3-business-credit-bureaus/

- ↑ https://www.entrepreneur.com/article/79638#

- ↑ https://www.entrepreneur.com/article/79638#

- ↑ http://www.nolo.com/legal-encyclopedia/buying-business-what-you-need-29703.html

- ↑ https://www.entrepreneur.com/article/79638#

- ↑ http://www.nolo.com/legal-encyclopedia/buying-business-what-you-need-29703.html

- ↑ https://www.entrepreneur.com/article/79638#

- ↑ http://fitsmallbusiness.com/seller-financing/

- ↑ https://www.inc.com/mike-handelsman/selling-your-business-understanding-the-purchase-and-sale-agreement.html