This article was co-authored by Jonathan DeYoe, CPWA®, AIF®. Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

This article has been viewed 542,379 times.

GDP stands for gross domestic product and is a measurement of all the goods and services a nation produces in a year.[1] GDP is often used in economics to compare the economic output of countries. Economists calculate GDP using two main methods: the expenditure approach, which measures total spending and the income approach, which measures total income. The CIA World Factbook website provides all the data necessary to calculate GDP of every nation in the world.

Steps

Help Calculating GDP

Calculating GDP Using the Expenditure Approach

-

1Start with consumer spending.[2] Consumer spending is the measure of all spending a nation's consumers make on good and services during the year.[3]

- Examples of consumer spending would include the purchase of consumable goods like food and clothing, durable goods like tools and furniture, and services such as hair cuts and doctor visits.

-

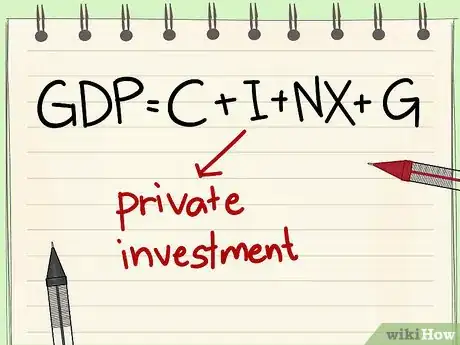

2Add in investment.[4] When economists calculate GDP, investment does not mean the purchase of stocks and bonds, but rather money spent by businesses to acquire goods and services to help or maintain the business.[5]

- Examples of investments include materials or contracting services used when a business builds a new factory, equipment purchases and software to help a business run efficiently.

Advertisement -

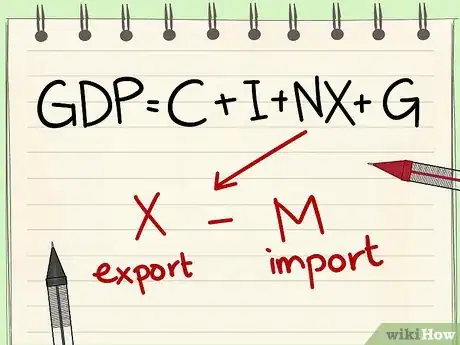

3Insert the excess of exports over imports. Because GDP only calculates products produced domestically, imports must be subtracted out.[6] Exports must be added in because once they leave the country, they will not be added in through consumer spending. To account for imports and exports, take the total value of exports and subtract the total value of imports. Then, add this result into the equation.

- If a nation's imports have a higher value than its exports, this number will be negative. If the number is negative, subtract it instead of adding it.

-

4Include government spending.[7] The money a government spends on goods and services must be added to calculate GDP.

- Examples of government spending include payroll for public employees, spending on infrastructure and defense spending. Social security and unemployment benefits are considered transfer payments and are not included in government spending because the money is simply transferred from one person to another.

Calculating GDP Using the Income Approach

-

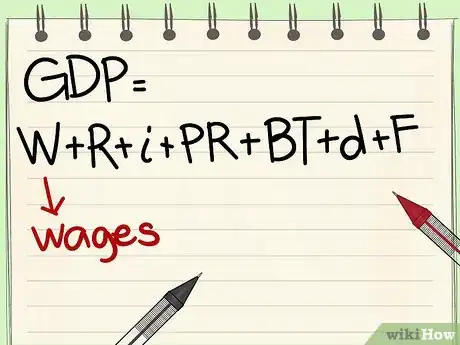

1Start with employee compensation. This is the total of all salaries, wages, benefits, pensions and social security contributions.[8]

-

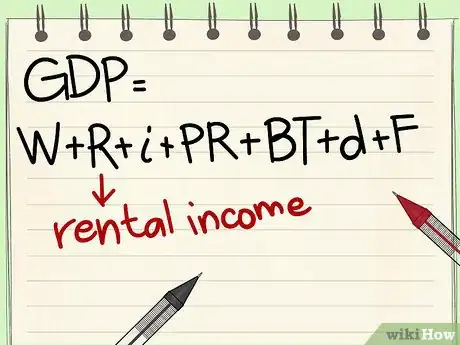

2Add in rent. Rent is simply the total income earned from property ownership.

-

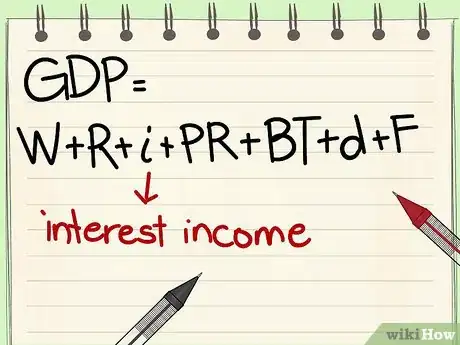

3Include interest. All interest (money earned by supplying capital) must be added.

-

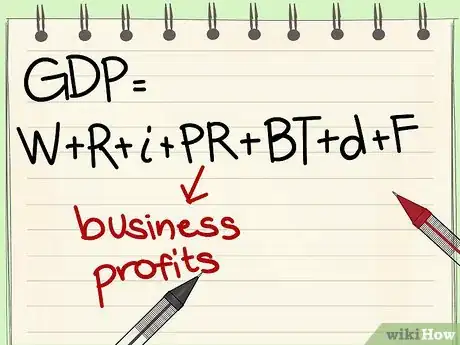

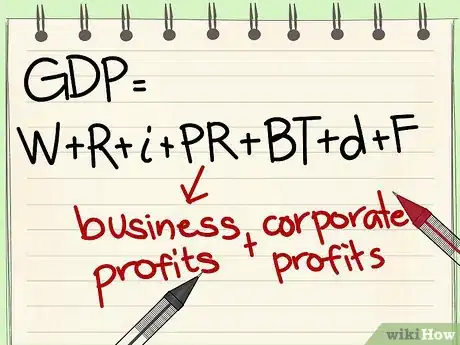

4Add proprietor's income. Proprietor's income is the money earned by business owners, including incorporated businesses, partnerships and sole proprietor-ships.

-

5Add in corporate profits. This is the income earned by stockholders.

-

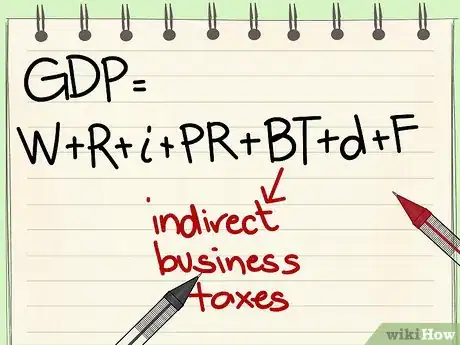

6Include indirect business taxes. This is all sales tax, business property tax and license fees.

-

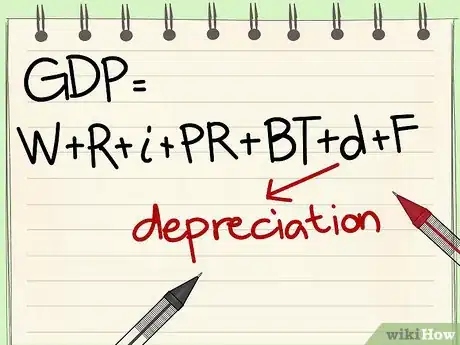

7Calculate all depreciation and add it in. This is the decrease in value of goods.[9]

-

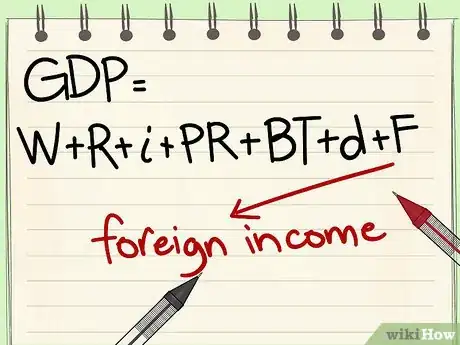

8Add in net foreign factor income. To calculate this, take the total payments received by domestic citizens from foreign entities and subtract the total payments sent to foreign entities for domestic production.

Differentiating Nominal and Real GDP

-

1Differentiate between nominal and real GDP for a more accurate picture about how a country is doing. The main difference between nominal and real GDP is that real GDP takes inflation into account.[10] If you don't take inflation into account, you could believe that a country's GDP is increasing when really their prices are increasing.

- Think about it like this. If GDP of country A was $1 billion in 2012, but in 2013 it printed and then circulated $500 million, of course its GDP is going to be bigger in 2013 than it was in 2012. But this increase isn't a good reflection of the goods and services produced in country A. Real GDP effectively discounts these inflationary increases.

-

2Choose a base year. Your base year can be a year back, five years, 10, or even 100. But you need to choose a year against which to compare the inflation. Because, at heart, real GDP is a comparison. And a comparison is only really a comparison if two or more things — years and figures — are being weighed against one another. For a simple real GDP calculation, choose the year prior to the year you're looking at.

-

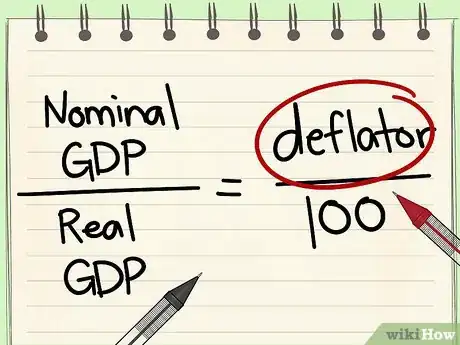

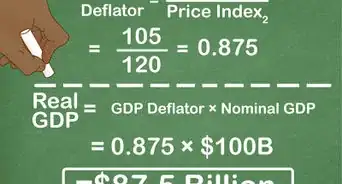

3Decide how much prices have gone up from the base year. This number is also called the "deflator." If your rate of inflation from the base year to the current year is 25%, for example, you'd list that inflationary rate as 125, or 1 (100%) plus .25 (25%) times 100. For all cases of inflation, the deflator is going to be higher than 1.

- If, for example, the country that you're measuring actually experienced deflation, where purchasing power increased instead of decreased, the deflator would drop below 1. Say, for example, the rate of deflation was 25% from the base period to the current period. That means the currency can buy 25% more than it used to in its base period. Your deflator would be 75, or 1 (100%) minus .25 (25%) times 100.

-

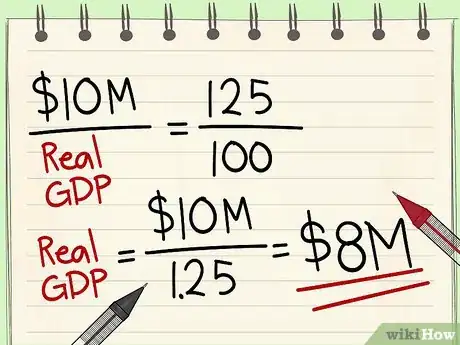

4Divide the nominal GDP by the deflator. Real GDP is equal to the ratio of your nominal GDP divided by 100. As an equation, it starts off like this: Nominal GDP ÷ Real GDP = Deflator ÷ 100.[11]

- So, if your current nominal GDP is $10 million, and your deflator is 125 (inflation was 25% from the base period to the current period), this is how you'd set up your equation:

- $10,000,000 ÷ Real GDP = 125 ÷ 100

- $10,000,000 ÷ Real GDP = 1.25

- $10,000,000 = 1.25 X Real GDP

- $10,000,000 ÷ 1.25 = Real GDP

- $8,000,000 = Real GDP

- So, if your current nominal GDP is $10 million, and your deflator is 125 (inflation was 25% from the base period to the current period), this is how you'd set up your equation:

References

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://www.wallstreetmojo.com/gdp-formula/

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://www.wallstreetmojo.com/gdp-formula/

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/economics/gdp-formula/

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/economics/gdp-formula/

- ↑ https://courses.lumenlearning.com/boundless-economics/chapter/comparing-real-and-nominal-gdp/

- ↑ https://courses.lumenlearning.com/boundless-economics/chapter/comparing-real-and-nominal-gdp/

- http://www.mindtools.net/GlobCourse/formula.shtml

- http://staffwww.fullcoll.edu/fchan/macro/2gdp_computation.htm

About This Article

To calculate GDP, start by adding the total amount that consumers in the country spent during the year to the number of investments businesses made to help maintain their business. Then, take the amount of money spent on imports and subtract it from the money earned through exports. Once you've calculated that, add that number to the first number you calculated. Finally, add the amount of money the government spent on goods and services that year. Whatever number you come up with after adding everything together is the GDP. If you want to learn how to calculate GDP by calculating income, keep reading the article!