X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 45,969 times.

Learn more...

Profit margin is a measure of profitability in terms of percentage of sales revenue. You can calculate both gross and net profit margin.

Steps

Method 1

Method 1 of 2:

Gross Profit Margin

-

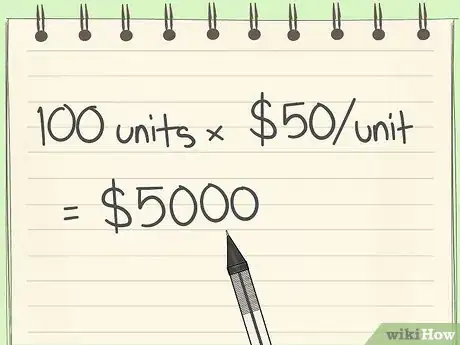

1Calculate total sales. Add up all the money made from the sale of goods and services sold by your business. This is the total sales. You don't necessarily have to calculate your revenue for your business as a whole - depending on your specific needs, you may want to find the revenue for individual departments of your business or for individual products.Total sales can be calculated as number of units sold multiplied by selling price per unit.[1]

- Example: a company sells 100 units of its product as $50 a piece. So total sales would be $50*100 = $5000.

-

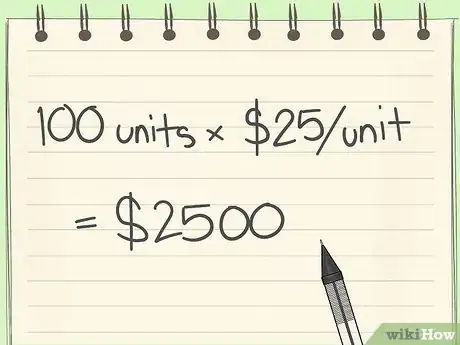

2Calculate the cost of goods sold (COGS). Add up the expenses associated with selling the products to generate a value for the cost of goods sold.[2]

- Let's say that COGS is $25 a piece, so total COGS would be $25*100 = $2500.

Advertisement -

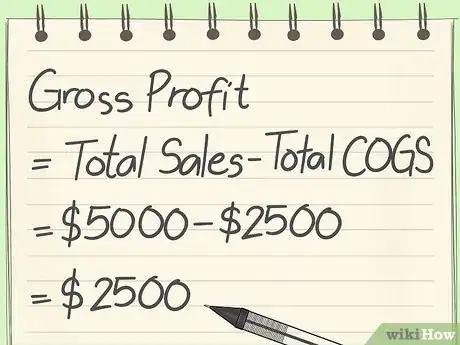

3Determine Gross Profit. Subtract the total cost of goods sold from the total sales calculated to determine the gross profit for the business for this period. The number you get is a representation of how much money you make solely from selling your products - it's from this pool of money that you'll pay the business' taxes, salaries etc. Gross profit should be positive - if it isn't, you're losing money by selling your products at their current price.[3]

- For the above example gross profit would be $5000- $2500 = $2500.

-

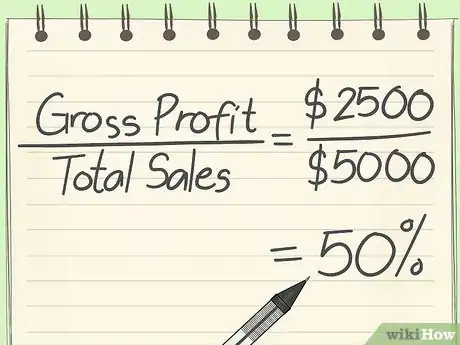

4Calculate Gross Profit Margin. It is the ratio of Gross profit / Total sales, which in the above example would be equal to $2500 / $5000 = 50%.[4]

Advertisement

Method 2

Method 2 of 2:

Net Profit Margin

-

1Find your Fixed Costs. Calculate the fixed costs incurred by the company. They would include salaries, interest payments, maintenance etc.[5]

- Let's say the total of all these would be equal to $1500 in the above example.

-

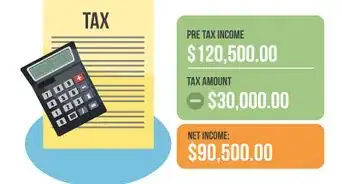

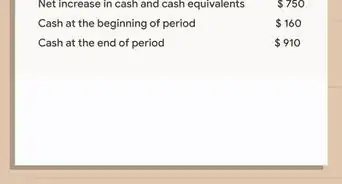

2Calculate Net Profit. Net profit is the final profit which the company makes after deducting all the costs from the total sales. If this number is negative, it implies that the company is making losses and its cost price is more than the selling price.[6]

- Net profit for the above example would be $2500 - $1500 = $1000.

-

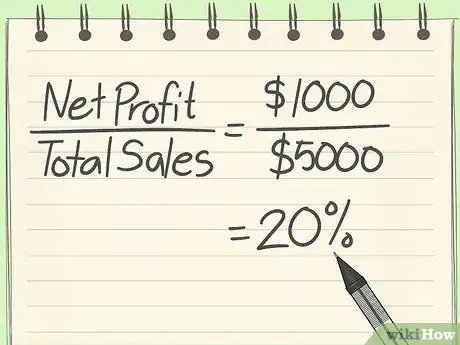

3Find your Net Profit Margin. It is the ratio of Net profit / Total sales which in the above example would be equal to $1000 / $5000 = 20%.[7]

Advertisement

References

- ↑ https://bizfluent.com/how-5124651-calculate-gross-sales.html

- ↑ https://www.dummies.com/business/accounting/how-to-compute-cost-of-goods-sold/

- ↑ https://www.entrepreneur.com/article/226158

- ↑ https://www.entrepreneur.com/article/226158

- ↑ https://blog.hubspot.com/marketing/fixed-cost

- ↑ http://www.accounting-basics-for-students.com/cost-of-goods-sold.html

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/finance/net-profit-margin-formula/

About This Article

Advertisement