X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 33,668 times.

Learn more...

There are many factors involved in determining a monthly house payment. You must determine the mortgage amount, or amount borrowed to purchase the house, the interest rate, the term of the loan, property taxes and homeowners' insurance. In addition, under certain circumstances, your monthly house payment will include private mortgage insurance and condominium association fees.

Steps

-

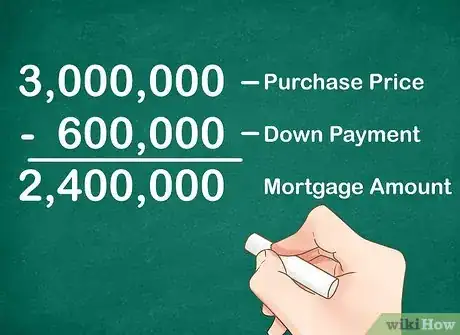

1Calculate the mortgage amount. Subtract your down payment from the purchase price of the house. Add to this any closing costs you plan to finance (or roll into the mortgage).

- Conventional mortgages typically require a 20 percent down payment.

- Your down payment on a Federal Housing Authority (FHA) mortgage can be as low as 3.5 percent of the purchase price. The FHA also allows you to include many closing costs in the amount financed.

- The down payment on a Veteran's Administration (VA) loan can be as low as 0 percent.

- Private mortgages are often available with down payments of less than 20 percent of the mortgage amount, but they require you to purchase private mortgage insurance.

-

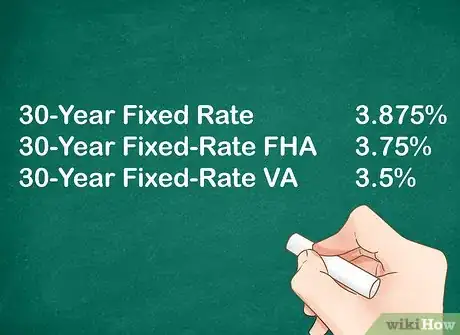

2Determine the interest rate on your mortgage. Interest rates vary based on several factors. Some lenders will provide a lower interest rate in exchange for charging "points," which are prepaid interest fees you pay to the lender at closing. Lenders will typically charge lower interest rates on adjustable rate mortgages (ARMs) than on fixed rate mortgages.

- The interest rate on an ARM will be adjusted at predefined intervals, often each year, every 3 years or every 5 years. With most ARMs, your monthly payment will change when you interest rate adjusts.

Advertisement -

3Choose a mortgage term that meets your financial needs. The most common mortgage term is 30 years, but mortgage loans can be written for longer or shorter periods.

-

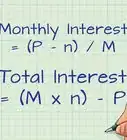

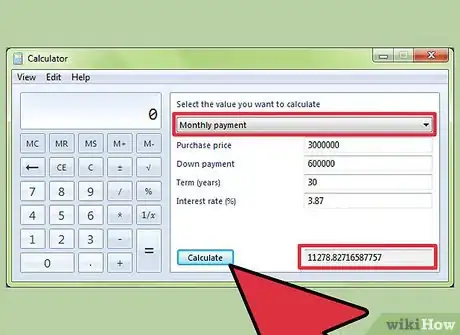

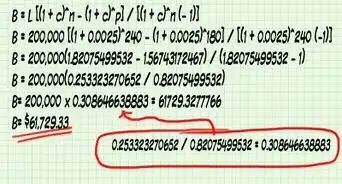

4Calculate the monthly principal and interest payment using a financial calculator, a spreadsheet program such as Excel or Open Office Calc, or an online mortgage calculator.

- When using a financial calculator or spreadsheet program, you will need to convert the annual interest rate into a monthly interest rate by dividing the rate by 12. You will also need to state the length of the mortgage in months (360 months for a 30-year mortgage).

- Many mortgage calculators are available online. These tools calculate your monthly principal and interest payment once you input a loan amount, annual interest rate and loan term in years.

-

5Determine the monthly amount you will pay into escrow each for payment of your property taxes.

- Identify all of the taxes that are levied on the property. Often property taxes are levied by multiple jurisdictions, such as village, town, city, county, school district, fire district, water district or sewer district.

- Make sure you have accurate figures for tax bills from each taxing jurisdiction.

- Determine whether the current tax bills include any credits you will not qualify for. You should add these credits to the tax amounts currently paid to better estimate the total property taxes you will have to pay.

-

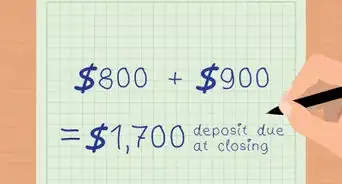

6Add all of the annual property tax amounts and divide by 12. This is your monthly tax payment.

-

7Contact several insurance companies and obtain quotes for homeowners' insurance. Once you have selected an insurance carrier, divide the annual premium by 12. This is your monthly homeowners' insurance payment.

-

8Ask you lender if private mortgage insurance (PMI) will be required on your mortgage loan and how much the monthly premium will be.

- Typically, if your down payment is less than 80 percent of the mortgage amount, the lender will require that you purchase PMI, which protects the lender from loss if you default on the mortgage.

- When you purchase PMI, you usually will pay a fee at closing and also pay a monthly fee, which is included in your house payment.

-

9Determine the amount of any additional monthly fees.

- Condominiums, co-ops, some townhouses and houses in homeowner's associations are subject to additional fees. Make sure you identify the amount of all association fees and maintenance fees.

-

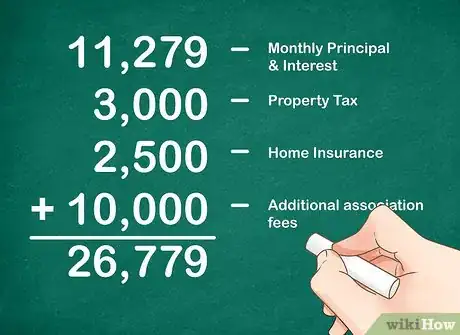

10Add the principal and interest payment, monthly tax payment, monthly insurance payment and monthly payment for any additional association fees. The total is your monthly housing payment.

Advertisement

About This Article

Advertisement

-Step-18.webp)