This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

This article has been viewed 29,297 times.

Market value of equity, also known as market capitalization, is calculated in order to determine the total currency value of all the outstanding shares issued by the company. In layman's terms, it is defined as the product of the current stock price of the company and its total number of outstanding shares.[1] Both of these numbers are used to determine market value of equity as it changes with time, so it is helpful to recalculate capitalization periodically.

Steps

Calculating Market Value of Equity

-

1Make sure you use up-to-date information. The market value of equity is constantly changing, and thus the calculation requires the newest information in order to be accurate. Stock markets are open from Monday to Friday. If you need to calculate market capitalization on the weekend, then you will have to use Friday's closing stock price.

-

2Determine the total number of outstanding shares. This refers to the number of shares actually available for trading. Refer to the company's most recent financial report to get accurate information. Any publicly traded company will post a link to this report on its website.

- This information is on the company's balance sheet, under the heading "Capital Stock."[2]

- If you are unable to find the website, refer to investing sites like Reuters Finance or Bloomberg for a link.

Advertisement -

3Check the current stock price of the company. Get the latest quote by referring to stock exchange websites. This will give you the most up-to-date information. Stock brokers also provide real-time quotes.

- In the case of small companies with low trading volume, it is advisable to call a broker for a quote.

-

4Multiply the number of outstanding shares by the current stock price. This will give you the current market value of equity.

- For example, Infosys is a well-known, publicly traded IT company. Recently, Infosys had 574.2 million shares of stock outstanding. At the time the closing price of the stock was 3069.55 rupees ($46.04 USD).

- The market capitalization was calculated by multiplying 574.2 million shares by 3069.55 rupees, which equals nearly two trillion rupees (around $26,436,000,000 USD). Note again that this calculation reflects changing quantities within a company's financial profile and must be recalculated periodically.

Understanding Market Value of Equity

-

1Know what market value of equity measures. You can think about market value of equity as the stock market's evaluation of a company's value. This is because the value of stock, on which market value of equity depends, is reliant on investor confidence. After all, investors wouldn't invest in a company that they didn't believe would increase the value of its stock. In this way, market value of equity represents one valuation of a publicly-traded company.

-

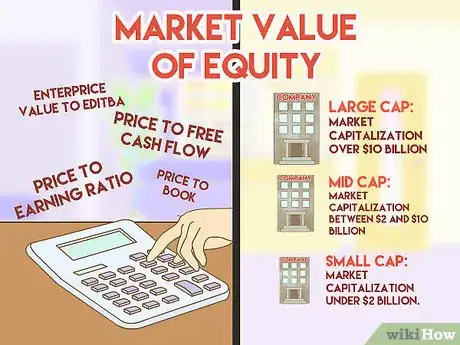

2Learn how it is used. Investors and market analysts used market value of equity for two major purposes: for calculating performance ratios and for separating companies by size. The market value of equity is essentially a starting point for analyzing a company.

- It is primarily used in the calculation of the price to earnings ratio, but it is also used to calculate price to free cash flow, enterprise value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), and price to book value.[3] These ratios are used to analyze current company performance.

- Market value of equity is also used to separate companies by size. There are no official categories, but many institutions follow roughly the following guidelines:

- Large cap: Market capitalization over $10 billion

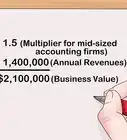

- Mid cap: Market capitalization between $2 and $10 billion

- Small cap: Market capitalization under $2 Billion.[4]

- Investors separate companies like this so that they can vary their portfolios by investing in companies of different sizes.

-

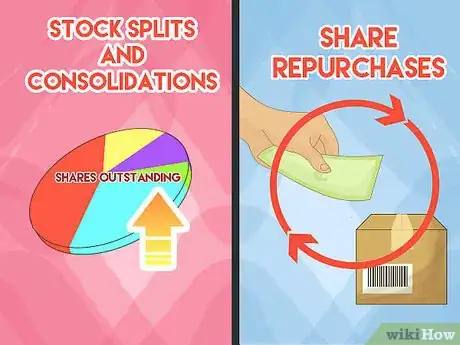

3Understand what changes in it mean. Keep in mind that any change in this measure is just a change in the value of either or both of its components: shares outstanding and stock price. Stock prices change daily during trading and rely on a number of factors, including expected performance, investor confidence, and world events, among others. Shares outstanding, however, is only changed by a direct action taken by the company. Actions that change shares outstanding include:

- Stock splits and consolidations. Stock splits occur when the company decides to increase the number of shares outstanding. Existing shareholders usually also have their share ownership doubled. However, this immediately cuts the price of the stock in half, so market cap remains more or less the same. The idea is that stock splits add to stock value in the long run, thus increasing market cap. Stock consolidations are the opposite of splits, meaning that the company reduces the number of shares outstanding by some factor.[5]

- Share repurchases. A company may also choose to buy back some of its own stock to increase the stock price.[6] This reduces shares outstanding and (hopefully) increases share price accordingly. This means that it may or may not result in a significant change in market cap.

-

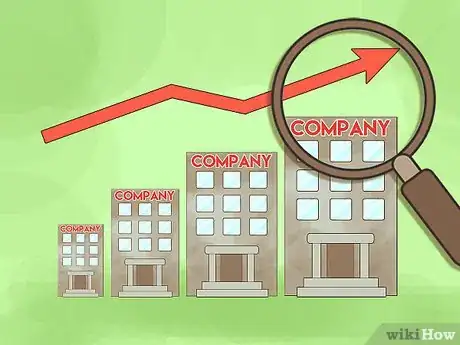

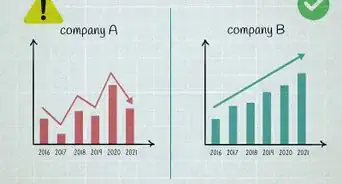

4Use market value of equity to track company growth. Market capitalization can be easily used to follow the growth of a company, and its success in the market, for long periods of time. In this way, a graph of market capitalization can show you how a company has developed through the years, through recessions, and comparatively to other companies.

- Graphs of company market capitalizations can be located online or easily generated using a number of financial programs.

Considering Other Factors to Determine Value

-

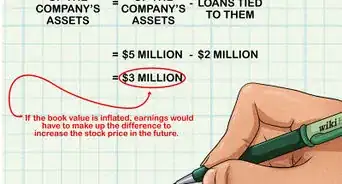

1Understand that market value of equity doesn't mean the sale price of a company. Theoretically, the market value of equity would be the cost of buying up all of the company's shares. In reality, the price would be much different if the company were valued for a merger or acquisition. This is partially because cash and debt obligations are not considered in market capitalization. This calculation, incorporating both the company's financial position and market cap, is known as enterprise value and is a better calculation of a company's real value.[7]

- When a company is bought or sold, another, similar value called simply "market value" is created to reflect the sale price of the company. Don't get this value confused with market value of equity.

-

2Consider control premiums. Successful companies hardly ever sell at market value of equity, or even at enterprise value. Rather, the current owners of the company will want a premium above the assessed value. This extra amount is known as the control premium and reflects the amount that the owners are willing to give up control of the company for. This can make the sale price of a company considerably higher than the market value of equity.[8]

-

3Factor in industry confidence. Investors are usually fickle in their moods and thus the securities they invest in are able to change without real cause. Industry confidence, or lack thereof, might cause a company's stock to be over or undervalued without any backing in reality. These are generally short-term adjustments, causing bumps and declines in stock prices for shorter periods of time. Check for these quick changes when using market capitalization to assess a company's value.[9]

-

4Think about the effects of trading volume. Many companies' stocks are not actively traded in large volumes. Rather, they are held by investors and rarely sold. If they are sold, even in a relatively small amount, the activity can affect the price of the stock significantly. If the stock price changes, this also means that the market value of equity will be affected. Watch out for these instances when dealing with thinly-traded stocks.[10]

References

- ↑ http://www.investopedia.com/terms/m/market-value-of-equity.asp

- ↑ http://www.investopedia.com/terms/o/outstandingshares.asp

- ↑ http://www.investopedia.com/ask/answers/042415/how-can-i-use-market-capitalization-evaluate-stock.asp

- ↑ http://www.investopedia.com/ask/answers/042415/how-can-i-use-market-capitalization-evaluate-stock.asp

- ↑ http://www.investopedia.com/terms/o/outstandingshares.asp

- ↑ http://www.investopedia.com/terms/o/outstandingshares.asp

- ↑ http://www.investinganswers.com/node/806

- ↑ http://www.investinganswers.com/node/806

- ↑ http://www.investinganswers.com/node/806