This article was co-authored by Michael R. Lewis and by wikiHow staff writer, Jennifer Mueller, JD. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 519,034 times.

The State Bank of India (SBI) is the largest lender in India, offering a number of different credit cards with various rewards and features. If for whatever reason you decide that your SBI credit card is not for you, you can easily cancel it over the phone or by writing to SBI. Your cancellation will not be processed until your balance is paid down to zero.[1]

Steps

Checking Your Account Status

-

1Access your account online. Go to https://www.sbicard.com/ and click the login button at the top of the page to access your account. If you haven't created an online account, click the link below the login button to register as a new user.[2]

- To register as a new user, you will have to provide your card number, CVV number, and date of birth. If you don't have your card number handy, call the SBI Card Helpline for advice at 1860-180-1290.

-

2Make sure your account is active if you haven't used your card in a while. SBI has the right to cancel credit card accounts at any time. If your account is inactive, SBI may have canceled it without your knowledge.[3]

- Banking laws forbid banks from charging additional fees for inactivity. For this reason, SBI may close an inactive account that isn't making the bank any money.

Advertisement -

3Bring your account balance to zero. SBI won't cancel your card until your balance is paid in full. Check your account balance online to determine how much you owe. If you've used the card recently, be sure to check for any pending charges.[4]

- Check the latest statement carefully to make sure there are no fraudulent transactions before you pay your balance in full and cancel your card. If you don't notice a fraudulent transaction until after you've canceled your card, you may not be able to get your money back.

- If you have a substantial balance on your card, make several installments to pay it down over a few months rather than paying the whole thing at once. A large repayment could damage your credit score.[5]

-

4Switch any recurring payments to another card. If you've used your SBI card to make any automatic payments, contact those businesses and either cancel your automatic payments or provide a different payment method. Check the date the automatic payment is scheduled to make sure it won't go through before you cancel your card.[6]

- With some companies, it may take a few days to process any changes you make to automatic payments, or the change may not take effect until the next billing cycle. Double-check the dates before you cancel your card.

Tip: If you have an outstanding balance that you're paying off over several months, it makes sense to go ahead and cancel any recurring payments so they don't continue to add to the balance while you're trying to pay it off.

-

5Confirm that any payment you made has posted to your account. Before you cancel your card, log in to your online account again and confirm that the balance is zero. Look at recent transactions as well and make sure there are no pending charges that you may have overlooked.[7]

- While you're paying down your balance or after you've made your last payment, it's a good idea to stop using your card completely. That way you'll know there aren't any new charges coming up.

Closing Your Account

-

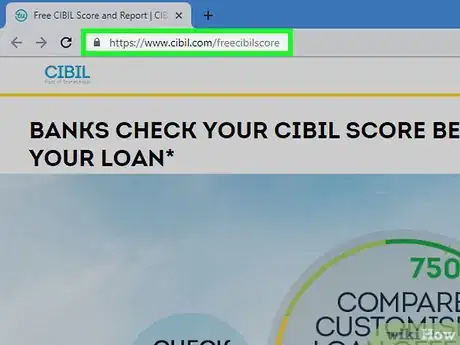

1Check your credit report before closing your account. Go to https://www.cibil.com/freecibilscore and create an account to get your free score and report from CIBIL (Credit Information Bureau India Limited). You will have to provide personal information to create an account, including your date of birth, address, and PAN card or Aadhar number.[8]

- Review your credit report, focusing on the amount of credit you have available and the amount you are using. If you cancel your SBI card, this will decrease the amount of credit available to you, which could lower your credit score.

- If you only have one credit card and you cancel it, this may not lower your credit score initially. However, you may have a difficult time opening another credit card without that continuous credit history.

-

2Call or write to SBI customer service. While some banks in India require you to submit a cancellation request in writing, SBI also takes cancellation requests over the phone. The phone number to call is 1860-180-1290. It's also printed on the back of your credit card.[9]

- To request cancellation in writing, send a letter to SBI Card, PO- Bag 28, GPO, New Delhi-110001. In your letter, state that you wish to cancel your card. Provide your full name, address, card number, and contact information. Do not include any confidential information, such as your PIN or your card's CVV number.

- When canceling by phone, you may receive a reference number for your cancellation request. Write it down and keep it safe in case the cancellation doesn't go through or you have any questions.[10]

Tip: When you request cancellation of your primary SBI card, any add-on cards will also be canceled automatically.

-

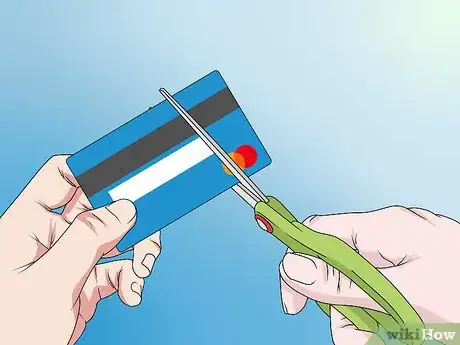

3Cut your card diagonally after submitting your request. SBI requires that canceled cards by cut diagonally from the bottom left corner to the top right corner. After you've cut the card, you may dispose of it however you wish.[11]

- Unlike some banks, SBI does not require you to send the cut card back to them.

- Even though it might be a few weeks before your cancellation takes effect, do not use your card after you've requested cancellation. This could result in the cancellation being delayed.

-

4Receive confirmation of your cancellation. When you submit a request to cancel your card, you'll typically receive a letter from SBI confirming the date on which your card is canceled. The bank may hold cancellation for a couple of weeks to assure no new charges go through. Your confirmation typically will include your final credit card statement.[12]

- If you close your account in the middle of a billing period, you may also get one more statement. However, call customer service if you receive any statements more than 30 days after you canceled your card.

-

5Redeem any unused reward points within 45 days. With some banks, any reward points you accrued while you had the card but failed to redeem are simply eliminated when you cancel the card. However, SBI gives you 45 days to redeem those points before they expire.[13]

- You can redeem the points for items from the bank's reward catalog or you can use them for discounts. However, if you redeem points for discounts after you've canceled your card, make sure you aren't required to use your card to make the purchase.

Protecting Your Credit

-

1Use the credit cards you have periodically. When credit cards remain inactive for months on end, it can actually have a negative impact on your credit score. The easiest way to ensure this doesn't happen is to put a small recurring bill that you normally pay each month on the credit card, then pay the credit card bill.[14]

- You can also arrange your finances so that you use particular credit cards for particular categories of things. You can align this with the rewards you receive. For example, if you have a credit card with travel rewards, use it when booking flights or hotel rooms.

- Paying your card balances off each month is generally better for your credit than carrying an unpaid balance from month to month.

-

2Maintain a balance of credit cards and loans. A mixture of types of credit is better for your credit score than a lot of unsecured credit cards. If you have several credit cards and no loans, you might want to take out a personal loan from your bank. You can put the money in a savings account and pay it back each month. It will cost you a little in interest payments, but you'll help build your credit.[15]

- Another way to maintain a balance of credit is to take out a mortgage on a house or get a car loan to finance the purchase of a car.

-

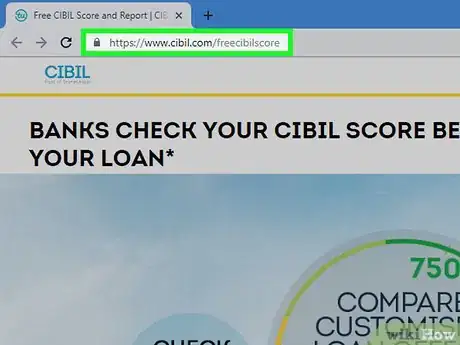

3Check your credit report at least once every 6 months. Use your account at https://www.cibil.com/freecibilscore to check your credit report and score for free. If you see any mistakes or incorrect information, contact CIBIL to get the error corrected.[16]

- You can also work with the lender who provided the information to get it corrected. Sometimes, it's a matter of a simple typographical error that can be corrected quickly.

-

4Keep your credit usage under 30 percent. Your credit usage is the ratio of the amount of credit you're using out of the amount of credit that is available to you. Ideally, you want to pay off your credit card balances each month. However, if circumstances dictate that you have to carry a balance, anything over 30 percent will lower your credit score.[17] #*Credit usage is calculated based on revolving accounts. Typically, these are credit cards where you have a credit limit and can spend up to that amount. As you make payments, the credit becomes available again. Loans that you're simply paying down over time do not factor into credit usage.

-

5Make loan and credit card payments on time. Late payments will damage your credit rating. Mark your due dates on a calendar or set a reminder on your phone or computer so you won't forget your payments.[18]

- You may also be able to set up automatic payments. Even if you do this, make sure you know how much the payment will be each month and review your statement every couple of weeks to check for errors or fraudulent transactions.

Tip: Don't skip a payment because you have a dispute over transactions that posted to your account. If the charge is reversed, your money will be refunded. However, if you skip the payment, your credit rating may drop.

Warnings

- Any annual fees you paid for your credit card will not be refunded when you cancel your card, either in whole or in part.[21]⧼thumbs_response⧽

References

- ↑ https://www.goodreturns.in/classroom/2017/09/how-cancel-your-sbi-credit-card-619449.html

- ↑ https://www.goodreturns.in/classroom/2017/09/how-cancel-your-sbi-credit-card/articlecontent-pf9839-619449.html

- ↑ https://www.goodreturns.in/classroom/2017/09/how-cancel-your-sbi-credit-card/articlecontent-pf9839-619449.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-sbi-credit-card.html

- ↑ https://www.bankbazaar.com/cibil/how-to-improve-cibil-credit-score.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-sbi-credit-card.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-sbi-credit-card.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-sbi-credit-card.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-credit-card.html

- ↑ https://www.creditmantri.com/article-how-to-cancel-an-sbi-credit-card/

- ↑ https://www.sbicard.com/en/faq/closing-of-credit-card-account.page

- ↑ https://www.creditmantri.com/article-how-to-cancel-an-sbi-credit-card/

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-sbi-credit-card.html

- ↑ https://www.bankbazaar.com/cibil/factors-that-affect-credit-score.html

- ↑ https://www.bankbazaar.com/cibil/factors-that-affect-credit-score.html

- ↑ https://www.bankbazaar.com/cibil/factors-that-affect-credit-score.html

- ↑ https://www.bankbazaar.com/cibil/how-to-improve-cibil-credit-score.html

- ↑ https://www.bankbazaar.com/cibil/how-to-improve-cibil-credit-score.html

- ↑ https://www.goodreturns.in/classroom/2017/09/how-cancel-your-sbi-credit-card/articlecontent-pf9839-619449.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-sbi-credit-card.html

- ↑ https://www.bankbazaar.com/credit-card/how-to-close-credit-card.html

About This Article

To cancel an SBI credit card, start by paying off whatever you owe on the card since SBI won't cancel a card that hasn't been paid in full. Then, call SBI at 1860-180-1290 and request to cancel your card. You can also request to cancel your card in writing by sending a letter to SBI. Finally, once you've canceled your card, cut it in half and dispose of it. For more tips from our Financial co-author, like how to tell if canceling your SBI credit card will impact your credit score, keep reading!