This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

This article has been viewed 80,473 times.

Budget sheets are useful tools that help you manage your income and stay out of debt. Creating a budget is important for everyone, be they college students, families, or businesses. Though it takes some effort, knowing how to create a budget sheet can actually give you freedom and peace of mind, since you know exactly where your money is going.

Steps

-

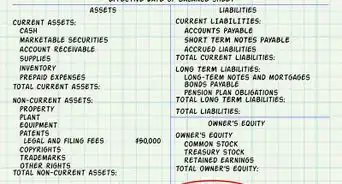

1Understand how a budget works. A budget is a plan for how you will and can spend your money. It helps you see where your money is going; can help you save for a vacation, car, college, or retirement; and can help you stay out of debt. The bottom line of a budget is that your expenses be equal to or less than your income.

- Expenses (also called expenditures) are costs that you have: bills, loan payments, dry cleaning, food, clothes, and other needs.

- Income is any money you receive, specifically for a job or service you provide. Income can also include things like child support and alimony.

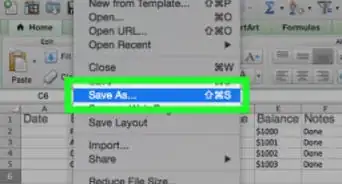

- Budgets can take many different shapes, depending on how detailed you want to be. There are also many tools available to help you, including online budget sheets, software, and spreadsheets. Once you understand the basics of a budget, find a system that works for you.

-

2Identify your goal. Determine if you simply want to track where your money is going, making it possible for you to track your savings for something in particular, your work to get out of debt, or trying to pay your way through college. Know your goal up front so you can budget your money appropriately.Advertisement

-

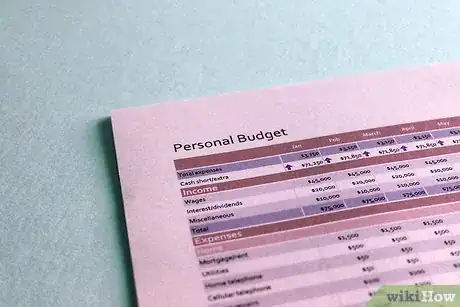

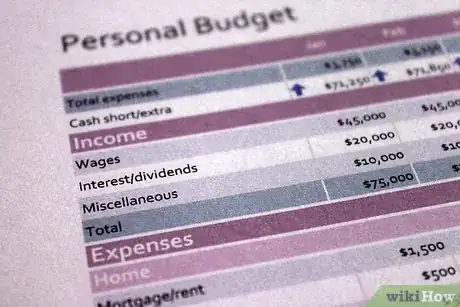

3List your monthly income(s). It may be from a single job or from multiple jobs. Perhaps you get paid for watching someone else's children periodically. Wherever the income comes from, list it at the top of your budget sheet. Then find your total income and draw a box around that number.

- If you receive a paycheck every week, simply take that number and multiply it by 4. If you receive a paycheck biweekly, take that number and multiply it by 2. In both cases, you will have a little extra throughout the year to help cover annual or biannual expenses.

- If you work by commission or via client contract, estimate your monthly income by totaling what you have made in the past 12 months and dividing that by 12. You will need to save a little extra in order to get by in the leaner months.

-

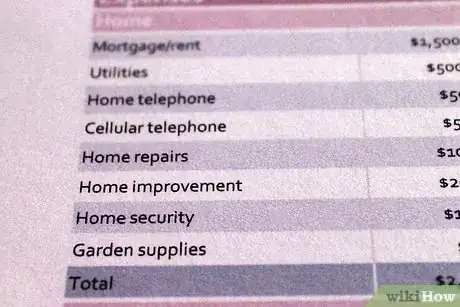

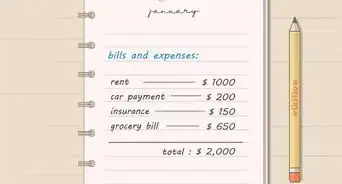

4Outline monthly expenses. These include bills that come on a regular basis: electric or gas, insurance, mortgage, water, loan payments, and other monthly bills. It also includes gasoline, groceries, phone, and any regular tithing or donation. List an expected amount of money spent in each category. Be realistic.

- Prioritize items. Start with the things you absolutely need or are committed to pay. This ensures that you have money for the most important items.

- Put more money than you think you will need in the groceries category. Many people tend to not put enough here.

- Add your "extras" to the end. This includes things like movies, coffee drinks, books, music, or whatever your favorite pastime happens to be. You may be tempted to leave these out, but go ahead and plan for them. Then when you engage in these fun activities, you will know it was in your budget.

- Consider adding an emergency fund. Saving money for emergencies helps eliminate debt should a medical issue or other crisis arise.

-

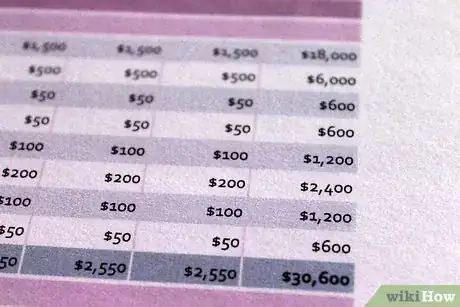

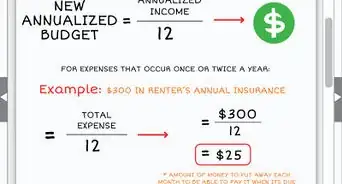

5Add annual or other expenses. Some things are paid only once or twice a year. Estimate a monthly price for that item so you can be prepared when that expense comes. For example, if you pay insurance every 6 months, divide that number by 6 to get your monthly expense.

-

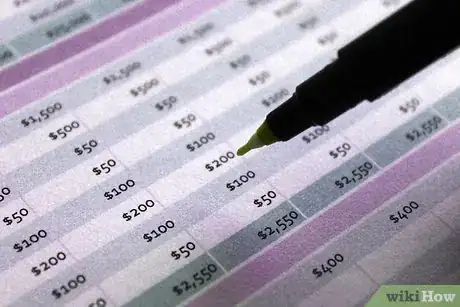

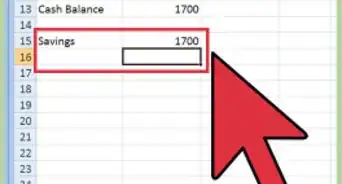

6Check your budget. Total your expenses and see if they are equal to or lesser than your income. If you have income left, that is called a surplus. If your expenses are more than your income, that is called a shortage. In the case of a shortage, you will need to modify your budget.

-

7Modify your budget. There may be several reasons you want to modify your budget. Perhaps you want to save for a car or are spending more than you make. Maybe you noticed that your spending does not match your projected expenses. Or maybe your income has increased or you decided to start a family. It is okay to change your budget to reflect the changes in your life.

Community Q&A

-

QuestionWill tracking your expenses help you develop a better budget for how to spend your money?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive Yes. You can't have a plan if you don't know where your money is going. By creating a budget, you see where every dollar is going and it can help you visualize your spending and help you cut back on wasteful spending. At the end of the day, money is a resource and every dollar should be accounted for. The goal is to find ways to create more income or fewer expenses and you invest the difference.

Yes. You can't have a plan if you don't know where your money is going. By creating a budget, you see where every dollar is going and it can help you visualize your spending and help you cut back on wasteful spending. At the end of the day, money is a resource and every dollar should be accounted for. The goal is to find ways to create more income or fewer expenses and you invest the difference. -

QuestionHow can you reduce your expenses?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive One way is by reducing rent. You could split the rent with a roommate or you could rent the couch to help subsidize your portion of the rent. Another good way is to track your monthly spending so you know where each dollar is going in order to try to figure out where you can cut back. For example, do you really need subscriptions such as Netflix or Spotify or are you eating out too much? Also, check your car insurance for the most competitive rates. A lot of insurance companies offer competitive rates because they want to get new clients and increase their customers.

One way is by reducing rent. You could split the rent with a roommate or you could rent the couch to help subsidize your portion of the rent. Another good way is to track your monthly spending so you know where each dollar is going in order to try to figure out where you can cut back. For example, do you really need subscriptions such as Netflix or Spotify or are you eating out too much? Also, check your car insurance for the most competitive rates. A lot of insurance companies offer competitive rates because they want to get new clients and increase their customers. -

QuestionHow do I do a monthly budget on the computer?

Community AnswerYou can download dedicated budgeting software online or use spreadsheet software like Excel, Google Sheets, or LibreOffice Calc.

Community AnswerYou can download dedicated budgeting software online or use spreadsheet software like Excel, Google Sheets, or LibreOffice Calc.

Things You'll Need

- Paper

- Pencil

- Calculator

References

- http://www.daveramsey.com/article/the-truth-about-budgeting/lifeandmoney_budgeting/

- http://www.daveramsey.com/article/whats-the-big-deal-about-budgeting/lifeandmoney_budgeting/

- http://www.mattaboutmoney.com/2011/02/08/how-to-budget-dont-miss-this-step/

- http://www.kiplinger.com/basics/archives/2003/02/budget.html

- http://christianpf.com/how-to-make-a-budget/

- http://www.bellaonline.com/articles/art48469.asp