This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 63,977 times.

A commercial invoice is a form used by exporters and importers to provide specific information required by customs officials when sending or receiving products across international borders. While there is no standard format for a commercial invoice, customs agencies typically require that certain information be presented in clear and easily legible way. This article provides instructions on how to create and fill out a commercial invoice for imported goods.

Steps

Creating a Commercial Invoice Form

-

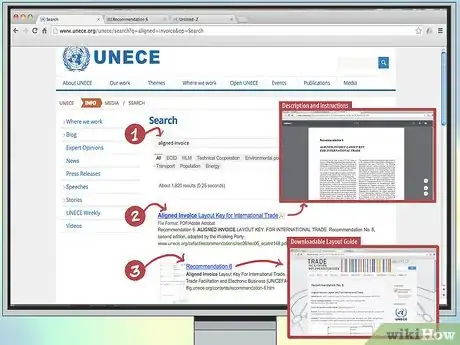

1Print a pre-made commercial invoice. Numerous websites offer free, pre-made commercial invoice forms that can be printed and filled out manually. Some good examples include the aligned invoice by the United Nations Economic Commission for Europe and examples by international shipping companies like FedEx and UPS. These invoices meet all of the necessary requirements for commercial invoices and can be found with a Google search for "commercial invoice templates."

-

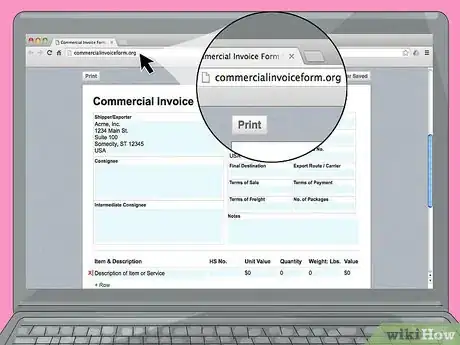

2Fill out a commercial invoice online. The free resource commercialinvoiceform.org allows you input your information directly into their online template. The site also offers a handy how-to page that outlines explains the terminology of the form and clarifies each input value.Advertisement

-

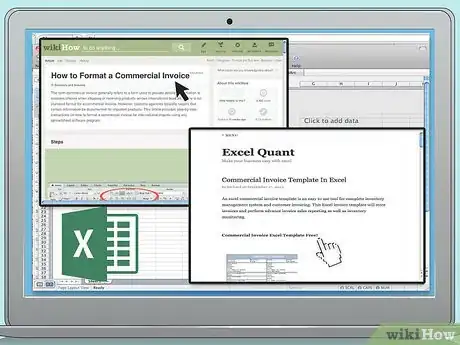

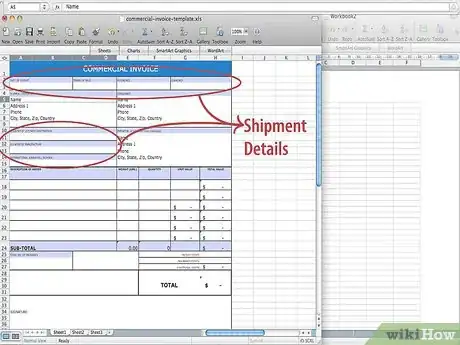

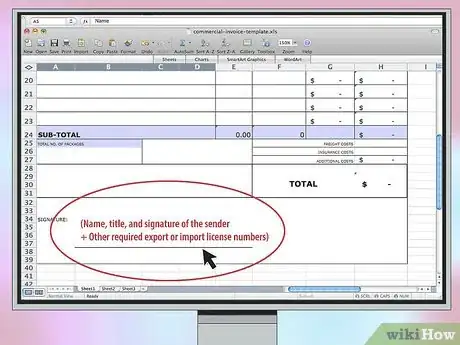

3Create your own invoice using Microsoft Excel. While the above templates will suffice for the majority of transactions, some specific products or formalized commercial transactions may require additional information. These requirements are listed on the United States International Trade Commission's website.[1] If your transaction requires additional information, you will have to create your own commercial invoice using Excel or another spreadsheet program.

- When creating your invoice, remember that while there is no required format, you must be sure to include the required basic information in addition to the specialized information required by your transaction. See how to format a commercial invoice for instruction on creating your own invoice.

- Instead of creating a document from scratch, you could save time by downloading a pre-made commercial invoice and editing it to suit your needs. There is a commercial invoice template available here that can be download free and easily edited to suit your needs.

Completing Your Commercial Invoice Correctly

-

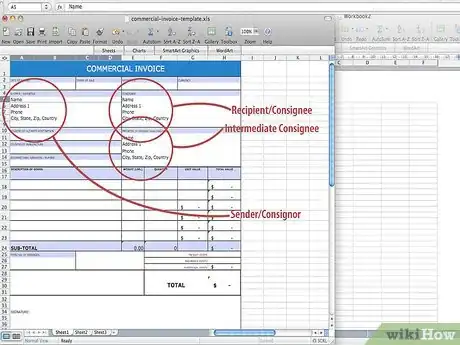

1Provide complete information for the buyer and seller, and for any intermediaries. This includes name (company or individual), full address (with country code), tax ID, and phone number (with country code). Recipients may be referred to as the consignee and senders may be referred to as a consignors. Additionally, information for an importer (sometimes called an intermediate consignee) may be necessary if they are not the final recipient.[2]

- If the sender or recipient of the item is an individual, their tax ID will likely be their Social Security Number or equivalent government identification number.

-

2Complete the shipment details. This information includes the invoice number used by the exporter, terms of sale (also called Incoterms), the reason for export (gift, sale, item for repair, etc.), the shipment ID and/or waybill number (used by the carrier to track or identify the shipment), carrier name, and the date of export. Keep in mind that some of these items may not be applicable to your shipment and thus do not need to be included.[3]

- Terms of sale, or Incoterms, specify which party (the exporter or importer) pays for each stage of shipping and provides each necessary document. It may also specify when payment is due to the exporter. These will often be expressed in acronyms or complicated international trade terminology.[4]

-

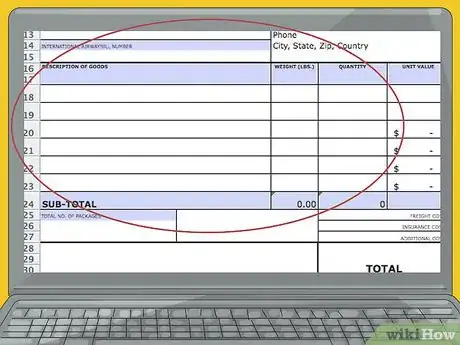

3Describe included items. Item information will typically include what the included items are, a description of each item, a brief description of the intended use of each item, the country of origin, the quantity of each item, and the unit used in measuring the quantity of each item (rolls, stacks, individual). Descriptions of items must also include what materials each item is made of and the item number, if applicable.[5]

- There may be a space on your form to include a Harmonized Tariff Schedule code (HTC, HTS, HS or Schedule B number) for your item. These codes, maintained by the World Customs Organization, specify what type of item is being sold and what tariff will be charged for importing it. While not always necessary, this will help expedite the import or export process and allows you to know at what rate you will be charged import duties. These codes can be found either on the US International Trade Commission's website.[6]

- Note that the country of origin information must be filled in with the country in which the item was manufactured, not necessarily where it is being shipped from.[7]

-

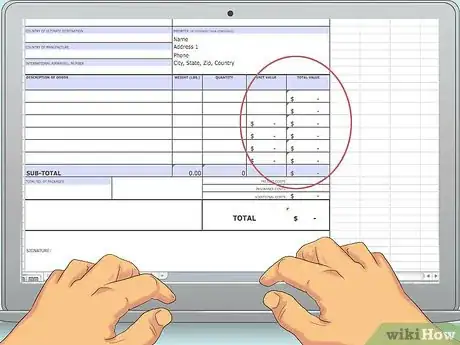

4Fill out the unit value and total value of your shipment. This information will include the unit value of each item, the total value of all items, and the currency used to calculate these values. If you are importing the items, you should include the amount that you paid for them, excluding any shipping or insurance charges. If you are exporting the items, you must include the amount that the items were bought for in the currency in which they were originally listed.

- All items imported into the United States must be priced in US Dollars on entry documents.[8]

- Even if items being shipped are free to the recipient, such as gifts or product samples, a value must still be included. In these cases, the value can be expressed either as the original purchase price, in the case of a gift, or as the cost of materials needed to produce the item in the case of a free sample.[9]

-

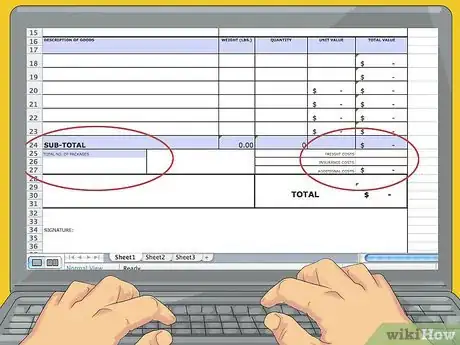

5Complete other shipment information. Other required information may included insurance costs, number of packages, total weight of packages, any discounts or rebates applied to the shipment, other costs associated with the shipment, and any freight charges associated with the shipment. These details will be included or completed as needed and depend on the nature of the shipment.[10]

-

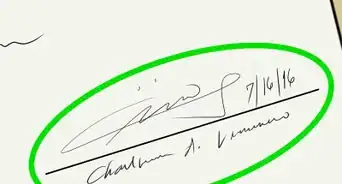

6Sign the document. Many shipments will require a Declaration statement that includes the name, title, and signature of the sender of the shipment, along with any other required export or import license numbers.[11]

-

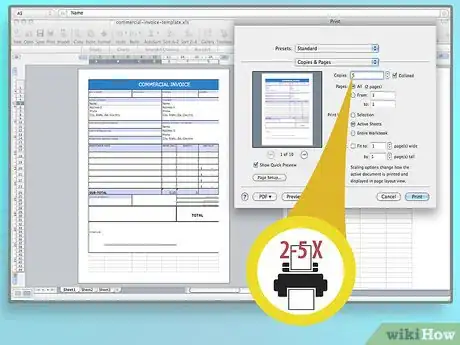

7Copy your invoice. You will likely need multiple copies of your invoice. In addition to copies to keep in your records, you will also need an invoice to submit to customs and one to include inside of the shipment itself if you are exporting the goods.[12]

-

8Check to see if you need to submit any additional documents. Depending on their destination, international shipments may require a certificate of origin. For example, items shipped within North America require a NAFTA (North American Free Trade Agreement) form. Other shipments may required additional certificates of origin.[13]

References

- ↑ http://www.usitc.gov/tata/hts/bychapter/index.htm

- ↑ https://www.ups.com/media/en/Commercial_Invoice_Guide.pdf

- ↑ https://www.ups.com/media/en/Commercial_Invoice_Guide.pdf

- ↑ http://www.foreign-trade.com/reference/incoterms.htm

- ↑ https://www.ups.com/media/en/Commercial_Invoice_Guide.pdf

- ↑ http://www.usitc.gov/tata/hts/index.htm

- ↑ http://www.fedex.com/il/shippingguide/invoice.html

- ↑ https://help.cbp.gov/app/answers/detail/a_id/407/kw/commercial%20invoice

- ↑ https://www.ups.com/media/en/Commercial_Invoice_Guide.pdf