wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 68,343 times.

Learn more...

The Accounting Rate of Return (ARR) is also known as the Average Rate of Return or the Simple Rate of Return. It represents the expected profit of an investment and is therefore used in capital budgeting to determine potential investments' values. In addition, the ARR can be useful if you are trying to evaluate a cost-reduction project.[1] Need to determine an ARR?

Steps

Method 1: Using Initial Investment as a Denominator

-

1Determine the Annual Profit. This method of determining the Accounting Rate of Return uses the basic formula ARR = Average Annual Profit / Initial Investment. To begin, you'll need to find the Annual Profit. This number is based on accruals, not on cash, and it reflects the costs of amortization and depreciation.[2]

-

2Identify the depreciation value. Assuming the investment involves the purchase of a fixed asset (such as equipment or machinery), you'll need to calculate a depreciation value. This is a two-part process:

- First, subtract the scrap value of the asset – the value of its separate components when no longer operational – from the asset's initial value. If, for example, a given piece of machinery was originally valued at $1000, and its scrap value is $500, you'll subtract to get $500.

- Second, divide the resulting amount by the asset's useful life – the number of years the asset is expected to perform productively. If, in our example, the piece of machinery is expected to perform well for five more years, then you'll divide $500 by 5 to get $100.

Advertisement -

3Find the Average Annual Profit. Deduct the amount of depreciation from the Annual Profit of the project; you will be left with the Average Annual Profit. This number will be the numerator in the ARR equation above.

-

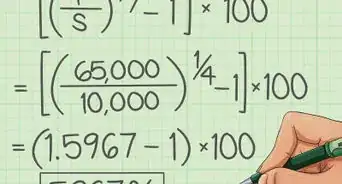

4Divide to get the ARR. Divide your Average Annual Profit by the amount of your initial investment (the combined value of the fixed asset investment and any change in the working capital as a result of that investment). The result, expressed as a percentage, is your ARR.

Method 2: Using Average Investment as the Denominator

-

1Find the Average Annual Profit. This method of determining the Accounting Rate of Return uses the basic formula ARR = Average Annual Profit / Average Investment. As with the first method, you'll need to find the Average Annual Profit. Deduct the amount of depreciation from the Annual Profit of your project, and you will be left with the Average Annual Profit. This number will be your numerator in the ARR equation.[3]

-

2Calculate the Average Investment. Average Investment represents the capital expenditure needed to kick-start a project, in addition to the final scrap value of any machinery, divided by two. This is expressed by the equation Average Investment = (Initial Investment + Scrap Value) / 2.

-

3Divide to get the ARR. Divide your Average Annual Profit by your Average Investment. The result, expressed as a percentage, is your ARR.

Method 3: Evaluating Cost Reduction Projects

-

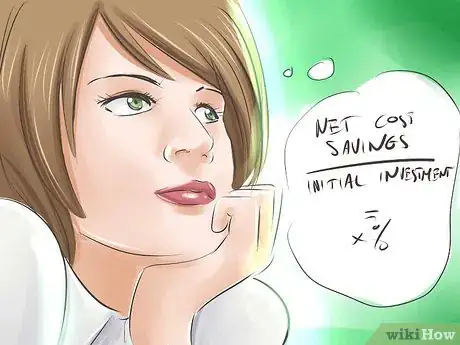

1Determine Net Cost Savings. When you use an ARR to evaluate cost reduction projects, you'll want to use the basic formula ARR = Net Cost Savings / Initial Investment. First, you'll need to find the Net Cost Savings. This is a two-part process:

- Add together the amount of operating expenses and depreciation expenses.

- Deduct the sum total from the projected reduction in labor costs resulting from the use of new equipment.

-

2Divide to get the ARR. Divide the Net Cost Savings by the Initial Investment. The result, expressed as a percentage, is your ARR.

References

- ↑ https://www.myaccountingcourse.com/accounting-dictionary/accounting-rate-of-return

- ↑ https://www.accountingtools.com/articles/what-is-the-accounting-rate-of-return.html

- ↑ https://xplaind.com/393885/arr

- http://www.accountingtools.com/questions-and-answers/what-is-the-accounting-rate-of-return.html

- http://www.capitalbudgetingtechniques.com/accounting-rate-of-return/

- http://beginnersinvest.about.com/od/incomestatementanalysis/a/straight-line-depreciation.htm

About This Article

The Accounting Rate of Return, also called ARR, represents the expected profit of an investment and is used to determine potential investments’ values. To calculate an ARR, you’ll need to divide the average annual profit of the asset by the amount of the initial investment. The average annual profit should take into account amortization and depreciation. You can calculate this by subtracting the amount of depreciation from the annual profit of the asset. Once you have your average annual profit, divide it by the amount of your initial investment. For instance, if your average annual profit for an asset is $1,000, and you bought the asset for $2,500, you would divide 1,000 by 2,500 to get .4 for your ARR, or 40%. To learn other methods for calculating an ARR, read on!

-Step-10.webp)