This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 12,918 times.

When you are the executor or personal representative of an estate, your responsibilities include filing income tax returns for the estate if the estate earns income over the year. This return isn't the same as the personal income earned by the deceased person before he or she died. Estate income includes dividends from investments, interest earned, or capital gains on property held by the estate.[1] [2]

Steps

Preparing State Returns

-

1Check with the state department of revenue. If the estate for which you're serving as executor or personal representative has earned income through the course of the year, you typically must file a state income tax return in the state where the estate is being probated.[3]

- If there is income-earning property in the estate that is located in a different state, you may have to file an income tax return for the estate in that state as well.

- The website for the state department of revenue typically has information on income taxes potentially owed by the estate. You also may be able to walk in to a nearby state taxation office and speak with someone in person.

- If you're unsure whether you need to file a state income tax return for the estate, it may be in your best interest as a fiduciary to work with a licensed and certified tax professional.

- Keep in mind that any fees owed to a tax professional will be paid by the estate, not by you.

-

2Download the appropriate forms. If you're required to file income tax returns for an estate, you must use forms specifically for that purpose – not regular individual income tax returns. Particularly if the state also has general estate taxes, make sure you've chosen the correct form for estate income taxes.[4]

- You typically can download the forms from the state department of revenue's website.

- You also may be able to order paper forms, or request paper forms at a state taxation office.

- The forms typically come with instructions on how to fill them out correctly. Make sure you read these instructions thoroughly before you start filling out the forms.

Advertisement -

3Calculate the estate's gross income. Any income earned by assets in the estate should be included in the estate's gross income. Once you've arrived at the total, check the minimum amount of income for which a state estate income tax return must be filed.[5]

- Other examples of typical income attributed to an estate include rent payments on real estate held by the estate, interest paid on an estate bank account, or salary owed to the deceased person that was paid to the estate after the person's death.

- Gather any account statements or distributions the estate has received, as well as any tax forms that were filed reporting income to the state or to the IRS.

- Even if the estate's income falls below the minimum requirement to file a state return, you may want to consider filing a return anyway, just so you have the record.

- Keep in mind that if the estate has income and you fail to file a return, the state department of revenue may question this. It's typically better for the estate if you file the return anyway, especially if you end up having to file federal estate income taxes.

-

4Make any applicable deductions. Each state typically has a standard deduction, similar to the standard personal deduction you would routinely make on an individual state income tax return. Deductions also may be available for common estate administration expenses.[6]

- If you paid distributions to beneficiaries in accordance with the will or trust instrument that governs the estate, you may be entitled to deduct those distributions from the gross income so they aren't taxed twice.

- Deductible estate administration expenses include fees paid to attorneys, accountants, or tax professionals.

- You also may be able to use miscellaneous itemized deductions similar to those allowed on an individual state income tax return, subject to a 2 percent floor.

-

5Allocate income and expenses. If the estate holds property located in other states, you may need to determine which income and expenses are attributable to property located within the state for which you're completing a state estate income tax return.[7]

- An example of this would be a deceased person whose primary residence is in one state, but who owned a vacation property in another state from which rent income was received after the person's death.

- While the state in which the estate is being probated may consider all estate income as potentially subject to state tax, in some circumstances the income produced by property outside the state may be excluded – particularly if that income is taxed in the other state.

- Keep in mind that if you've paid income tax in one state, you typically are allowed a credit for that tax if you end up having to pay income taxes in another state.

- If you have excluded income earned on assets located in another state, typically you also must exclude expenses associated with those properties.

-

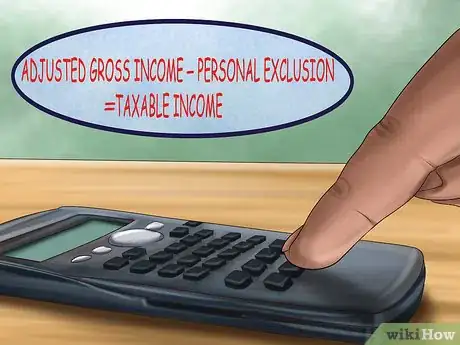

6Determine the estate's taxable income. After you've made all deductions to the gross income, you're left with the estate's adjusted gross income. That amount minus any personal exclusion set by the state is the estate's taxable income.[8] [9]

- If the taxable income falls below the state's minimum threshold for income tax assessment after all deductions are taken, the estate won't owe any state income taxes.

- Just as with individual taxpayers, you still must file an income tax return for the estate even if it shows that no tax is due.

- Since typically the types of income earned by an estate aren't subject to income tax withholding, you shouldn't expect the estate's return to show a refund is owed.

- Place the taxable income amount on a table included on the return itself or in the instructions to find the tax rate.

- Multiply the taxable income by the applicable percentage rate. The result of this calculation is the amount of state income tax the estate owes.

Preparing Federal Returns

-

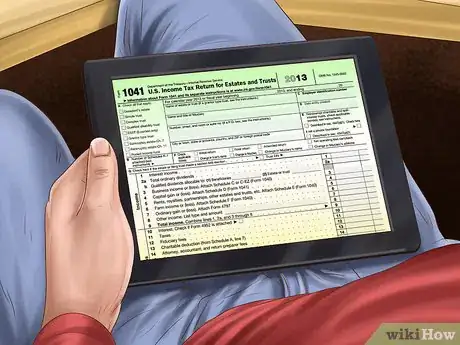

1Download Form 1041 and instructions. To file a federal income tax return for an estate, you'll need Form 1041, the U.S. Income Tax Return for Estates and Trusts. Typically you'll want to download the fillable PDF of this form, available on the IRS website.[10] [11] [12]

- You also can download instructions for completing the form and all associated schedules. Make sure you read these instructions carefully before you start filling out the form.

- If you are confused by the instructions or have any questions, consult with a tax professional. Keep in mind you won't have to pay this tax professional's fees out of your own pocket, they'll be paid by the estate.

- It's part of your responsibility as a fiduciary for the estate to get assistance if you don't feel comfortable completing the forms on your own or don't have extensive tax knowledge and experience yourself.

-

2Choose the estate's fiscal year end. If this is your first year filing an income tax return for the estate, the IRS allows you to choose the last day of any month as the estate's fiscal year end, provided that date is not more than 12 months after the date of death.[13] [14]

- Individuals and most trusts must use the calendar year rather than choosing a fiscal year. However, estates governed by wills have the option of choosing a fiscal year end.

- You can use this to the estate's tax advantage by having the fiscal year end prior to a large distribution, thus limiting the amount of income for at least that first year.

- However, if the state department of revenue requires estates to use the calendar year rather than choosing a fiscal year end, you may want to use the calendar year for federal taxes as well for purposes of consistency.

-

3Determine the estate's gross income. If you've already completed state income tax returns for the estate, the gross income for the estate's federal return will be the same. For estates with income-producing property in more than one state, make sure you're using the total of all income, not just income in one state.[15] [16]

- For the purposes of federal estate income tax, you aren't required to file a return if the estate earned income of less than $600.

- However, even if the estate earned income below that threshold amount, you may want to consider filing a return anyway just so you have the record of the filing – particularly if you have reason to believe you'll have to file a federal income tax return for the estate next year for a larger amount of income.

-

4Take the applicable deductions. Estates are entitled to a number of deductions under the federal tax code – most of which are similar to the deductions you would take on an individual income tax return.[17] [18] [19]

- Estate administration expenses are some of the most common deductions on estate income tax returns. Any expenses, including attorney's and accountant's fees, typically are deductible as long as they're not considered uncommon or unusual.

- If any income from the estate was distributed to beneficiaries, the estate may qualify for an income distribution deduction for those amounts.

- To calculate the income distribution deduction, you must complete Schedule K-1 according to the instructions provided.

- You also may be entitled to deduct state taxes paid on the estate's federal income tax return.

- If you have any questions regarding whether a particular expense is deductible, consult a tax professional for guidance.

-

5Calculate the estate's taxable income. The adjusted gross income minus the applicable personal exclusion equals the estate's federal taxable income. Once you've found the estate's taxable income, locate it on the table located in the Form 1041 instructions to determine the estate's effective tax rate.[20] [21]

- Multiply the taxable income by the applicable tax rate to find the amount of tax owed.

- Keep in mind that in some cases the amount of tax owed may be "zero." Just because the estate doesn't owe any taxes doesn't mean you don't have to file a federal income tax return for the estate.

- Just as with individuals, if the estate has more than the threshold amount of income for the year, you are required to file a return.

Filing Estate Income Tax Returns

-

1Finalize your returns. If you've completed the tax returns on your own rather than with the assistance of a tax professional, look over your entries and double-check your calculations before you file the forms.[22]

- Keep in mind that on both federal and state estate income tax returns, you must use the employee identification number (EIN) that you got from the IRS for the estate – not your Social Security number or the deceased person's Social Security number.

- Once you're satisfied that all the information in the tax return is correct and the calculations are accurate, sign and date the estate's return as fiduciary for the estate and identify your role as executor, trustee, or personal representative of the estate.

- Make a copy of all forms before you file them so you have them for the estate's records.

-

2Mail your returns to the appropriate address. The address to which you must mail your completed returns typically can be found on the form itself, or on the instructions that accompanied that form.[23]

- Check the deadline for filing estate income tax returns and make sure you're not filing late. The deadlines may be different for state and federal returns, but if one is earlier than the other you may want to file them both on the earlier date.

- You may be able to use electronic filing rather than mailing in paper forms. If this option is available, it's typically more convenient and also results in the return being processed more quickly.

-

3Include payment for taxes owed. Check the form's instructions to determine the methods of payment accepted. If this information isn't included in the instructions, it should be available on the taxing authority's website or by calling the appropriate office.[24]

- Typically you will need to pay estate income taxes with a check drawn from the estate bank account.

- If you're filing electronically, you may have the funds withdrawn from the estate bank account using an ACH electronic payment.

- Keep in mind that you must make full payment of the income taxes the estate owes or you risk accruing late fees, interest, and other penalties.

- Filing late taxes or making partial tax payments may be considered a violation of your fiduciary duty.

Warnings

- If you distribute the estate's assets without reserving enough money to pay all estate taxes, federal and state law will hold you personally responsible for paying the amounts owed, including interest and penalties.⧼thumbs_response⧽

References

- ↑ http://www.nolo.com/legal-encyclopedia/filing-income-tax-return-estate.html

- ↑ http://blog.taxact.com/filing-form-1041/

- ↑ https://www.ftb.ca.gov/forms/2015/15_541.pdf

- ↑ https://www.ftb.ca.gov/forms/2015/15_541.pdf

- ↑ http://blog.taxact.com/filing-form-1041/

- ↑ https://www.ftb.ca.gov/forms/2015/15_541.pdf

- ↑ https://www.ftb.ca.gov/forms/2015/15_541.pdf

- ↑ https://www.ftb.ca.gov/forms/2015/15_541.pdf

- ↑ http://blog.taxact.com/filing-form-1041/

- ↑ http://www.dummies.com/how-to/content/how-to-prepare-to-file-tax-returns-for-a-decedent-.html

- ↑ https://www.irs.gov/pub/irs-pdf/f1041.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1041.pdf

- ↑ http://www.dummies.com/how-to/content/how-to-prepare-to-file-tax-returns-for-a-decedent-.html

- ↑ http://blog.taxact.com/filing-form-1041/

- ↑ http://www.dummies.com/how-to/content/how-to-prepare-to-file-tax-returns-for-a-decedent-.html

- ↑ http://blog.taxact.com/filing-form-1041/

- ↑ http://www.dummies.com/how-to/content/how-to-prepare-to-file-tax-returns-for-a-decedent-.html

- ↑ http://blog.taxact.com/filing-form-1041/

- ↑ https://www.irs.gov/pub/irs-pdf/i1041.pdf

- ↑ http://www.dummies.com/how-to/content/how-to-prepare-to-file-tax-returns-for-a-decedent-.html

- ↑ https://www.irs.gov/pub/irs-pdf/i1041.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1041.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1041.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1041.pdf