This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 5,793 times.

Learn more...

Losing your job without warning can be an extremely stressful experience. However, if you were let go through no fault of your own, you may be eligible to receive temporary unemployment benefits while you look for a new job. In South Carolina, you can file a claim relatively easily online through the state’s Department of Employment and Workforce website.[1]

Steps

Qualifying for Unemployment

-

1Make sure you were not fired for misconduct. In order to qualify for unemployment benefits (also called unemployment insurance), South Carolina requires you to have lost your job through no fault of your own. If you were laid off or your company went out of business, there’s a good chance you’ll qualify.[2]

- Even if you were fired, you may still qualify, as long as you did not engage in misconduct.

- If you quit your job, you’ll need to prove that you had “good cause” for doing so. Examples of good causes include dangerous working conditions or if your employer violated your employment agreement.[3]

-

2Check that you earned at least $4,445 during your “base period.” As in most states, South Carolina considers your base period the first four of the last five calendar quarters before you filed your claim. For example, if you’re filing your claim in November, your base period will be from July of the previous year through June of the current year.

- You also need to have earned at least $1,092 during your highest earning quarter of your base period.[4]

Advertisement -

3Confirm that you’re filing your claim in the state you were employed in. In order to qualify for unemployment benefits in South Carolina, you need to have been employed in that state. If you live in South Carolina, but were employed in another state, you’ll need to apply in the state you were employed in.[5]

-

4Maintain an active job search. To qualify, South Carolina requires you to be actively looking for a job and willing and able to work. If, during your job search, a suitable position is offered to you, you must accept it or risk losing your benefits.[6]

-

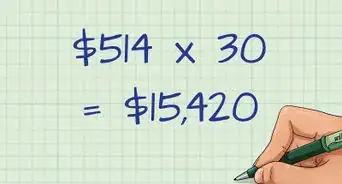

5Estimate the amount of your weekly benefits. You can typically expect to receive about 50% of whatever your weekly earnings were during your base period. However, your weekly benefits cannot exceed $326.[7]

- Benefits may be paid out for up to 20 weeks.

Filing a Claim

-

1Gather your information and know your social security number. Filing your claim will go a lot faster and more smoothly if you have all the information you need readily available before you start the process.[8]

- You’ll need your social security number or, if you're not a US citizen, your alien registration number.

- You are also required to provide your recent work history, including the names, addresses, and phone numbers of all employers you worked for in the last 18 months.[9]

-

2Visit https://dew.sc.gov and create a username and password. The first step is to set up an account through the website’s MyBenefits portal. Navigate to the login page and click “Register Now!” to create an account.

- You’ll be asked to provide your name, date of birth, social security number, email address, and other information.

- At this time, you’ll also set up security questions in case you have problems logging into your account in the future.

-

3Register your account. To do this, enter the username and password you just created. You’ll be prompted to provide additional information, including your address and contact information.

- Once you’ve registered your MyBenefits account, you’ll be able to access the Customer Menu page, where you’ll file your claim.

-

4File your initial claim through the online portal. From the Customer Menu page, select “File a New Unemployment Insurance Claim.” You’ll be asked to answer a series of questions about your employment history and your separation from your most recent employer. You’ll also be asked how you'd like to receive your benefits (via direct deposits or prepaid debit cards).[10]

- Federal and State income taxes must be paid on unemployment benefits. During the application process, you’ll be asked if you would like these to be withheld or if you want to be responsible for paying them yourself.

- If, at any point during the application process, you need to log out and finish your application another time, your progress will be saved. Simply click “Resume My UI Claim” when you log back in.[11]

-

5File weekly claims to continue receiving benefits. Filing weekly claims is not as long or involved as filing your initial claim. However, if you want to continue receiving unemployment benefits, you’ll need to remember to log on and file a claim for each week you are unemployed.[12]

- You’ll be asked to indicate whether you worked at all that week, if you earned any income, and whether or not you're continuing to look for work.

- Claim weeks begin on Sundays and end on Saturdays. Each time you file your weekly claim, you’ll be providing information about the previous week.

Appealing a Rejected Claim

-

1Read your determination letter carefully. Your letter will indicate why your claim was denied and include detailed information about the appeals process.

- Common reasons for having a claim denied include quitting your job without a good cause, being fired for misconduct, refusing suitable employment, and insufficient base period earnings.[13]

-

2Decide if filing an appeal makes sense. Even if your claim was denied, you may still qualify for benefits.

- If you disagree with the Department of Employment and Workforce’s decision, or believe an error was made in the evaluation process, it’s worth filing an appeal to have the decision reversed.

- However, if your appeal was denied for a legitimate reason (for example, you simply didn’t earn enough during your base period), it's not worth filing an appeal.[14]

-

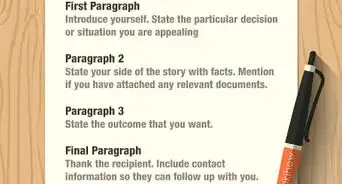

3Complete a Notice of Appeal form. You must send your notice of appeal to the Department of Employment and Workforce's Appeals Division by mail or fax within 10 days of the date listed on your determination letter.

- Visit dew.sc.gov/individuals/manage-your-benefits/appeals to download a Notice of Appeal form.

- You'll need to provide your name, social security number, and other personal information. You’ll also need to provide your employer’s information and state your reason(s) for filing an appeal. Make sure to sign the document by hand before you mail or fax it.

-

4Hire an employment attorney if you need legal advice. You will not be provided with an attorney, but you may choose to consult one on your own to help you prepare for and participate in your hearing.[15]

-

5Gather and submit evidence and select witnesses for your hearing. You’ll want to be as prepared as possible leading up to your hearing. The information and documentation you’ll need will depend on the reason your claim was denied.

- For example, if you believe your earnings were calculated incorrectly, you’ll want to bring documentation that reflects your actual earnings.

- You may also want to bring witnesses (such as coworkers) that can support your case with testimony.[16]

- If your witnesses are willing to testify voluntarily, you are not required to obtain a subpoena. However, you can request that witnesses be subpoenaed if necessary.[17]

-

6Attend your hearing by phone or in person. In South Carolina, most appeal hearings are held by phone conference. In other cases, you may be asked to appear in person.

- The hearing will be conducted by an administrative hearing officer who will place witnesses under oath and hear their testimony. You will have the opportunity to interview all witnesses and submit your evidence.

- In most cases, hearings are held within 10 weeks of the date a complainant filed their appeal.[18]

-

7Appeal an unfavorable decision to the appellate panel. You will receive a written decision in the mail notifying you of the administrative hearing officer’s decision. If you have lost your appeal, you’ll have 10 days to appeal the decision to the appellate panel. The letter you receive will include information about how to do so.

- If the appellate panel also rules against you, you will have 30 days to file a lawsuit with the South Carolina Administrative Law Court.[19]

-

8Continue filing weekly claims while your appeal is pending. If you win your appeal, you will be entitled to receive benefits retroactively as long as you continue to file weekly claims and look for work during the appeals process.[20]

- If you fail to file weekly claims while your appeal is pending, you will not receive any benefits for those weeks, even if you win your appeal, so it’s important to remember to file a claim each week.[21]

References

- ↑ https://dew.sc.gov/individuals

- ↑ https://www.nolo.com/legal-encyclopedia/collecting-unemployment-benefits-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/collecting-unemployment-benefits-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/collecting-unemployment-benefits-south-carolina.html

- ↑ https://workforcesecurity.doleta.gov/unemploy/uifactsheet.asp

- ↑ https://www.nolo.com/legal-encyclopedia/collecting-unemployment-benefits-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/collecting-unemployment-benefits-south-carolina.html

- ↑ https://dew.sc.gov/individuals/apply-for-benefits/claims-process

- ↑ https://dew.sc.gov/individuals/apply-for-benefits/claims-process

- ↑ https://dew.sc.gov/docs/default-source/scubi-documents/new-claim.pdf?sfvrsn=b1e72624_4

- ↑ https://dew.sc.gov/docs/default-source/scubi-documents/new-claim.pdf?sfvrsn=b1e72624_4

- ↑ https://dew.sc.gov/individuals/manage-your-benefits/weekly-claims

- ↑ https://www.nolo.com/legal-encyclopedia/how-appeal-unemployment-denial-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/how-appeal-unemployment-denial-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/how-appeal-unemployment-denial-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/how-appeal-unemployment-denial-south-carolina.html

- ↑ https://dew.sc.gov/individuals/manage-your-benefits/appeals/appeals-faq

- ↑ https://dew.sc.gov/individuals/manage-your-benefits/appeals/appeals-faq

- ↑ https://www.nolo.com/legal-encyclopedia/how-appeal-unemployment-denial-south-carolina.html

- ↑ https://www.nolo.com/legal-encyclopedia/how-appeal-unemployment-denial-south-carolina.html

- ↑ https://dew.sc.gov/individuals/manage-your-benefits/appeals/appeals-faq