This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 165,923 times.

A purchase of unused land is generally harder to finance than a parcel with an existing property, largely because most lenders find these types of loans to be too risky. While getting financing for a land purchase is certainly possible, you will need to do your homework and be able to convince the lender of your ability to repay the loan. This will require submitting a large amount of information about the property and your plans for it. Once you've gathered the information you need, you'll be able choose the type of loan that's right for you and finally purchase the land you want.

Steps

Planning Your Land Purchase

-

1Have the land professionally surveyed. After you have chosen the right parcel of land for your purposes, you will need to have the land surveyed to determine its dimensions and property lines. A survey will also reveal any easements for access to the property, which refers to neighbor's rights to travel through the property. Right-of-way issues are often critical to open plots of land because they are important for the purposes of improving or using that land over time and may affect your ability to get a loan.[1] For more information on having land surveyed, see how to get a land survey.

- In some cases you may be able to simply ask for a recent land survey from the seller.[2]

-

2Examine the relevant zoning laws. Go to municipal offices and look through zoning records to get a better idea of how a desired plot of land could be legally used. If your intended use for the land is not allowed by zoning laws, you may be able to apply to seek a zoning change from the municipal government.[3]

- You may also wish to secure any flood or hazard warnings relevant to the land. A potential lender may ask for these documents.[4]

Advertisement -

3Evaluate any improvements on the land. Improvements are any existing or planned man-made additions to the plot of land. Adding improvements to the land or detailing planned improvements for the land may help you secure financing.[5]

- It may be easier to secure financing if you plan to build structures on the land. These could be residential or commercial structures, depending on your needs and zoning laws. In order to secure financing more easily, have an architect draw up plans for whatever kind of structure you want to build. You may also wish to contact a general contractor for an estimated cost of building the structure.[6] Note that 100% financing packages are rarely available for raw land, even those expected to be developed. Lenders will expect you to have a stake in the financing as well.

- Whether a piece of land is close to water and sewer utilities may affect its value. Other types of access may also make a huge difference in valuation, and may affect a financing deal. If there are no utilities already installed on the land, contact the utility companies that service the area for an installation estimate.[7]

- Even if there is no building on the land, existing wells, trails, roads or other items may increase the perceived value of the parcel. Any perceived improvement in value will make financing easier to get.[8]

-

4Look for various ways to produce asset value on land. Perhaps the most common one for unimproved land is timber value. Sellers and buyers often identify timber value for a piece of forested land in land calculations. This value may also influence a financing deal by convincing the lender that you will be able to profit from the land.

- Grazing or farming rights may be another way to earn money on a piece of land.

-

5Compile your information. You'll need to put the information about the land and your plans for it together in a sort of loan application, sometimes known as a land portfolio. The more information you have, the better "story" you will be able to tell the lender and the higher your chances of securing financing. Your land portfolio should also include information about your creditworthiness (like a credit report or score).[9]

Financing the Land Purchase

-

1Consider hiring a lawyer. Before taking any action, especially if you are purchasing completely raw land, consider hiring professional legal help. Hiring a real estate attorney will ensure that your rights are protected during the bidding process for purchasing the land and during the financing process. A good attorney will also be able to help you with price negotiations.

-

2Make an offer on the land. Before you can purchase your property, you will need to make an offer on the land and have that offer accepted by the seller. This process can be very simple, but can also follow a relatively complicated bidding process. For more information on the actual buying process for land, see How to Buy Raw Land. It may also be in your best interest to ask for an exclusive option on the property for a period of time so you can pursue financing, etc. Having an option is better than owning, since there is less money involved.

- Before submitting an offer on the land, be sure that you have the proper permits and any requisite insurance. Ask your lawyer for assistance in this matter.[10]

-

3Contact potential lenders. If your offer is accepted by seller, you now will have to find a way to finance your purchase. Start by contacting potential lenders like local banks and credit unions to request a loan interview. Meet with these lenders and present your land portfolio. With enough salesmanship and good credit, along with a good land portfolio, you might be able to get a loan through one of these institutions.[11]

-

4Consider other financing options. With some land types, especially raw land parcels, it may be very difficult to secure funding from a financial institution. Luckily, there are a bevy of other financing options available. The land serves as collateral for loan; additional security might come from downpayment in place of other assets. Be aware that some financing options may be more expensive than borrowing from the bank, so consider your options before setting down any of the following paths.

- One option is owner financing. This essentially allows you to gradually pay the seller of property directly, rather than going through a lending institution. This will generally require a large down payments to secure the trust of the seller. Like any bank loan, owner financing will be secured by legal documents. Contact the seller of the property to see if they are willing to do this financing option.

- Another option is through a private-party loan. This will require you to find a friend or family member willing to loan you money. These loans can be secured with collateral (the lender takes possession of a house or car if you default) or unsecured.

- Additionally, if the land is being purchased for a specific purpose, like for farming or commercial use, you may be able to apply for government loans. Specifically, the Small Business Administration (SBA) offers loans specifically designed for the purpose of purchasing land and the United States Department of Agriculture (USDA) offers land loans to farmers who fail to qualify for traditional loans.[12] [13] See their respective websites or contact your local SBA or USDA offices to learn more.

-

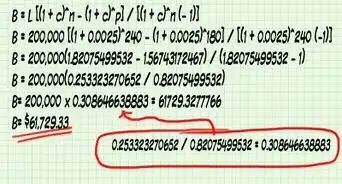

5Compare your financing options. Estimate the total costs of each loan and compare them against each other. Generally, owner financing will be the cheapest option, unless you have great credit and are able to secure a low-interest bank loan. Also think about the durations of the loans; you don't want to take a great interest rate but be stuck paying it off for many years. Choose a loan that you can afford and, if you're utilizing your land for profit, one that will allow you to earn money in the long run.

-

6Choose a loan. Select which loan works best for you and pay the down payment. Be advised that in many cases, this down payment may be as high as 20 to 50 percent of the value of the property.[14]

Expert Q&A

-

QuestionPurchasing a developed lot to build a retirement home on. Should I get a lot loan or a home equity line of credit?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Research both, see which option gives you the most favorable terms. If it is the Home Equity Line of Credit, you will need to weigh the risk of making your personal home vulnerable to foreclosure if the retirement home does not work out vs. the additional cost of the lot loan.

Research both, see which option gives you the most favorable terms. If it is the Home Equity Line of Credit, you will need to weigh the risk of making your personal home vulnerable to foreclosure if the retirement home does not work out vs. the additional cost of the lot loan.

References

- ↑ http://www.bankrate.com/finance/mortgages/what-you-should-know-about-land-loans.aspx

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ http://www.bankrate.com/finance/mortgages/what-you-should-know-about-land-loans.aspx

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ http://blog.lotnetwork.com/lot-and-land-loans-financing-your-property-purchase/

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ http://buildingadvisor.com/buying-land/questions-to-ask/

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

- ↑ https://www.sba.gov/content/u-s-small-business-administration-loan-funds-available-purchase-commercial-real-estate

- ↑ http://www.fsa.usda.gov/programs-and-services/farm-loan-programs/index

- ↑ http://homeguides.sfgate.com/finance-purchase-raw-land-62950.html

About This Article

To finance land, start by getting it surveyed so you have an accurate value for it. Then, note down any plans you have for land improvements, including building residential or commercial structures, and any ways to profit from the land, like grazing rights. You'll want to gather all of this information into a land portfolio, which you'll need to submit to potential lenders. Then, submit an offer for the land to the owner, and if it's accepted, apply for a loan from a local bank or credit union. To find out why it may be worth hiring a lawyer and how to find alternative financing sources, read on!

-Step-18.webp)