This article was co-authored by Clinton M. Sandvick, JD, PhD and by wikiHow staff writer, Christopher M. Osborne, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 39,798 times.

If you are a small business owner, forming a Limited Liability Company (LLC) may be a wise choice, even if it seems like a hassle. As the name indicates, an LLC limits the owner's (or owners') personal liability for the actions of the company, which could save you a great deal of money and legal troubles down the road. If you live in Connecticut, the process for forming an LLC is similar to most other states. You could rely on an attorney to do the work for you, but the process is not beyond the reach of the average person.

Steps

Filing Your Application

-

1Choose a business name. Each LLC is a unique entity in the eyes of the law, so, like a person, it needs a legal name for identification purposes. To avoid confusion, you need to choose a unique name that is not already in use in Connecticut.[1]

- Thankfully, the Secretary of the State of Connecticut offers a searchable online database of existing business names in the state (http://www.concord-sots.ct.gov/CONCORD/online?sn=PublicInquiry&eid=9740).

- To register as a Limited Liability Company, those three words, or the abbreviations LLC, L.L.C., or Ltd. Liability Co., must appear at the end of your business name as part of the actual name. For instance, “Acme Shoes, LLC” would be your full business name, not “Acme Shoes.”[2]

- If you want to make sure your preferred name is not snatched up while your file your application materials, you can request a name hold for 120 days by filing a form and paying $60.

-

2File your Articles of Organization. This is the primary form required by the State of Connecticut in order for you to create an LLC. All things considered, it is a refreshingly short and straightforward application form, and is available for download.[3]

- The form requires you to enter the LLC's chosen name and business address (which can be your home address); a brief description of the nature of the business; the name, address, and signature of the Registered Agent for the LLC (see the Step below for more information on this); the name and address of all managers or members of the LLC (there must be at least one, such as yourself); and an indication of whether the LLC will be run by manager(s) or its member(s).

Advertisement -

3Appoint a Registered Agent. Most states in the U.S., including Connecticut, require LLCs to identify an agent for “service of process.” Basically, that means you must name a person or business entity that will accept legal papers on the LLC's behalf if it is sued.[4]

- In Connecticut, the Registered Agent (listed on the form as “Statutory Agent for Service of Process") must be either a resident of the state (including the members or managers of the LLC); a business located in the state; or an out-of-state business certified to do business in the state.

- Make sure your chosen Registered Agent agrees to the appointment beforehand. Your chosen individual, or a representative of the business you choose, must sign the Articles of Organization before filing.

-

4Mail your application and fee. While the Connecticut Secretary of the State Office indicates that it is working on developing an e-file capacity, at present you must apply to form an LLC by mail.[5]

- The filing fee is $120, payable by check to “Secretary of the State.” Include it with your application.

- Mail the application and fee to: Commercial Recording Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford, CT 06115-0470.

Completing the Requirements

-

1Apply for tax numbers. Not surprisingly, the “tax man” will come calling for your new LLC. Applying for tax identification numbers is likely a legal requirement — depending on the nature of your LLC — and certainly wise regardless.

- If your LLC has more members than just you alone, it is required by federal law to have an Employer Identification Number (EIN) from the IRS. If your LLC is just you, you can still apply for an EIN (https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Employer-ID-Numbers-EINs).[6]

- To do business in the state, your LLC must also apply for a Connecticut Tax Registration Number (TRN) (http://www.ct.gov/drs/cwp/view.asp?a=1433&q=265880).[7]

-

2Determine if you need other licenses, permits, or registrations. Depending upon the nature of your LLC, the type of business it conducts, and its location within Connecticut, you may need to file for one or more additional permits, licenses, or registrations.[8]

- Check with the Connecticut Department of Consumer Protection (DCP) to determine if you need any occupational or trade licenses (http://www.ct.gov/DCP/site/default.asp).

- The state's Department of Energy and Environmental Protection (DEEP) issues permits for some types of business activity, so check with it as well (http://www.ct.gov/deep/site/default.asp).

- The Business Response Center (BRC) for the Connecticut Economic Resource Center (CERC) can help you determine if your LLC requires additional registrations, permits, or licensure (http://www.ct-clic.com/).

- Although many small businesses are not required to do so, you may need to register your LLC with the Connecticut Department of Labor (DOL) (http://www.ctdol.state.ct.us/).

- If you wish to trademark the name (or logos, etc.) of your LLC, you may choose to do so at the state level by filling out a form and paying $50, and/or by registering with the U.S. Patent and Trademark Office (http://www.uspto.gov/).

-

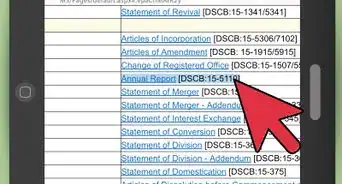

3Prepare for continuing obligations. All business entities in Connecticut, including LLCs, are required to file an Annual Report with the Office of the Secretary of the State. Additionally, your LLC must pay a bi-annual Business Entity Tax.[9] [10]

- Fortunately, you can file your Annual Report online. It is due during the anniversary month of the establishment of your LLC each year (http://www.concord-sots.ct.gov/CONCORD/).

- The Business Entity Tax (BET) currently stands at $250, and is typically due on April 15 of every other year (http://www.ct.gov/drs/cwp/view.asp?a=1454&Q=307250&PM=1).

- If your LLC will be selling goods and collecting sales tax, or if it will have employees (non-members), then you must register it with the state Department of Revenue Services (DRS) as well (http://www.ct.gov/drs/site/default.asp).

-

4Protect your LLC by drafting an operating agreement. Once you have completed all the requirements for your Connecticut LLC, you should strongly consider creating an operating agreement. This document is not legally required in the state, but it is just plain smart business to have one.[11]

- An operating agreement explicitly states the particular details of your LLC, and can be particularly important if it has multiple members with varying levels of investment and/or interest in operations. It will be used by the courts whenever problems with your LLC arise. Without one, for instance, the default rules for LLCs dictate that all members share in profits and losses equally, regardless of investment or activity level.[12]

- Operating agreements typically include sections regarding the members' percentage interests; the members' rights and responsibilities; the members' voting powers; the allocation of profits and losses; the management structure of the LLC; the rules for holding meetings and votes; and buyout provisions. However, the agreement should be tailored to fit your particular LLC.

- You can find templates to help you write an operating agreement, but it is very important that it meets the legal requirements in your state (in this case, Connecticut). Because of its significance when dealing with legal matters relating to your LLC, you may want to hire an attorney to draft the operating agreement for you.

-

5Draw up a business plan to guide your new LLC moving forward. Again, this is not legally required but is very important nonetheless. A good business plan serves as an operations guide as your LLC gets off the ground.[13]

- A business plan is essentially a sales pitch for potential investors, but it is a valuable document for any new business. See the detailed article How to Write a Business Plan for extensive information on the process of creating one, including the following listing of common contents:

- Title Page and Table of Contents.

- Executive Summary, in which you summarize your vision for the company.

- General Company Description, in which you provide an overview of your company and the service it provides to its market.

- Products and Services, in which you describe, in detail, your unique product or service.

- Marketing Plan, in which you describe how you'll bring your product to its consumers.

- Operational Plan, in which you describe how the business will be operated on a day-to-day basis.

- Management and Organization, in which you describe the structure of your organization and the philosophy that governs it.

- Financial Plan, in which you illustrate your working model for finances and your need from investors.

- Entities such as the U.S. Small Business Administration (https://www.sba.gov/offices/district/ct/hartford) can also offer guidance on developing a business plan.

- A business plan is essentially a sales pitch for potential investors, but it is a valuable document for any new business. See the detailed article How to Write a Business Plan for extensive information on the process of creating one, including the following listing of common contents:

References

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false#

- ↑ http://www.nolo.com/legal-encyclopedia/connecticut-form-llc-31832.html

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false#

- ↑ http://www.nolo.com/legal-encyclopedia/connecticut-form-llc-31832.html

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false#

- ↑ http://www.nolo.com/legal-encyclopedia/connecticut-form-llc-31832.html

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false#

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false#

- ↑ http://www.nolo.com/legal-encyclopedia/connecticut-form-llc-31832.html

- ↑ http://www.nolo.com/legal-encyclopedia/connecticut-form-llc-31832.html

- ↑ http://www.nolo.com/legal-encyclopedia/llc-operating-agreement-30232.html

- ↑ http://www.concord-sots.ct.gov/CONCORD/NewBusinessFormation/BusinessRegistrationTool.jsp?pInquiry=false#

-Step-1.webp)

-in-the-USA-Step-20.webp)