This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 16 testimonials and 89% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 329,285 times.

The Federal Housing Administration (FHA) offers special loans to help families who do not qualify for conventional loanspurchase housing. All FHA loans are federally insured and all FHA lenders have been approved by the federal government to service the loans. When compared to other types of mortgages, an FHA loan is especially affordable and easy to qualify for, making them a great choice for people and families who have a limited budget or a tarnished credit history.

Steps

Applying for a Loan

-

1Make sure you qualify for an FHA loan. FHA Loans are known for having looser requirements than conventional home loans, but they do still have requirements. You must be able to meet most, if not all, of these standards to qualify. If you don't meet one of these standards, you can still potentially be approved for a loan if you can prove extenuating circumstances.[1]

- You must prove that you have had 2 years of steady employment in the same line of work where your income has remained the same or increased. Your credit score should be 620 or higher with fewer than two 30-day late payments in the past 12 months, one 60 day late payment and any other late payment in the last 12 months, or one 90 day late payment in the last 12 months.[2] However some lenders can accept a credit score as low as 500, with 10 percent down or 580 with 3.5% down, which is the minimum credit score required by the FHA to insure a loan.

- Your bankruptcy discharge date cannot be within two years of the FHA case assignment date or had a foreclosure in the past 3 years. However, if the foreclosure was on a HUD loan, then you may have to wait longer than three years.[3] If you have, you will likely not qualify for an FHA loan.

- FHA Loans are available only for primary residence occupancy. You have to intend to live in the property you're buying.

- You must also, of course, have the cash to pay the down payment on your loan (the minimum down payment required is generally 3.5% of the purchase price).

-

2Meet with an FHA-approved mortgage lender or broker in your area. Only certain federally-approved lenders and brokers can offer these special loans. To get started, find a mortgage broker near you who is authorized to make FHA loans. You can find a mortgage lender near you by using the FHA Lender finder available on the United States Department of Housing and Urban Development (HUD) website.[4]Advertisement

-

3Save money for a down payment. Almost every home loan requires a down payment - a percentage of the total purchase price paid up front. While FHA loans have especially small down payments, they are no exception. While it varies by location, FHA loans generally allow borrowers to obtain no more than 96.5 percent financing, which means you can expect to pay 3.5 percent of a home's cost up front. There's no way around it - you can't get the loan without making this lump-sum payment.

- You can also ask a family member to make the payment on your behalf, though the family member must write a note indicating that this is a gift and not a loan.[[

- FHA loan requirements state that you can finance (pay as part of your loan) the upfront portion of the mortgage insurance premium. The monthly mortgage insurance premium, however, cannot be financed.

-

4Supply necessary documents. To apply for a loan, you'll need to provide the FHA-approved lender with documents that prove your employment status, savings, credit and personal information. The documentation that you'll need is fairly extensive, including job records, tax documents, and personal information. Be prepared with the following when you apply for an FHA loan:[5]

- Addresses of the locations you've lived in the last two years.

- The addresses and names of your employers for the last two years, plus the amount of your gross monthly salary.

- Valid W2 forms for the past two years.

- Income tax forms submitted for the past two years.

-

5Complete a loan application. Your FHA-approved lender will be able to provide you with the correct application documents for your loan. Fill the application out as carefully and as factually as you can. If you don't know certain pieces of information, look them up. Don't guess - knowingly lying on federal documents is a crime.

- You may want to get pre-approved for your FHA loan. Talk to your lender about pre-approval - if your credit history and financial situation are in good order, you're more likely to be pre-approved.

- Before you fill out the application, you may want to look the document over to ensure you understand all the questions you'll be required to answer. The application is available as a .pdf online.[6]

-

6Have the property appraised. Even if your application is accepted, you can still be denied a loan if the property you wish to buy doesn't pass a proper appraisal and inspection by an FHA-approved appraiser. However, keep in mind that the lender or broker must be the one to order the appraisal on behalf of the borrower. The appraisal cannot be ordered by the borrower. The appraisal is performed for two reasons:

- To ensure the property complies with health and safety regulations.

- To determine the property's value, which also takes into account the value of similar homes in the area.

-

7Complete the FHA loan transaction by signing the closing papers. Be sure to read everything before you sign the final paperwork. Never feel afraid to ask for clarification on anything you don't understand.

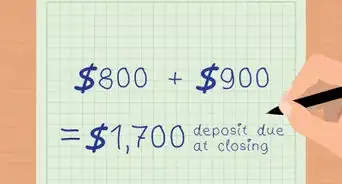

- Closing costs are generally 3.5 to 4 percent of the purchase price of your new home. Closing costs are miscellaneous fees and expenditures associated with acquiring a home loan, such as attorney's fees, the fee for the property appraisal, title examination and insurance, prepaid interest, property taxes, the recording fees and others. Take these into account when you're budgeting for your loan because you'll need the money for these costs on top of the money for your down payment.

- Expect to pay a loan origination fee of 1 percent or more of the value of the loan as well. If they charge more, negotiate the terms down to 1 percent, less than 1 or choose a different lender. Make sure to shop around with different lenders and brokers to get the best rate. Some may not even charge an origination fee.

Considering the Loan

-

1Know the pros and cons of FHA loans. FHA loans offer a variety of advantages, but they aren't for everyone. Before you try to get an FHA loan, make sure you understand how, specifically, an FHA loan differs from normal loans.

- Pros: FHA Loans are, as a general rule, easier to obtain than average home loans. Your credit history isn't as strictly scrutinized for an FHA loan as it is for other types of loans, so, depending on the specifics of your situation, you may still be able to get a loan if you have a foreclosure or a repossession in your credit history. FHA loans also require a smaller down payment - about 3.5% of the purchase price, as opposed to the 3 to 5% most loans other than USDA loans require. Finally, FHA loans are "assumable" - if you sell your home, the buyer can assume payments on your loan. Note that you must wait several years after a foreclosure before you can get another loan.

- Cons: FHA loans require your house to pass a special inspection and appraisal process performed by an FHA-approved appraiser. Also, because FHA loans, don't have the tight standards of normal loans, they require you to pay two kinds of mortgage insurance premiums. These are:[7]

- Upfront Mortgage Insurance Premium (MIP). Borrowers must pay this premium, which is 1.75% of the home loan, regardless of their credit score. This can be paid as a lump sum or can be rolled into the mortgage payments.

- Monthly MIP. This premium is figured into your monthly mortgage payments. It is based on several criteria: your loan-to-value ratio, the size of your loan, and the timeline for paying off your loan.

-

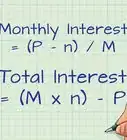

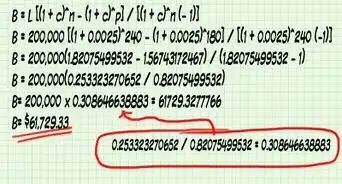

2Determine whether you can afford monthly FHA mortgage payments. You will need to provide your monthly income to an FHA-approved lender. The lender will also investigate your monthly debt services (student loans, credit card debts, etc.) Lenders won't generally be allowed to give you a loan if the monthly payment on the loan requires too high a percentage of your income.[8]

- To get approved for an FHA loan, your front-end ratio (your monthly housing expenses divided by your monthly gross income) has to be below 31%, although, with special justification, you may be able to get approved for a front-end ratio of up to 47%.

- Your back-end ratio (debt to income ratio) has to be less than 43%. As above, in situations with extenuating circumstances, you may be approved for a back-end ratio

-

3Seek advice. Still not sure? Don't make a decision about applying for an FHA loan before you completely understand what you're getting into. Talk to a professional - s/he will be able to help you decide whether an FHA loan is appropriate, based on the specifics of your situation. The U.S. Department of Housing and Urban Development (HUD) sponsors housing counseling agencies throughout the country designed to help you make informed decisions about housing, loans, your personal credit, etc.[9] Search for a housing counseling agency near you via the HUD website's housing counselor locator.[10]

- Alternatively, access the Housing and Urban Development (HUD)'s housing counseling hotline at (800) 569-4287.

Expert Q&A

-

QuestionCan I get a loan for a condominium?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage This depends. Condo projects must either be on the FHA approved project list, or they must pass a condominium review by your lender. The condo review will determine the financial stability of the condo management to determine if the lender is comfortable lending in that particular project.

This depends. Condo projects must either be on the FHA approved project list, or they must pass a condominium review by your lender. The condo review will determine the financial stability of the condo management to determine if the lender is comfortable lending in that particular project. -

QuestionHow can I get approved for a mortgage in Delaware if I don't have a job there yet?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage You can not be approved for a mortgage without being able to prove income. In some cases, future income is allowed if you already have the job secured but have not started yet. Regardless, you must have a job secured that will continue in the area to which you will be moving.

You can not be approved for a mortgage without being able to prove income. In some cases, future income is allowed if you already have the job secured but have not started yet. Regardless, you must have a job secured that will continue in the area to which you will be moving. -

QuestionWhat is the maximum salary to qualify for an FHA loan?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage There are no maximum income guidelines for FHA loans, so any salary is fine.

There are no maximum income guidelines for FHA loans, so any salary is fine.

Warnings

- To protect yourself from predatory lenders, work with FHA-approved lenders only. You can become a victim of loan fraud by giving your personal information to the wrong people.⧼thumbs_response⧽

- FHA loans have a maximum loan amount that varies by location. Check with your FHA-approved lender to determine what that price ceiling is. If the purchase price of your new home exceeds the maximum purchase price of the FHA loan, you will be responsible for the difference.⧼thumbs_response⧽

References

- ↑ http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/comp/premiums/ufmain

- ↑ https://portal.hud.gov/hudportal/documents/huddoc?id=40001HSGH.pdf

- ↑ https://portal.hud.gov/hudportal/documents/huddoc?id=40001HSGH.pdf

- ↑ http://www.hud.gov/ll/code/llslcrit.cfm

- ↑ http://www.fha.com/hud-fha-04

- ↑ portal.hud.gov/hudportal/documents/huddoc?id=92001-a.pdf

- ↑ http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/comp/premiums/ufmain

- ↑ Ibid.

- ↑ http://portal.hud.gov/hudportal/HUD?src=/i_want_to/talk_to_a_housing_counselor

About This Article

To get an FHA loan, start by using the FHA Lender finder on the Department of Housing and Urban Development website to find an FHA-approved mortgage lender. Next, you’ll need to supply the lender with documents that prove your employment status, savings, credit, and personal information. Once your lender has looked over your documents, you’ll need to complete a loan application, and have the property you wish to buy appraised by an FHA-approved appraiser. Finally, you’ll complete the transaction by signing the closing papers and paying the required down payment. To learn how to determine if you qualify for an FHA loan, keep reading!

-Step-18.webp)