wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 75,984 times.

Learn more...

A debt collection agency is a third party company hired to collect debt owed to a creditor such as a credit card issuer. Typically, the creditor has given up collecting the debt, but still wants the money. Since the debt collection agency has assumed the role of acquiring the money you owe, its representatives may constantly call or send you letters. It may also sue you to obtain the money. However, you can settle your debt with the collection agency. Nevertheless, you must know how to make a settlement with a collection agency to avoid any complications.

Steps

-

1Validate the debt collection agency claims.

- You should send the debt collection agency a letter requesting that it send you proof you owe the debt.

-

2Check the statute of limitations.

- Each state has a statute of limitations on how long a creditor has to collect on a debt. For example, debts from 10 years ago may be considered zombie debts-or debts too old to collect on. You won't have to settle the debt if the collection agency tries to collect on a zombie debt.

Advertisement -

3Know the method of payment. You have 2 options.

- You can make a settlement offer in installments. Paying in installments requires you to make more than 2 payments to the debt collection agency.

- You can pay in a lump sum. A lump sum payment requires you to make 1 payment.

-

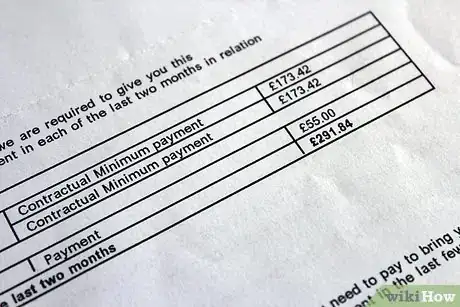

4Know how much money to pay.

- You should save money before settling any debt with a collection agency. You want to have enough money to negotiate a settlement.

-

5Negotiate a settlement with the debt collection agency. You can negotiate in 2 ways.

- A debt collection agency may contact you with a settlement offer.

- You can contact the debt collection agency in writing and offer a settlement figure. Generally, you should start the negotiation by offering approximately 25 percent of the debt.

- You can make a counter offer if the agency's settlement offer is too high or it rejects your offer. The counter offer is an alternative offer. You may have to go through the negotiation process several times.

- Accept the terms of the agreement in writing.

-

6You should write an offer of acceptance or request a letter from the agency if it accepts your offer.

-

7Send the payment along with a letter to the debt collection agency. You should send the payment by certified mail so you have confirmation that it receives the money.

Community Q&A

-

QuestionWhere do I find the statute of limitations in my city?

DonaganTop AnswererIn the United States, statutes of limitation are set by state governments, and in other countries, by the national government.

DonaganTop AnswererIn the United States, statutes of limitation are set by state governments, and in other countries, by the national government. -

QuestionWhere can I find a debt counselor that can help me repair my credit and make better financial choices?

DonaganTop AnswererSearch online or in your phone book for "credit counseling," "debt counselor," or "debt management."

DonaganTop AnswererSearch online or in your phone book for "credit counseling," "debt counselor," or "debt management."

Warnings

- The statute of limitations has nothing to do with how long the debt stays on your credit report. Typically, debt stays on your credit report for 7 years.⧼thumbs_response⧽