This article was co-authored by Brian Stormont, CFP®. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 21,770 times.

Most investment accounts and savings accounts you put money in will earn you what is called "compound interest". When you put money into a compound interest bearing account, your principal (i.e., the money you put in yourself) will earn interest at a certain rate over time. What makes a compound interest bearing account unique, however, is that the interest you earn, if you reinvest it (e.g., leave it in your account), will generate interest along with your principal.[1] You can maximize your earning potential by finding accounts with high interest rates and letting the interest accumulate. Additionally, you can maximize the benefits of your compound interest bearing account by investing early and often, by putting as much money in the account as possible, and by being patient.

Steps

Finding the Best Interest Bearing Accounts

-

1Shop around. Not all compound interest bearing accounts are created equal. Different accounts have different interest rates and different benefits. Therefore, do not simply set up an account at your local bank. Check online for information about interest rates at different places. In addition, call banks, credit unions, and investment firms to understand how they can help you. Do not settle when it comes to growing your money using compound interest.

- Think about your financial objectives and what type of investor you are. If you want to create a balanced portfolio, you might include an even mix of different stock categories and bond categories. If you're more comfortable with risk, you might choose to invest more of your money in stocks, and less in bonds.[2]

-

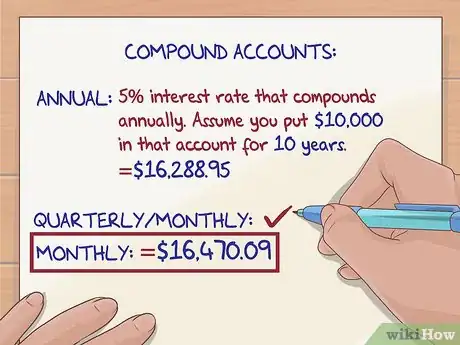

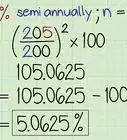

2Look for accounts that compound quarterly or monthly instead of annually. The more often your money compounds, the more you will make. When you shop around for different accounts, look for ones that compound monthly or quarterly as opposed to annually. These accounts will put interest back into your account more often, which means it will start growing faster.[3]

- For example, assume you find an account with a 5% interest rate that compounds annually. Assume you put $10,000 in that account for 10 years. At then end of those 10 years, the balance of your account will be $16,288.95.

- However, if that same account, with the same investment, compounds monthly, the balance after 10 years would be $16,470.09.

- This means that by simply finding an account that compounds more often, you can make more money.

Advertisement -

3Analyze different investment vehicles. Compound interest is not unique to one type of investment vehicle. Your interest is likely to compound whether you get a savings account, certificate of deposit (CD), or even some checking accounts. Therefore, do not just assume that you have to put your money in a savings account to earn this type of interest. When you shop around, ask banks about their investment options. Some types of investment vehicles generally earn higher interest rates than others.

- For example, CDs often have higher interest rates than savings accounts, but your money is not as liquid (i.e., readily available). However, because you will want to leave you money alone for a long period of time, liquidity might not be a concern. Therefore, a CD may be a great investment vehicle to help you earn the most interest possible.

- Historically, small cap stocks generally bring the highest rate of annual return to investors, but you also incur the highest level of volatility for that level of return. Bonds don't have as high of a return, but they also don't fluctuate as much over time.[4]

-

4Look for rewards accounts. Banks nowadays will usually offer certain accounts to those people that meet certain qualifications. These special accounts will often have higher interest rates than normal accounts. For example, some banks might give you a better interest rate if you use your debit card to make purchases a certain amount of times every month. Additionally, other banks will offer higher interest rates if you set up direct deposit.[5]

- Find these accounts and determine whether the bump in interest is worth what you have to do to qualify. If it is, consider taking advantage.

-

5Ask about new customer specials. Banks fight for your business just like any other industry. To help bring in new customers, banks will offer special deals and perks for people starting new accounts. Therefore, while you may need to switch banks to take advantage of these deals, it may be worth it. Banks will often offer introductory rates for a limited amount of time to incentivize you. For example, a new bank might offer you a 4% interest rate for the first three years, and then it will move back down to the normal rate after that.[6]

-

6Find demographic specials. If you are a part of a special group of people, banks might offer you better interest rates on certain accounts. This is especially true for members of the military and young people. For example, some banks will offer better rates if you are an active duty member of the military serving overseas. Additionally, a lot of good rates are offered to young people to help them save early.[7]

- If you think you might be part of a group that could get special rates, ask your bank about them.

Maximizing Your Benefits

-

1Start saving early. Compound interest is most effective when your money is in an account for a long period of time. When you start saving late in life, you do not have the ability to leave your money in the account for a long time. Therefore, it is important that you contribute to a compound interest bearing account early.[8] Start setting money in an account when you are 18. Do not wait until you are 50.

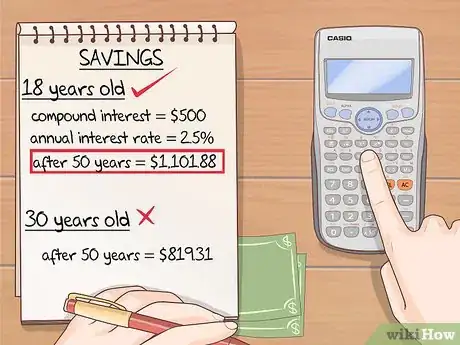

- For example, if you, as an 18 year old, put $500 in a compound interest account that has a 2.5% interest rate, compounded annually, and you leave the money in the account until you are 50, you will have $1,101.88.

- However, if you wait until you are 30 to make the same investment and leave it in the account until you turn 50, you will only have $819.31.

- Because of the compounding effect of interest, if you're able to, start putting money away for retirement when you're as young as 20. If you compare that to what you'll have if you start investing at 35, it can really make a big difference down the road.[9]

-

2Invest as much money as possible. The more money you put in the account, the more interest you will make. Create a budgeting plan and put as much money in the account as you can afford. This will help you create more money over a shorter period of time and maximize the benefits of compound interest.

- For example, assume you open a compound interest bearing account that has a 4% interest rate, compounded annually, and you leave the money in your account for 10 years. If you invest $1,000, the balance after 10 years will be $1,480.24. This means you made $480.24 in interest.

- However, consider what would happen if you invested $10,000 in that same account for the same period of time. In this instance, the balance of your account after 10 years would be $14,802.44. This means you made $4,802.44.

- As you see, the more money you invest, the more interest you will make.

-

3Leave your money in the account as long as possible. Compound interest takes time to make a great affect on your investment. The more time you have, the more effective the account will be.[10] In addition, the longer your money sits in the account, the faster it grows.[11]

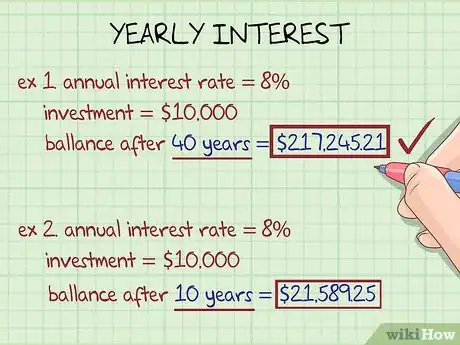

- For example, assume you have a compound interest bearing account that has an 8% interest rate, compounded annually, and you invest $10,000. Next, assume you plan on saving for 40 years. At the end of those 40 years, the balance of your account would be $217,245.21.

- However, if you have the same account but you only leave your money in for 10 years, the balance of your account at the end of that period would be $21,589.25.

- The longer the investment time horizon, the more aggressive you can be with your mix of investments. That means you could have a higher dose of small cap stocks, mid cap stocks, large cap stocks, and international stocks.[12]

-

4Make regular deposits. The last way you can maximize the benefits of compound interest is to keep adding money to your account. Adding a small amount every month can really help build your money faster. Set up an automatic transfer between your regular checking account and your interest bearing account. The more money you have in your account, the more money you can make in interest.[13]

Calculating Compound Interest

-

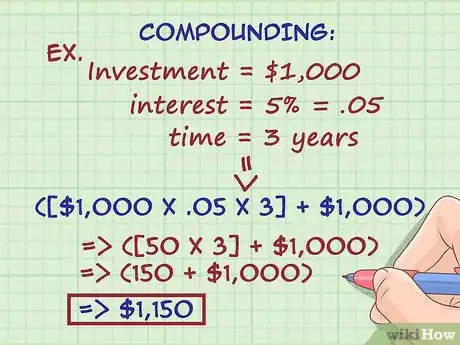

1Understand the concept of compounding. Most interest bearing accounts calculate interest one of two ways. First, if an account accumulates simple interest, the interest you earn will always be calculated by multiplying the interest rate by the principal of the investment or deposit. It never adds the interest you earn back into the calculation. For example, if you invest $1,000 in a simple interest account with a 5% interest rate for a period of three years, the account balance after that three year period will be $1,150 ([$1,000 x .05 x 3] + $1,000).

- Second, if an account accumulates compound interest, the interest will be computed using both the principal and the reinvested interest payments. Compound interest accelerates your earning potential in interest bearing accounts when compared to simple interest bearing accounts. For example, if you invest $1,000 in a compound interest account with a 5% interest rate for a period of three years, the account balance after that three year period will be $1157.63.

- As you can see, the same investment, placed in a compound interest bearing account as opposed to a simple interest bearing account, will earn you extra money.[14]

-

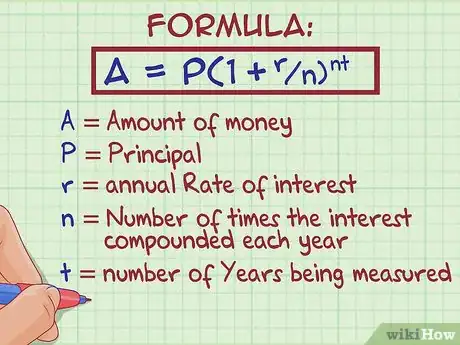

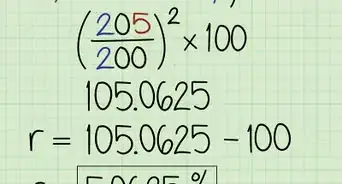

2Obtain the formula for compound interest. To understand compound interest completely, and to help you determine how much money you need to invest in these accounts to make a certain amount of money, you need to know how to calculate compound interest. When you make one initial investment into a compound interest bearing account, you can figure out how much that account will be worth at some point in the future by using the following formula: . The variables in this equation can be defined as follows:[15]

- A is the amount of money that will have accumulated over "n" years, which includes interest

- P is the principal

- r is the annual rate of interest, represented as a decimal

- n is the number of times the interest is compounded each year

- t is the number of years being measured

-

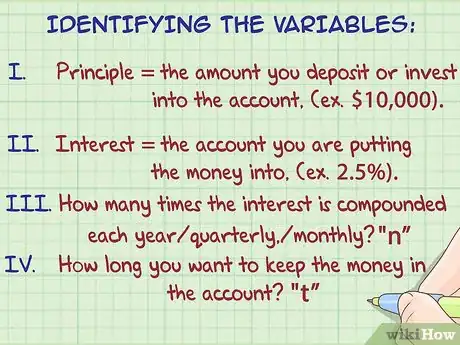

3Identify the variable values. Once you know the formula, you need to gather the factual information so you can input the numbers into the correct spots. When you input your numbers, make sure you they are represented in the correct form. For example, the interest rate needs to be represented as a decimal and your "t" value needs to be in years.

- First, identify the principal, which is the amount you deposit or invest into the account. For example, if you put $10,000 into an account when you open it, that would be the principal.

- Second, you need to know the interest rate of the account you are putting the money into. This number will be told to you when you open the account. For example, a bank might give you a savings account that has an interest rate of 2.5%.

- Third, you need to find out how many times the interest is compounded each year. Most commonly, interest compounds annually. However, in some circumstances, interest can compound quarterly, or even monthly.

- Finally, you need to decide how long you want to keep the money in the account. This number is completely up to you.

-

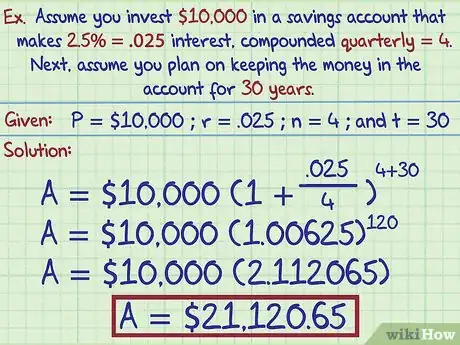

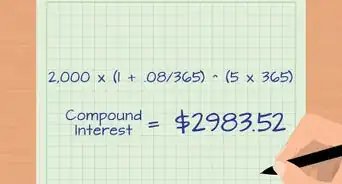

4Make the calculations. Once you know the values of all of your variables, you can make the calculation. For example, assume you invest $10,000 in a savings account that makes 2.5% interest, compounded quarterly. Next, assume you plan on keeping the money in the account for 30 years. Based on this example:

- Your variable values would be as follows: "P" = $10,000, "r" = .025, "n" = 4, and "t" = 30.

- You will plug in the numbers in the correct spots in the formula, which will look like this:

- You will make the final calculation by completing what is in the parenthesis first, then you will do the exponent, and then you will multiply the number by your "P" value.

- In this example, if you initially invested the $10,000 into the account for 30 years, the account balance would be $21,120.65 at the end of those 30 years.

-

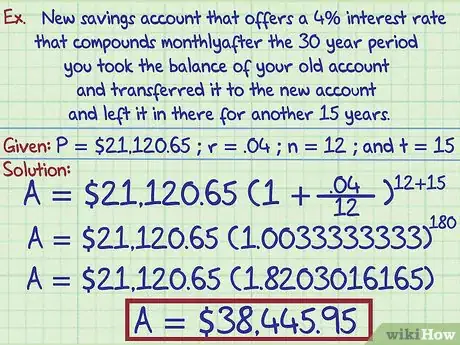

5Change the numbers you input when necessary. The variables in the formula may change over time and you may need to recalculate. For example, you might find a new savings account that offers a 4% interest rate that compounds monthly. If, after the 30 year period you took the balance of your old account and transferred it to the new account and left it in there for another 15 years, you could recalculate how much you would have after that 15 year period.

- Start by identifying your variable values, which would be as follows: "P" = $21,120.65, "r" = .04, "n" = 12, and "t" = 15.

- You would then plug in the numbers in their respective places, and the formula would look like this:

- You would make the final calculation and determine that the balance of your new account, after 15 years, would be $38,445.95.

-

6Use a compound calculator. If you do not have a calculator or device that can do the equation, there are websites out there that will do the math for you. All you have to do is input the numbers and it will do the rest. For example, the U.S. Securities and Exchange Commission has a compound interest calculator you can use. Once you visit the website, simply input the numbers in the correct spots and click "calculate".[16]

Expert Q&A

-

QuestionHow can I maximize my compound interest in long-term investments?

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Certified Financial Planner That depends on whether you'd prefer a more stable investment, or if you're more comfortable with risk. If you don't like to see your balance fluctuate much, you might want to invest in an even mix of different stock categories and bond categories. If you're a more aggressive investor, you might choose to invest more in stocks, and less in bonds.

That depends on whether you'd prefer a more stable investment, or if you're more comfortable with risk. If you don't like to see your balance fluctuate much, you might want to invest in an even mix of different stock categories and bond categories. If you're a more aggressive investor, you might choose to invest more in stocks, and less in bonds. -

QuestionHow can I maximize my investments?

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Certified Retirement Planning Counselor The best way to grow your money is to put it into an account that will pay dividends. If you just put $100 under your pillow, in a year, you're still going to have $100. Even if you add to it every year, you'll still just have what you put in. If you put that same money into an account that will make you 10% a year, you'll have $110 the following year.

The best way to grow your money is to put it into an account that will pay dividends. If you just put $100 under your pillow, in a year, you're still going to have $100. Even if you add to it every year, you'll still just have what you put in. If you put that same money into an account that will make you 10% a year, you'll have $110 the following year.

Warnings

- Compound interest on debts like credit cards works the same way as compound interest in savings. In those cases, though, compound interest has a negative impact on your credit. Try not to carry around credit card balances whenever possible.⧼thumbs_response⧽

References

- ↑ http://www.investopedia.com/university/beginner/beginner2.asp

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ http://money.usnews.com/money/blogs/my-money/2012/09/20/10-things-you-need-to-know-about-compound-interest

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ http://www.forbes.com/sites/moneybuilder/2013/01/13/maximize-your-opportunities-to-earn-the-highest-interest-rates-on-savings-accounts/#280b450e157b

- ↑ http://www.forbes.com/sites/moneybuilder/2013/01/13/maximize-your-opportunities-to-earn-the-highest-interest-rates-on-savings-accounts/#280b450e157b

- ↑ http://www.forbes.com/sites/moneybuilder/2013/01/13/maximize-your-opportunities-to-earn-the-highest-interest-rates-on-savings-accounts/#280b450e157b

- ↑ https://www.tsp.gov/PlanningTools/InvestmentStrategy/retirementsavings/powerOfCompounding.html

- ↑ Chad Seegers, CRPC®. Certified Retirement Planning Counselor. Expert Interview. 16 July 2020.

- ↑ https://www.tsp.gov/PlanningTools/InvestmentStrategy/retirementsavings/powerOfCompounding.html

- ↑ http://money.usnews.com/money/blogs/my-money/2012/09/20/10-things-you-need-to-know-about-compound-interest

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.wellsfargo.com/financial-education/investing/compound-interest-growth/

- ↑ http://www.dividend.com/my-money/the-pros-and-cons-of-compound-interest/

- ↑ https://qrc.depaul.edu/StudyGuide2009/Notes/Savings%20Accounts/Compound%20Interest.htm

- ↑ https://www.investor.gov/additional-resources/free-financial-planning-tools/compound-interest-calculator