This article was co-authored by John Gillingham, CPA, MA. John Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 23,808 times.

Whether you prepare your own tax return each year, use a software program, or hire a tax professional, you need to be thinking ahead to maximize your allowable deductions. With some planning through the year, you can put yourself in a good position for claiming deductions and maintain the appropriate records to simplify your tax return preparation. In general, you can claim deductions for many payments related to your home, business, or other miscellaneous expenses, if you know to be alert for them.

Steps

Maximizing Home-Related Deductions

-

1Plan your mortgage payments to maximize deductions. Your interest payments on most home mortgages are tax deductible. If you time your payments, you may be able to increase your deduction for a particular year. For example, when the end of 2019 approaches, you could prepay your January 2020 payment in December. If you do, the interest for this extra payment will be deductible on your 2019 tax return.[1]

- The IRS measures the date that the payment is actually made, not the date that the payment is considered due by your lender.

-

2Keep records of mortgage interest payments. You should retain copies of checks or other forms of payment that you use. Your lender should be able to provide you with a statement at the end of the year that contains a total of your payments. The lender’s statement should break your payment totals into the amount that was applied to the principal of your loan and the amount that paid interest.[2]

- Only the interest on your home mortgage is deductible. You cannot deduct the payments that pay down the principal of your loan.

Advertisement -

3Deduct real estate taxes. If you paid real estate taxes at settlement or closing or to a tax authority during the year, you may be able to deduct them from your income. This deduction is limited to $10,000 or $5,000 if you are married but filing separately. You can only deduct real estate taxes if you itemize your deductions.[3]

-

4Use a home equity loan for large expenses. Under the 2017 Tax Cuts and Job Act, if you use a home equity loan to purchase, construct, or greatly improve your home, you may deduct the interest. Unlike in previous years, you may not deduct the interest if the loan was used for large purchases or to pay personal expenses.[4]

- For example, if you get a home equity loan for $10,000 to purchase, construct, or improve your home, the interest that you incur on this loan will be tax deductible.

-

5Report your home mortgage interest payments on Schedule A. When you are preparing your tax return, you will need to report your interest payment deductions on Schedule A. You can find this schedule by going to the official IRS website at www.irs.gov and then the “Forms & Pubs” tab.[5]

Making the Most of Business-Related Expenses

-

1Keep separate accounts. If you expect to have business expenses that you will want to deduct at the end of the year, it would make sense to open a separate charge account or checking account for your business expenses. Then, throughout the year, use only that account to pay for business costs. At the end of the year, you can then easily itemize your deductions by using the statement for that account.[6]

- You would be able to deduct business expenses without opening a separate account, but you would have to be very careful with your record keeping throughout the year.

-

2Save receipts. You will need to justify any expenses that you incur as business expenses, to be able to claim them as deductions. Keep receipts for all such expenses. You may need these receipts to complete your tax return at the end of the year. You may also need them in case you get audited by the IRS after filing.[7]

-

3Keep records of business use of personal items. In many cases, you are entitled to claim a deduction on your federal taxes when you use certain personal property for business purposes. To be able to claim business deductions, you need to keep very good records of the amount of time and space that you use for your business. In particular, you can claim deductions when you use the following items for business purposes:[8]

- Home office. If you establish an office in your home, you are eligible to claim it as a deduction. In order to claim this deduction, you must dedicate the office space exclusively for business purposes. You can then calculate the fraction of your entire house that this office comprises.[9] Alternatively, you can simply multiply the square footage of your home office space by $5, with a maximum deduction of $1,500.

- Use IRS Form 8829 to claim business deductions at your home. You can find the form you need by going to the official IRS website at www.irs.gov, and then navigating to the “Forms & Pubs” tab. Search for Form 8829 and the instructions that accompany it. Complete the form to report your deductions. If you use the simplified method, you do not need to fill out this form.

- Your car. To deduct for using your personal car for business reasons, you need to keep very careful records. You will need to measure the total mileage that you put on the car in the course of the year, and measure the mileage that is used exclusively for business purposes. From this data, calculate the percentage that you used the car for business, and you will be able to claim that fraction as a deduction. Alternatively, you can track your expenses (including insurance, gas, and repairs) and claim a portion of them based on your business mileage.

-

4Claim all applicable deductions if you are self-employed. If you are self-employed, you may be able to deduct the cost of your health insurance. Also, starting in 2018, you may be eligible for a Qualified Business Income Deduction, which is equal to 20% of your net business income. Some limitations do apply, so speak to a certified tax professional for more information.

Claiming Deductions for Business-Related Travel

-

1Claim these deductions only if you are self-employed. Though business expenses used to be deductible for all employees, this is no longer the case due to the 2017 Tax Cuts and Job Act. You can only claim these kinds of deductions if you are self-employed.

- Claim these deductions on Schedule C if you report your business on your personal income tax return. If your business has a separate income tax return filing (such as an S corporation or partnership), report your travel expenses there.

-

2Deduct the cost of actual travel expenses. You are entitled to claim your out-of-pocket costs for travel by airplane, train, bus or car. You should measure this from your home to the destination. You may also include the cost of any taxi or limousine travel between your home and the airport, and the airport and your hotel. Be sure to save receipts.[10]

- If you travel for free by using frequent flier miles, you are not entitled to claim any deduction, because you do not have an out-of-pocket cost.

-

3Take deductions for necessary shipping costs. If you must send certain luggage, display materials, or other items that are necessary for your business travel, you are entitled to claim the shipping cost as a deduction. This will include special costs for your business materials, as well as any baggage charges you incur for your own luggage.[11]

-

4Claim a deduction for some automobile use when you travel. If you take your own car to drive on a business trip, you are entitled to claim a deduction for all mileage you incur. You will need to record your mileage and claim the deduction at the federal mileage rate. You can also deduct costs for any tolls and parking fees that you incur during the trip.[12]

-

5Deduct the costs for meals, lodging, and tips. For expenses related to meals, lodging, and tips during your business trips, be sure to save your receipts. You may deduct 50% of the cost of meals and 100% of the cost of lodging.[13]

-

6Claim other necessary and ordinary costs as business deductions. While you are away on business travel, you may deduct dry cleaning and laundry costs, business calls, tips for any services that are themselves deductible, and any other costs that you can explain as necessary and ordinary.[14]

Maximizing Your Medical and Dental Deductions

-

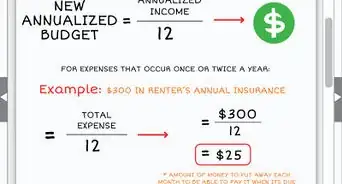

1Meet the threshold. If you itemize your deductions, your medical expenses must exceed 10% of your adjusted gross income for 2019 and future tax years. For 2017 and 2018, the threshold was reduced to 7.5%. You may combine all expenses for yourself, your spouse and your dependents over the course of the year. This deduction is for your actual out-of-pocket costs. You may not deduct payments that are covered by insurance or that are reimbursed after payment.

- For example, if your adjusted gross income is $65,000 in 2019, you must have medical and dental expenses that exceed $6,500 in order to take advantage of the deduction.

-

2Plan your medical expenses to increase deductions. Because you must meet the threshold level before you can claim deductions for medical expenses, you should try to plan the timing of your medical payments. You may want either to prepay some expenses to include them in a prior year, or put off payment to a subsequent year, in order to group your expenses.[15]

- For example, if your adjusted gross income is $65,000, you must have medical and dental expenses that exceed $6,500 in order to claim a deduction. If you know that you will have some major expenses next year, you may want to try to put off to that year whatever other expenses you can, in order to exceed the threshold.

-

3Make a deductible contribution to a Health Savings Account (HSA). If you were covered by a High Deductible Health Plan during the tax year, you may be eligible to make a deductible contribution to an HSA. The maximum amount you are able to contribute each year depends on whether you had single or family coverage as well as how many months out of the year you were covered by a High Deductible Health Plan.

- Amounts contributed to an HSA are tax-deductible and money can be taken back out tax-free for qualified medical expenses.

-

4Use Schedule A to itemize and claim medical and dental expenses. When you are preparing your tax return, you will need to report your medical and dental deductions on Schedule A. You can find this schedule by going to the official IRS website at www.irs.gov and then the “Forms & Pubs” tab.

Using Retirement Plans to Decrease Your Taxes

-

1Maximize annual contributions to employer-sponsored retirement plan accounts. If your employer offers a retirement plan, you should take advantage of it. This is good planning for retirement, and it also decreases your tax obligation. As of 2019, you can contribute up to $19,000 per individual to a qualified retirement plan at work. This money is taken out of your paycheck and deposited into a retirement account, so your taxable income for the year is decreased.[16]

- For example, if your annual salary is $70,000, and you maximize your contributions to an employer-sponsored retirement plan, your taxable income for the year will only be $51,000. The remaining $19,000 will be set aside until you retire. You will pay tax on the money when you eventually withdraw it, but you will likely be paying at a lower tax rate at that time.

-

2Contribute to an IRA to create further tax deductions. For tax year 2019, you may contribute up to $6,000 to a qualified IRA or Roth IRA. This limit is increased to $7,000 for individuals over 50 years old. If you already participate in a retirement plan at work, this limit may be decreased. To calculate your particular contribution limit, use the table at https://www.irs.gov/retirement-plans/plan-participant-employee/2016-ira-contribution-and-deduction-limits-effect-of-modified-agi-on-deductible-contributions-if-you-are-covered-by-a-retirement-plan-at-work.[17]

- A "traditional" IRA allows you to contribute funds and deduct the amount of the contribution from your taxable income. Contributions to a Roth IRA are not tax deductible when you make them, but the investment grows tax-free and has fewer restrictions on withdrawal. Additionally, you will be required to take minimum required withdrawals from a traditional IRA, but not from a Roth IRA. To decide which type of IRA is best for you, you should consult with a financial advisor.[18]

-

3Make retroactive contributions to increase your deduction. If you have not yet reached your annual limit for contributions to your retirement accounts, you may make contributions through the beginning of April and apply them to the prior tax year. The exact deadline varies each year due to federal holidays that fall in April. You can see IRS Publication 509, “Tax Calendars,” for more specific information for any year.[19]

- Similarly, if you find that you have exceeded your annual limit, you may withdraw money from your retirement account by the due date of your tax return, in order to stay within the allowable limit. If you exceed the annual contribution limit, you will be charged a 6% tax on the excess amounts left in the account.

Using Additional Deductions

-

1Make charitable contributions appropriately. In general, you can deduct charitable contributions that you make. These contributions may consist of direct monetary donations or donations of property. For most individuals, your deduction is limited to 50% of your adjusted gross income for the year.[20]

- For a more thorough discussion of all the regulations surrounding charitable deductions, see the IRS Publication 526, “Charitable Contributions,” or IRS Publication 561, “Determining the Value of Donated Property.” These can both be found at the “Forms & Pubs” tab at www.irs.gov.

- You may also want to check out Claim a Church Deduction for Federal Taxes or Figure Fair Market Value Donations.

- For 2018, you are entitled to make gifts of up to $15,000 to any individual without paying a gift tax. This does not create a tax deduction for you, but by remaining under the $15,000 limit, you will avoid incurring an additional gift tax. You may make as many of these gifts as you wish, to separate individuals.

-

2Deduct student loan interest. If you're paying student loans, you can deduct the interest you paid during the tax year. You can deduct up to $2,500 of interest you paid during the year. You may not claim this deduction if you are married but file separately from your spouse. Your modified adjusted gross income must also be under a certain limit, so speak to a tax professional for more information.[21]

- You do not need to itemize your deductions as you may use this deduction as an adjustment to your income.

-

3Claim deductions for eligible educator expenses. If you are a teacher, instructor, counselor, aide or principal of an elementary or secondary school, you may be eligible to claim a deduction each year. The deduction applies to any unreimbursed expenses that you incur for books, supplies, computer equipment or other educational materials. Your deduction is limited to $250 for the year for each individual. Therefore, if a married couple are filing jointly, they may each deduct up to $250, for a total of $500. To qualify, you must have worked at least 900 hours in an elementary or secondary school during the year.[22]

- For more information, you can see IRS Publication 529, “Miscellaneous Deductions.”

- Educator expense deductions can be claimed on Schedule A of your tax return.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can I maximize my tax deductions?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play If you want to maximize your IRS tax deductions as a business owner, have a bookkeeping system in place, and make sure that all of your business accounts and business credit cards go through that accounting system. Not only will this make it easier to see what taxes you owe, but you'll also be able to see any assets that you might be able to list as business expenses in the form of depreciation or amortization.

If you want to maximize your IRS tax deductions as a business owner, have a bookkeeping system in place, and make sure that all of your business accounts and business credit cards go through that accounting system. Not only will this make it easier to see what taxes you owe, but you'll also be able to see any assets that you might be able to list as business expenses in the form of depreciation or amortization.

References

- ↑ https://www.irs.gov/pub/irs-pdf/p936.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p936.pdf

- ↑ https://www.irs.gov/publications/p530

- ↑ https://www.irs.gov/newsroom/interest-on-home-equity-loans-often-still-deductible-under-new-law

- ↑ https://www.irs.gov/pub/irs-pdf/p936.pdf

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Tax-Deductions-and-Credits/How-to-Maximize-Your-Itemized-Tax-Deductions/INF22588.html

- ↑ https://www.irs.gov/taxtopics/tc511.html?_ga=1.227565341.1259482483.1474490452

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Tax-Deductions-and-Credits/How-to-Maximize-Your-Itemized-Tax-Deductions/INF22588.html

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/home-office-deduction?_ga=1.188273192.1259482483.1474490452

- ↑ https://www.irs.gov/taxtopics/tc511.html?_ga=1.227565341.1259482483.1474490452

- ↑ https://www.irs.gov/taxtopics/tc511.html?_ga=1.227565341.1259482483.1474490452

- ↑ https://www.irs.gov/taxtopics/tc511.html?_ga=1.227565341.1259482483.1474490452

- ↑ https://www.irs.gov/taxtopics/tc511.html?_ga=1.227565341.1259482483.1474490452

- ↑ https://www.irs.gov/taxtopics/tc511.html?_ga=1.227565341.1259482483.1474490452

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Tax-Deductions-and-Credits/How-to-Maximize-Your-Itemized-Tax-Deductions/INF22588.html

- ↑ https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-contributions?_ga=1.260110477.1259482483.1474490452

- ↑ https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

- ↑ https://www.fidelity.com/retirement-ira/ira-comparison

- ↑ https://www.irs.gov/retirement-plans/ira-year-end-reminders

- ↑ https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contribution-deductions?_ga=1.230291228.1259482483.1474490452

- ↑ https://www.irs.gov/taxtopics/tc456

- ↑ https://www.irs.gov/taxtopics/tc458.html?_ga=1.201521681.1259482483.1474490452

About This Article

There are all kinds of different deductions you can claim when you're filing your taxes. A lot of these are home-related deductions. For example, your interest payments on your home mortgage, real estate taxes you've paid, and any interest you paid on a home equity loan are all tax-deductible. You can also claim medical and dental expenses if they exceed 7.5% of your adjusted gross income. Charitable contributions and student loan interest payments are also generally deductible. If you're a business owner, a lot of your business expenses can be deducted as well. For more expert financial tips, check out the full article below!

-Step-1.webp)