This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 23,270 times.

The buy or sell a house, the buyer and seller must each sign a home purchase agreement. This document will identify the key terms of the sale, such as the purchase price and who pays the closing costs. It will also explain any contingencies which must be met before the contract becomes binding on the two parties. To prepare this contract, you should find sample contracts created by your state and then revise them accordingly.

Steps

Starting to Draft the Contract

-

1Find forms. Some states have created printed real estate purchase agreements that you can use. You should look online and see if a form is available. Type “your state” and “real estate purchase agreement” into your favorite search engine.

- In Utah, for example, real estate agents must use the printed form provided by the state.[1] However, if you are not a real estate agent, then you can revise the form.

- Other groups, such as realtor’s associations, may have also created a form you can use. Look for those as well.

-

2Format your document. You want a real estate purchase agreement that is easy to read. Accordingly, you should set up your purchase agreement by opening a blank word processing document and setting the font to something readable.

- Remember to use bold typeface throughout the document as well. For example, you can put section headings in bold. Doing so makes it easier for the reader to scan and find the information they are looking for.

- You can also set up the contract as a template by inserting blank lines in the place of information that will change from contract to contract. In this way, you can use the contract more than once.

Advertisement -

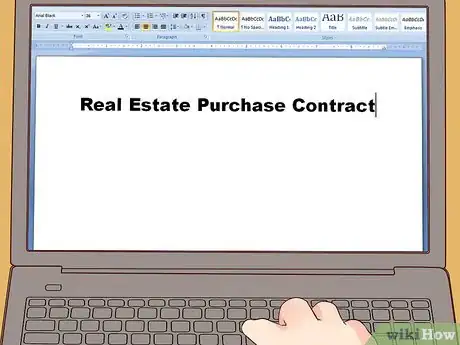

3Title the document. At the top of the document, you should insert the title “Real Estate Purchase Contract” in bold. You can center the title between the left- and right-hand margins.[2]

-

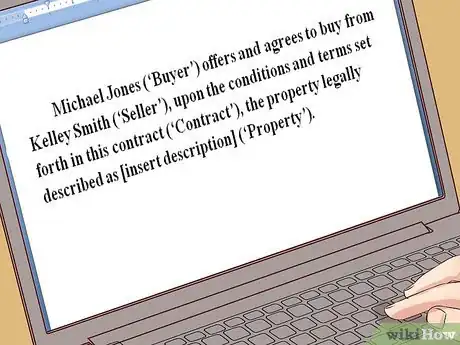

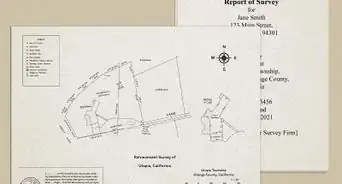

4Identify the parties and the property. You should also identify the parties at the very start of the contract. You also should put the address of the property. You may also need to include the legal description of property or else attach a copy of the legal description.

- Sample language could read: “Michael Jones (‘Buyer’) offers and agrees to buy from Kelley Smith (‘Seller’), upon the conditions and terms set forth in this contract (‘Contract’), the property legally described as [insert description] (‘Property’).”

Setting Forth the Terms of the Contract

-

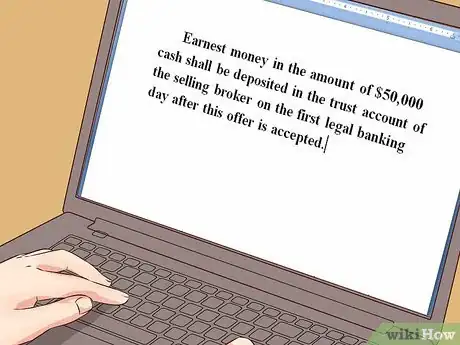

1Identify the amount of earnest money. Earnest money is the amount of money the buyer gives the seller to show that they are serious about going through with the sale.[3] You should identify the amount and also state where the earnest money will be held as you wait for the final sale to go through.

- Sample language could read: “Earnest money in the amount of $50,000 cash shall be deposited in the trust account of the selling broker on the first legal banking day after this offer is accepted.”

-

2State the purchase price. You want to explicitly state the purchase price and then state that the earnest money will be applied to the purchase price. For example, you could write:

- “The total purchase price is $300,000. After earnest money is credited, the remaining balance will be paid by Buyer at closing.”

-

3Explain what fixtures are included in the sale. In addition to selling the property, you may also be selling items in the house or on the property. You should identify them individually. For example, you may include the following in the sale:[4]

- washer

- dryer

- refrigerator

- microwave oven

- plumbing

- heating and air conditioning fixtures

- oven range and cook top

- dishwasher

- ceiling fans, light fixtures and bulbs

- curtain rods, curtains, and blinds

- storm doors and windows

- fencing

-

4Pick the closing date. You should list the closing date, which is also the day that the buyer gets possession of the property. You can also include a clause that the seller should remove all personal property before the closing.

- Sample language could read: “Closing date will be on or before May 20, 2016. Possession will be given to Buyer at that time. Seller agrees to keep the property in a comparable condition and agrees that Buyer shall have the right to inspect prior to closing. Seller shall remove all personal property not included in the purchase price before closing.”

-

5Explain who pays the closing costs. Closing a real estate deal involves many fees and taxes which must be paid. These are the “closing costs.” Your real estate contract should identify what closing costs the seller will pay and which ones the buyer will pay. For example, you could divide them this way:

- The seller will pay the existing loan and liens related to the sale of the property. The seller also typically pays the title insurance policy, as well as the seller settlement fees and real estate commissions.

- The buyer may pay transfer taxes, recording fees for the deed, any transfer fees, settlement fees, and all of the buyer’s loan-related expenses.

-

6Allocate the property taxes. The buyer and seller should also agree how to divide the property taxes. They can be prorated according to an agreed upon amount or on a percentage based on how long each party owned the property. Alternately, one party could agree to pay all of the taxes.

Explaining Contingencies and Warranties

-

1Understand contingencies. A contingency is a condition that must be satisfied before the contract can become legally binding.[5] If a contingency isn’t met, the buyer doesn’t need to go ahead with the purchase. There are many contingencies buyers might want in a contract, such as the following:[6]

- appraisal

- home inspection

- financing, such as mortgage availability or successful selling of the buyer’s house

-

2Add an appraisal contingency. This will protect the buyer in case the home is appraised a lower value than expected. You should also state whether the parties will renegotiate the price if the appraisal was low.

- You could write, “This offer is contingent on the property appraising for at least the purchase price. If the appraisal is lower than the purchase price, then the parties may renegotiate the purchase price.”

-

3Insert a contingency about inspections. An inspection offers protection to both sellers and buyers. The buyer can back out of the sale if the inspection finds unreported damage. Also, the seller can avoid a lawsuit by disclosing damage, which only an inspector might be able to find. You should certainly include a contingency regarding a home inspection. You also should state what options the parties have if problems are uncovered:

- The buyer can simply accept the existing condition and go ahead with the purchase.

- The seller can correct the condition and have the inspector certify that the problem has been corrected.

- The parties may negotiate a settlement, such as a reduction in the purchase price.

- The buyer has the option of cancelling the contract if no agreement can be reached.

-

4Include a contingency on buyer financing. This contingency protects the buyer so that they won’t have to go forward with the purchase if they can’t come up with the money. You can include different contingencies, depending on the circumstances:

- A contingency that the buyer will obtain a loan and provide the seller a commitment letter from the lender.

- A contingency that the buyer must be able to sell their home: “This offer is contingent upon the sale and close of Buyer’s property located at 6231 Mullholland Drive, Any City, California, 12345 within the time period for closing the Seller’s property.”

-

5Add seller’s warranties. The seller usually must warrant (promise) that certain things are true. The buyer can rely on these promises and, if the promise turns out to be false, cancel the contract. Warranties are also called “representations.” Sellers can include many warranties, such as the following:

- they will convey to buyer good and marketable title

- they will purchase and provide a title insurance policy

- the property is not violating zoning and other codes

- there are no encroachments, easements, or setbacks on the property

-

6Explain options after a breach of the contract. If one party fails to live up to its obligations under the real estate contract, the other party usually has options. You can spell out in the contract those options.

- You could write, “If either party fails to perform its obligations under this Contract, the other party can do any of the following: (1) cancel the Contract, (2) sue in court for specific performance, (3) sue for compensatory and actual damages.”

-

7Explain how you will resolve disputes. Sometimes disputes are minor and neither party wants to cancel the contract or sue. You can agree in the real estate contract how you will resolve these disputes before or after closing. For example, you could agree to mediate disputes. In mediation, a neutral third party listens to the dispute and tries to help both sides reach a resolution.

- A sample mediation clause would state: “All disputes relating to this Contract shall first be submitted to mediation. The parties will jointly select a mediator and share 50-50 the costs of mediation. If mediation is unsuccessful, then the parties can seek other remedies as spelled out in this Contract.”[7]

Finalizing the Contract

-

1Describe the real estate commissions. In the contract, you want the seller to agree that the closing company can deduct a percentage from the sale and give it to the real estate broker as their commission. You should identify the amount, which could be stated as a percentage of the purchase price. If more than one broker or real estate firm is to get a commission, then list information for each.

- Sample language could read, “Seller authorizes the closing company to deduct from Seller and pay commissions as follows at closing: [name of real estate firm] will receive 3% of the purchase price.”

-

2Assign risk of loss. The property might be damaged after the date the agreement is signed but before the closing date. Accordingly, you need to assign the risk of loss to either party. Generally, the seller will assume the risk of loss until the closing date.

- You could write, “If any part of the property is damaged or destroyed by flood, earthquake, fire, vandalism, or act of God prior to closing, the risk of loss or damage will be borne by Seller. However, if the costs of repairing the loss exceeds 10% of the Purchase Price, then either Seller or Buyer may choose to cancel this Contract by providing written notice to the other Party. Earnest Money deposits shall be returned to Buyer.”[8]

-

3Pick your choice of law. You should include a sentence stating what law will apply to the contract if there is a legal dispute. You should pick the law of the state where the property is located.

- For example, you could write, “This contract shall be governed by the laws of the State of Ohio.”[9]

-

4Include a merger clause. You want to make sure that everyone understands that the written contract represents the entire agreement. Accordingly, you want to include a “merger” clause, which states that no prior agreements are valid.

- For example, you could write, “This Contract contains all conditions, agreements, and covenants between the parties with respect to the subject matter. It supersedes prior agreements, understandings, and correspondence, whether in written or oral form. This Contract represents the complete statement of its terms and cannot be modified except by a written agreement signed by both parties. Any waiver must be in writing and cannot be inferred from conduct.”[10]

-

5Give the buyer a deadline for acceptance. The real estate contract should clearly state the deadline for the buyer to accept the offer. After that point, the offer will expire.

- Sample language could read, “Offer Expiration Date and Time: February 3, 2016. If not Accepted by this date and time, this offer will expire. At any time before the other party communicates acceptance, Seller may withdraw the offer and communicate the withdrawal to the other party. Seller will then deliver a Notice of Withdrawal.”

-

6Include signature blocks. There should be signature blocks for the seller and the buyer each. Make sure that there are lines for the following information:[11]

- name

- title

- date

- address

- fax number or email address

-

7Show the contract to a lawyer. This article describes a real estate contract that is appropriate for a basic home sale. Your needs might vary. To check that you have included everything, you should schedule a meeting with a real estate lawyer who can review the contract and offer suggestions.

- You can find a real estate lawyer by contacting your local or state bar association and asking for a referral.

- Call up ahead of time and ask the lawyer how much it will cost for a contract review.

References

- ↑ http://realestate.utah.gov/forms/REPC_2008.pdf

- ↑ http://realestate.utah.gov/forms/REPC_2008.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/buying-house-faq-32312-4.html

- ↑ http://realestate.utah.gov/forms/REPC_2008.pdf

- ↑ http://www.investopedia.com/articles/personal-finance/102913/contingency-clauses-home-purchase-contracts.asp

- ↑ http://www.realtor.com/advice/protect-yourself-with-creative-contingency-clauses/

- ↑ http://realestate.utah.gov/forms/REPC_2008.pdf

- ↑ http://realestate.utah.gov/forms/REPC_2008.pdf

- ↑ https://development.ohio.gov/cleanohio/greenspaceconservation/documents/real.estate.purchase.contract.pdf