X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 44,731 times.

Learn more...

Preparing a personal finance statement is a great idea if you are trying to get an idea of where you stand financially, or you are considering a major life change that will affect your finances. You will need a personal finance statement if you want to start your own business, change careers, retire or travel the world. Prepare a personal finance statement by creating a balance sheet and an income statement that reflect what you have and what you owe.[1]

Steps

-

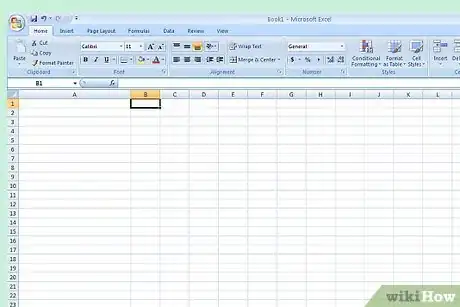

1Decide what format will work best for you. Most people prefer to use a spreadsheet program such as Excel.[2]

- Use a simple pad of paper and a pencil, if you are not good with computers. A handwritten finance statement will be fine if you are the only who will see it.

- Consider a software program that might help you prepare a personal financial statement, such as Quicken.

-

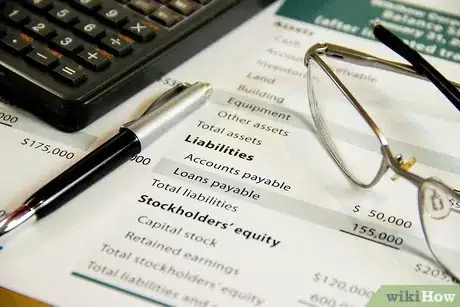

2Create a balance sheet. A balance sheet will show you how much you own and what you owe, giving you an idea of your personal net worth.[3] [4]

- Include assets in a column on the left. These will include bank account balances, the amount of money you have in stocks and the value of any property you have.

- Place your liabilities in a column on the right. Liabilities will include your mortgages, credit card debt and other loans you are repaying.

- Total the amount of your assets and liabilities. Subtract your liabilities from your assets, and you will have a snapshot of your net worth.

Advertisement -

3Create an income statement. This part of your personal financial statement will show you how much money you earned and how much you spent.[5] [6]

- Add up all of your income, including salaries, bonuses, rental and business income.

- Add up all of your expenses, including what you pay in rent, utilities, fees and other regularly occurring bills.

- Keep a special column or section for extraordinary occurrences of income or expenses that do not happen on a regular basis. For example, a large tax payment, a sizeable bonus or an expensive home repair might throw off your income statement and can be recorded separately.

- Tally the difference between your income and expenses, and you have an idea of what your net income is.

-

4Update your personal finance statement regularly. You might want to do it every month or every other month. This will help you monitor any changes in your finances.

-

5Include a narrative with the numbers. This will help you remember what was going on during any specific period of time.

- Provide a brief description of any special expenses, or note how you calculated some sums, such as the value of your home.

-

6Work with a financial planner or advisor. Ask a professional to review your personal finance statement to see if you have missed anything.

Advertisement

Community Q&A

-

QuestionDo your monthly expenses such as utilities and food need to be added to liabilities?

DonaganTop AnswererNo. Liabilities are just the debts you owe.

DonaganTop AnswererNo. Liabilities are just the debts you owe. -

QuestionDo my annual expenses for utilities, insurance and food need to be added to annual expenses?

DonaganTop AnswererYes. Include everything. Otherwise, the statement won't be accurate and useful.

DonaganTop AnswererYes. Include everything. Otherwise, the statement won't be accurate and useful.

Advertisement

References

- ↑ https://www.iasplus.com/en/standards/ias/ias1

- ↑ https://www.youtube.com/watch?v=VHh5FHFIddQ

- ↑ https://www.accountingcoach.com/balance-sheet/explanation

- ↑ https://www.fool.com/knowledge-center/balance-sheet.aspx

- ↑ https://www.youtube.com/watch?v=mSOmFsMz80s

- ↑ https://www.patriotsoftware.com/accounting/training/blog/income-statement/

About This Article

Advertisement