This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 11 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 84% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 190,784 times.

You need to set up procedures for accounts receivable if you extend credit to your customers. An account receivable arises when you allow a customer to take immediate possession of a product or receive a service in return for a promise to pay in the future. In other words, this means you allow them to take possession of your products before they pay you. If your business accepts credit cards, the credit card company manages the risk. But if customers are going to pay with cash or cheques, you must manage verification of payments and risk.[1] The accounts receivable process includes setting up procedures for extending credit, generating invoices, maintaining records of payments due and payments received, and performing accounting functions.

Steps

Establishing Credit Practices

-

1Develop a credit application process. Decide if you will extend credit to individual customers or only other businesses. Have all applicants fill out an application that provides you with information needed to evaluate their credit worthiness. Run a credit check on all applicants.[2] [3]

- Individuals applying for credit should provide you with their name, contact information, employment information and social security number.

- Businesses applying for credit should list their business name, contact information of their accounts department, references from other companies who have extended them credit and the names of their business directors.

-

2Establish the terms and conditions of sale. Prepare a document that explains your requirements and the customer’s obligations. This document should specify when payments are due. For example, you may state that payment is due within 30 days of purchase. State how much interest you will charge for late payments. Stipulate that the customer will be responsible for payment of returned check fees or debt collection fees.[4]

- Your credit application form should have a spot where applicants can check or sign to acknowledge that they have read and understand the terms and conditions.

Advertisement -

3Comply with consumer credit laws. The Federal Trade Commission (FTC) enforces the laws that protect consumers. Consumer credit laws regulate how you communicate with customers about credit. They also ensure that customers receive full disclosure about your credit practices.[5]

- You must clearly communicate your interest rate.

- You must reply to billing-mistake claims within a specified amount of time.

- You must follow regulations for debt collection procedures.

- Visit the FTC to learn about the laws regulating debt collection, the Fair Debt Collections Practices Act and consumer equal credit opportunity rights

Invoicing Customers

-

1Learn the definition of an invoice. An invoice is a document the buyer receives from the seller at the time of sale. It details the products and services that have been provided and the cost of these products or services, as well as the date by which payment is expected.[6] An invoice is not the same as a receipt. A sales receipt is only issued if the customer pays in full at the time of purchase. If the customer is paying at a later point in time or is paying over multiple payments, you issue an invoice.

- An invoice is not the same as a statement. A statement is sent to a customer with one or several current invoices with the business and specifies the total amount due. Statements are generated for the purpose of simplifying billing for the customer.

-

2Choose how you will invoice customers. You can choose to send invoices out yourself, or you can hire a company to do it for you. If you are just starting out, consider doing the invoicing yourself. This will allow you to develop a complete understanding of your company’s finances. Later, you can turn over the billing to someone else.[7]

-

3Include all relevant information on the invoice. The word “invoice” must be clearly displayed. Every invoice must also contain specific information that identifies the customer and the goods or services provided. It should also clearly state your name, the name of your business, and the address to which payments should be sent.[8]

- Every invoice should be given a unique number.

- The date should be clearly displayed.

- It should have the name and address of the customer and your business name and address.

- Provide a clear description of the good or service provided and the date on which it was provided.

- Indicate the amount that should be paid and the date payment is due.

-

4Choose between digital or physical invoices. You can either send paper invoices in the mail, digital invoices via email or both. The customer should indicate how invoices are to be sent. Electronic invoicing is less expensive and more convenient than paper. However some customers do not feel comfortable receiving financial information online. Also, if a customer’s email address changes, it can be difficult to find the new one.[9]

-

5Include a return envelope. This makes it easier for the customer to send in their payment. Pre-print your address on the envelope. Or you can use a window envelope, print your address on the remittance slip and instruct customers to make sure your address shows through the window. If customers routinely pay online or in person, make a note of it. If they don’t need one, save yourself the expense and don’t send them one.[10]

- In order to make payment easier for the customer, you can also set up a direct deposit system where invoiced amounts are automatically deducted from customers' accounts and sent to you. This is generally easy to set up with your respective banks.

Tracking Accounts Receivable

-

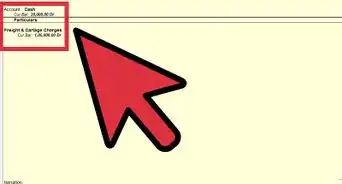

1Choose an accounts receivable management system. You may be comfortable with an offline, manual entry system using Excel. However, if your business is growing, you may choose to automate your process with accounts receivable management software like QuickBooks. Another option is an online accounts receivable tool such as Mint or FreshBooks.[11]

-

2Use a manual accounts receivable tracking system. If you are using a manual system, you can set up a spreadsheet in Excel. Create columns for the date, customer name, invoice number, amount and paid date. Record information on the spreadsheet when you send out invoices and receive payments.[12]

- You will have to create a document template for your invoices and manually create all of your invoices.

- Keep a receivables file and a paid invoices file.

- Unpaid invoices are kept in the receivables file.

- Once invoices are paid, remove them from the receivables file and place them into the paid invoices file.

-

3Track accounts receivable with a software program. If you are using accounting software with a receivables option, it will allow you to easily keep track of invoices and payments that are due. You can load all of your customer and sales information into the system. It will generate paper and digital invoices for you. If your program has internet connectivity, it can send your digital invoices to customers. You can run a report that tells you what invoices are still outstanding, so you don’t have to keep separate paper files of paid and unpaid invoices.[13]

- A software program is also able to perform invoice age analysis. This process separates overdue invoices by how many days late their payments are, allowing business owners to follow a collections policy that specifies certain actions when payments are 30, 60, or 90 days late.

-

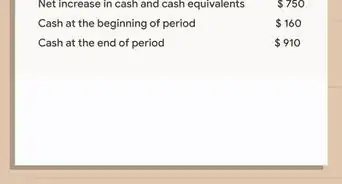

4Issue monthly statements to customers. A statement is different from an invoice. A statement is issued once per month. It details all of the amounts owed on past invoices. It also shows payments received. At the end, it calculates any balance forward that remains unpaid.[14] For accounts that continue to go unpaid, a system to identify, followup and collect on delinquent accounts should be developed and in place.

Accounting for Accounts Receivable

-

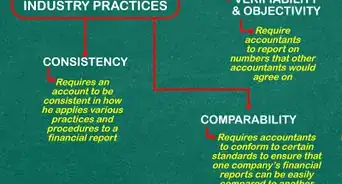

1Use accounting software to automate the process. If you generate an invoice in accounting software, it will automatically make an entry on your financial statements for the month. The benefit of this automation is that it saves you the time and effort of having to manually enter the same information more than once. Also, it reduces the occurrence of mistakes from typing different amounts or information on different reports.[15]

-

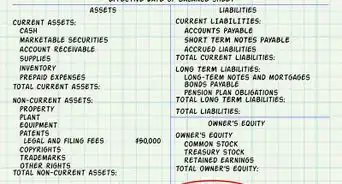

2Record a sale of services on credit. First, credit the sales account for the amount owed for the service. Next, debit the accounts receivables account for the same amount. When the customer pays, debit the cash account for the amount paid. Then, credit the accounts receivables account for the same amount.[16]

- For example, suppose you send a customer an invoice for $5,000 for providing a service.

- Create a journal entry of a $5,000 debit to accounts receivable. This increases the accounts receivable asset on the balance sheet.

- Make a journal entry of a $5,000 credit to sales. This increases the sales on the financial statement.

-

3Record a sale of goods on credit. First, make journal entries to record the sale and the related accounts receivable. Just as you did with the service, you would credit sales and debit accounts receivable. Next, you must record the reduction in inventory that was sold to the customer as the cost of goods sold.[17]

- For example, suppose you made a sales transaction of $10,000 in which you sold $7,000 of merchandise to the customer.

- Make a journal entry of a credit to sales for $10,000 and a debit to accounts receivable for $10,000.

- Next, make a journal entry of a debit of $7,000 to the cost of goods sold. This appears as an expense on the financial statements. Then, record a credit of $7,000 to the inventory account. This reduces the inventory asset by $7,000 on the balance sheet.

-

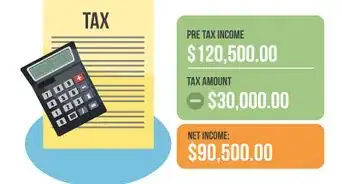

4Account for bad debt. The correct way to account for bad debt is to make an estimate of how many invoices will not be paid and accrue that much each month in journal entries. This accrual method allows you to record the expense for bad debt in the same month in which you issue invoices. It complies with the matching principle, which state that expenses must be recorded in the same month as the revenues they helped to earn.[18]

- If you do not accrue bad debt expense and simply wait to record the bad debt expense when a customer doesn’t pay, this violates the matching principle.

- For example, if you estimate that $40,000 in invoices won’t be paid one month, record a journal entry of a $40,000 expense to the bad debt expense account. This appears as an expense line item on your financial statement.

- Also, make a journal entry of a credit in the same amount to the allowance for bad debts account on the balance sheet.

- Later, when you identify specific invoices that have not been paid, you record a debit to the allowance for bad debt accounts and a credit to accounts receivable.

-

5Account for early payment discounts. If you offer a discount for paying early, then the customer will pay less than the invoice total. You must then record the difference as a profit reduction in the sales discount account. This reconciles the difference on your income statement.

- For example, suppose you sent a customer an invoice for $1,000 and you offered a discount of 10 percent, or $100, for paying 10 days early. Therefore, the customer only pays $900.

- Create a journal entry of a credit to accounts receivable for $1,000.

- Record a debit to sales for $900, and another debit to sales discount for $100.

-

6Prepare an accounts receivable aging report. This report gives you details about all unpaid invoices. It is structured to show how old invoices are. It gives you columns for current invoices, overdue by 0 to 30 days, overdue by 31 to 60 days, overdue by 61 to 90 days and overdue by more than 90 days. You would use this report to estimate your bad debt accrual. Also, you can use it to identify invoices that require follow-up action.[19]

References

- ↑ https://www.sba.gov/content/extending-credit-to-your-customers

- ↑ http://www.beginner-bookkeeping.com/accounts-receivable-procedures.html

- ↑ https://www.sba.gov/content/extending-credit-to-your-customers

- ↑ http://www.beginner-bookkeeping.com/accounts-receivable-procedures.html

- ↑ https://www.sba.gov/content/extending-credit-to-your-customers

- ↑ https://sumup.co.uk/invoices/dictionary/invoice/

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ https://www.gov.uk/invoicing-and-taking-payment-from-customers/invoices-what-they-must-include

- ↑ https://www.pitneybowes.com/pr/articles/the-challenges-of-invoicing-customers.html

- ↑ https://www.pitneybowes.com/pr/articles/the-challenges-of-invoicing-customers.html

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ http://www.beginner-bookkeeping.com/accounts-receivable-procedures.html

- ↑ http://www.beginner-bookkeeping.com/accounts-receivable-procedures.html

- ↑ http://www.accountingcoach.com/blog/difference-between-invoice-statement

- ↑ http://www.accountingtools.com/accounts-receivable-accounting

- ↑ http://www.accountingtools.com/accounts-receivable-accounting

- ↑ http://www.accountingtools.com/accounts-receivable-accounting

- ↑ http://www.accountingtools.com/accounts-receivable-accounting

- ↑ http://www.accountingtools.com/accounts-receivable-accounting

About This Article

To process accounts receivable, first you'll need to establish a credit application process and the terms and conditions of sale so your customers know when they need to pay you back by. Then, develop either a physical or digital invoice system so you can send invoices to your customers requesting payment. To help you keep track of your accounts receivable, use an automated management system like Quickbooks, or manually track everything in Excel. For more advice from our Finance co-author, like how to account for your accounts receivable, read on!