This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 10,492 times.

If someone has stolen your identity, including personal information such as your name, birthdate, Social Security number, and financial account numbers, the toll can be devastating – and things can become even more complicated if the identity thief uses your information to file a fraudulent tax return. Often you won't know this happened until you file your tax return and receive a notification from the IRS that a tax return has already been filed for you. However, if you are a victim of identity theft, contacting the IRS as soon as possible can help prevent tax-related consequences.[1]

Steps

Preventing Further Harm

-

1Organize your information. Making a list of all your accounts and other information that may have been compromised allows you to repair the damage in a more methodical way.

- Pull together any documentation you have for these accounts, including account agreements and receipts or recent statements, that might help you in completing identity theft reports or monitoring accounts for unauthorized charges.

- Create a separate file where you can keep all your information and documentation related to the identity theft in one place. You should make copies of all correspondence you have with any government agency or business, and keep a chronology of your contacts including the names and numbers of anyone with whom you speak about the identity theft.

-

2Contact your bank and credit card companies. Call the fraud department or fraud hotline and tell them that your identity has been stolen.

- Federal law limits your liability for unauthorized credit card charges to $50. If your bank debit card was stolen or used, you aren't liable for any unauthorized charges provided you notify the company before any unauthorized charges are made. If you contact the bank within two business days, you are only liable for $50 in unauthorized charges; however, if you wait you'll be on the hook for more. For this reason it is important to report identity theft to your bank and credit card companies as soon as possible, even if the accounts haven't been used by the thief.[2]

- Ask each company to cancel any cards or give you new account numbers. Take down the name of the person with whom you speak and get confirmation of any action taken in writing.

Advertisement -

3Change all your PINs and passwords. Particularly if your information was stolen over the internet, change your login information for any important accounts to prevent further access.

- If you have your old cards replaced, have your PIN changed rather than continuing to use your old PIN. This can help keep your new card secure.[3]

-

4Fill out an Identity Theft Victim's Complaint and Affidavit. The affidavit is used to report the identity theft to the Federal Trade Commission, and can be used to file additional reports.

- You can fill out the form by using the FTC's online complaint assistant, available at https://www.ftccomplaintassistant.gov/. Choose the identity theft category and follow the instructions to continue filing your complaint.

- Include as many details as you can, and the FTC will use the information you've provided to create your affidavit. You'll need to show your affidavit to other agencies when you report your identity theft.[4]

- You also can call 1-877-438-4338 to make a report. Save the number because you should call it again if you need to update your affidavit after you've submitted it.[5]

- Once your affidavit is complete, print it out and make copies to keep in a safe place.[6] Creditors may ask for this report if you later discover new accounts have been opened in your name by the thief.[7]

-

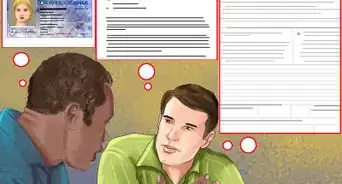

5File a report with your local police department. Your FTC affidavit and the police report can be used to prove to businesses that your identity was stolen.

- You should visit your local police department in person and bring a government-issued ID and other documents that will prove your identity and your address. Tell an officer that you need to file a police report. Take down the name and badge number of any officer with whom you speak.[8]

- Provide as much evidence as possible, and ask the officer to include a list of any accounts that have been accessed by the perpetrator.[9]

- Once you've spoken with an officer and filed your report, you should ask for a copy of it for your records. Some businesses require a police report as proof of your identity theft.[10]

- If your driver's license was stolen, you should contact your state's department of motor vehicles to request a new license number and have a fraud alert put on your old one.[11]

-

6Place a fraud alert on your credit report. You only have to contact one of the three major credit bureaus to have a fraud alert placed on all of your credit reports.[12]

- You can contact Equifax at 1-800-525-6285, Experian at 1-888-397-3742, or TransUnion at 1-800-680-7289.[13] After you contact one credit bureau, they are required by federal law to notify the other two.[14]

- Your initial fraud report will be on all three credit reports for 90 days. This alert requires any creditors to make reasonable efforts to verify the identity of anyone applying for credit in your name.[15]

- Placing an initial fraud alert on your credit reports entitles you to a free report from each of the major reporting bureaus. You can get this free report regardless of whether you've already ordered the free annual report to which you're legally entitled.[16]

- If you want, you can have the 90-day alert extended for seven years. When you have an extended fraud alert, potential creditors must contact you directly before they issue credit in your name. You must request an extended alert from each of the three major credit bureaus in writing, and provide copies of your identity theft report and proof of your identity.[17] [18]

- Some states such as California have laws allowing you to place a freeze on your credit report, which means new accounts cannot be opened in your name while the freeze is in effect.[19]

- Although the three main credit bureaus allow you to place a freeze on your credit report for a fee, state laws may reduce or eliminate these fees if you are a victim of identity theft. You typically must request the freeze in writing and provide proof of your identity.

-

7Contact your local Social Security office. If you believe that your Social Security number has been misused, or that someone has illegally gained access to it, you must visit your local Social Security office in person to prove your identity.

- Social Security will monitor your records and make sure your work history and records are correct.[20]

- Although Social Security cannot do anything to resolve any problems on your credit report or prevent the misuse of your Social Security number, you can request a new Social Security number.

- However, you should keep in mind that a new number may not solve all of your problems, and may create new ones. Since all of your old accounts and information will be under your old number, getting new accounts may become more difficult.[21]

- If you believe your Social Security number has been used to register for or receive benefits, you should contact the Social Security Administration's fraud hotline at 1-800-269-0271.[22]

- You also can check your Social Security Administration earnings statement yourself. If you see any entries that aren't accurate, contact the SSA to have the information corrected.[23]

Filing Your Report and Affidavit with the IRS

-

1Respond to any notice provided. If someone files a fraudulent tax return in your name, you will receive a notice from the IRS.

- This notice may state that you owe additional taxes, that more than one tax return has been filed in your name, or that you received wages from an employer you don't know.[24]

- If the notice states you were paid by an employer you don't know, you should contact that employer and explain your identity was stolen. Provide whatever information they need to remove your name and information from their records.[25]

- You can call the number provided on the notice to respond immediately. Then take any other steps recommended after you call. Make a log of the date and time you call and the person with whom you spoke and take notes of the conversation.[26]

-

2Complete the IRS Identity Theft Affidavit, Form 1403. The IRS has a fillable form available online that you can fill out to report the theft of your identity.

- You can download the form online at https://www.irs.gov/pub/irs-pdf/f14039.pdf. Once you've completed it, you will have to print it out, sign it, and attach proof of your identity.[27]

- You will have to include your current mailing address, as well as the mailing address used on any tax returns that were affected by the identity theft.[28] You may need to pull old tax returns to make sure this information is correct.

- Be sure to make a copy of the form for your records before you submit it to the IRS. If you're submitting the form in response to a notice, and the notice included a reply fax number, you can fax your form to that number with a cover sheet marked "Confidential." You also can attach the form and required documentation to your paper tax return and send it to the IRS location where you normally file your taxes.[29]

- When you file the identity theft affidavit, you will be assigned an IP PIN. When you use this PIN on your federal tax return, it indicates that you are the rightful filer of the return in your name.[30]

-

3File your tax return. Once you've reported the identity theft, you must file your taxes as you normally would.

- Keep in mind that you may have to mail in a paper return, since the electronic system may not accept your return if a fraudulent return has already been filed using your information.[31]

-

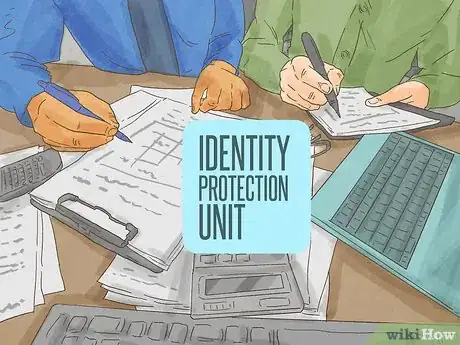

4Contact the IRS's Identity Protection Unit. Even if you haven't received a notice from the IRS, you can call 1-800-908-4490 if you want to report identity theft.[32]

- You also can use this number if you've already filled out the IRS's affidavit but need further information or assistance.[33]

- The dates and times you contacted the IRS, as well as copies of any information you sent to them, may be important to prove the steps you took, so make sure you keep a log of all communications.[34]

- The IRS reports that typical identity theft cases take around 120 days to fully resolve.[35]

Taking Other Action

-

1Review your credit report. Monitoring your credit report frequently allows you to stay on top of any fraudulent transactions and minimize the damage to your credit score and liability for fraudulent charges.

- If you notice any incorrect information on your credit report, contact the credit bureau that issued the report right away and dispute the entry. Although you can initiate this process over the phone, you also must send a written request.

- Include a copy of your identity theft report and proof of your identity with your request, and make copies of everything before you send it.[36]

- Once you've alerted the credit bureau to a fraudulent account or entry, the credit bureau must notify the creditor. Federal law prohibits creditors from selling fraudulent debt to debt collectors.[37]

-

2Close any new accounts opened in your name. If additional accounts were opened without your authorization, you can contact the company where the account was opened and alert them to your identity theft.

- When you contact the company, explain that you were the victim of identity theft and did not open the account. They may request further information or a copy of your identity theft reports or proof of your identity.[38]

- Keep organized records of every time you contact any businesses where unauthorized accounts were opened, and make sure you get the name of each person with whom you speak.[39]

- Although you may contact the business initially over the phone, get written confirmation of any action taken by the business including the closure of the account and removal of the information from your credit report.[40]

- To protect your credit score, ask that these accounts be marked that they were closed at the customer's request, rather than because a card was reported lost or stolen.[41]

- If a new account is opened, request a copy of the thief's application and transaction records. Make copies of these records and submit them to law enforcement and government agencies where you've filed a report.[42]

-

3Deal with debt collectors. You are not liable for fraudulent charges made as a result of the theft of your identity.

- If you are contacted by a debt collector regarding an account opened by the person who stole your identity, you have a complete defense against payment if you immediately dispute the debt and provide the collection agency with information regarding your identity theft including your identity theft report. However, you must respond to the debt collection notices – they won't go away if you simply ignore them.[43]

- If a debt collector sues you or threatens to sue you over debts incurred by the identity thief in your name, you should consider contacting an attorney to assist you.[44]

-

4Take steps to protect your personal information. Keeping your personal information secure can ensure you don't become a repeat victim.

- Avoid giving out personal information unless it's absolutely required, and then only if you initiated the communication. If someone calls claiming to be from your bank or credit card company and requests information, call them back using an official phone number such as the customer service number on the back of your card.[45]

- Protect information on your computer by using firewall and anti-virus software that you update regularly. Avoid storing payment information or entering payment information on websites that aren't secure, and don't access financial accounts or enter personal information on your computer while you're in a public place.

- Don't carry your Social Security card or any document containing your Social Security number in your wallet.

References

- ↑ https://www.irs.gov/uac/Taxpayer-Guide-to-Identity-Theft

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ https://www.identitytheft.gov

- ↑ https://www.identitytheft.gov

- ↑ https://www.identitytheft.gov

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691.html

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691.html

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691.html

- ↑ https://www.identitytheft.gov

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691.html

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ https://www.socialsecurity.gov/pubs/EN-05-10064.pdf

- ↑ https://www.socialsecurity.gov/pubs/EN-05-10064.pdf

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf

- ↑ https://www.identitytheft.gov

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f14039.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f14039.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f14039.pdf

- ↑ https://www.irs.gov/uac/Newsroom/IRS-Combats-Identity-Theft-and-Refund-Fraud-on-Many-Fronts-2015

- ↑ https://www.identitytheft.gov

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf

- ↑ https://www.identitytheft.gov

- ↑ https://www.irs.gov/uac/Newsroom/IRS-Combats-Identity-Theft-and-Refund-Fraud-on-Many-Fronts-2015

- ↑ https://www.identitytheft.gov

- ↑ https://www.identitytheft.gov/Know-Your-Rights

- ↑ https://www.identitytheft.gov

- ↑ https://www.identitytheft.gov

- ↑ https://www.identitytheft.gov

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691-2.html

- ↑ https://www.irs.gov/pub/irs-pdf/p5027.pdf