This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 13,284 times.

Internet fraud can cost substantial amounts of money – both to individual victims and to the public as a whole. The FBI and the Secret Service combat internet fraud in its many forms, from hackers that break into secure servers to steal credit card numbers to email spammers who try to trick you into giving up bank account numbers or other identifying information. If you are a victim of online fraud, there are several methods you can use to report the activity to the appropriate authorities to minimize losses and help bring the perpetrators to justice.[1]

Steps

Reporting Internet Auction Fraud

-

1Gather information about the transaction. To make a full report, you'll need details about the seller and the items sold, including the seller's user name and address, and the date and time of the close of the auction.[2]

- Internet auction fraud includes misrepresenting an item listed on an internet auction site, or not delivering the item purchased after you've won the auction and paid for it.[3]

- Learn as much as you can about the seller, and take note of all feedback, both positive and negative. If the seller is listed as a business, you also might check the Better Business Bureau in the seller's state and see if any complaints have been filed there.[4]

-

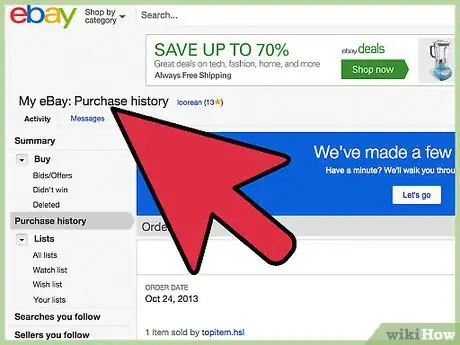

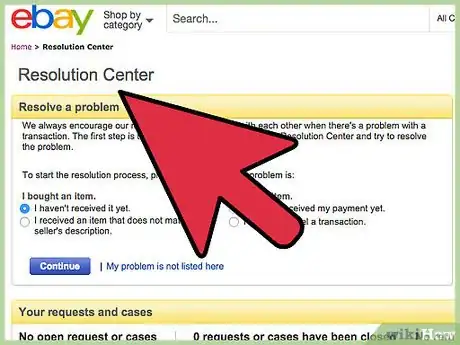

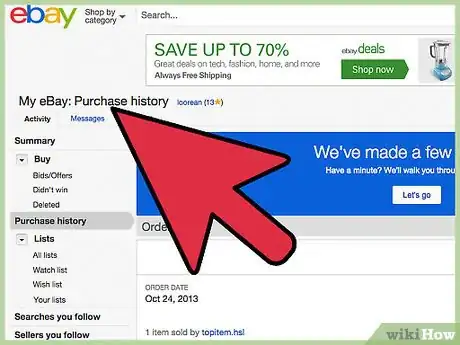

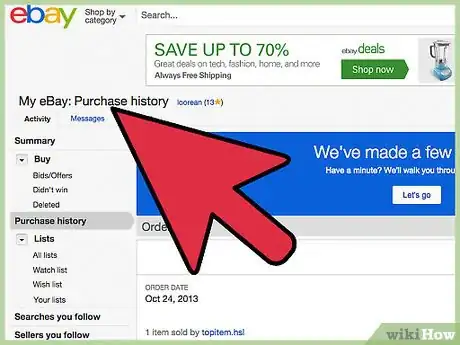

2File a complaint with the auction host. Most online auction hosts such as eBay have their own methods for resolving a dispute.[5]Advertisement

-

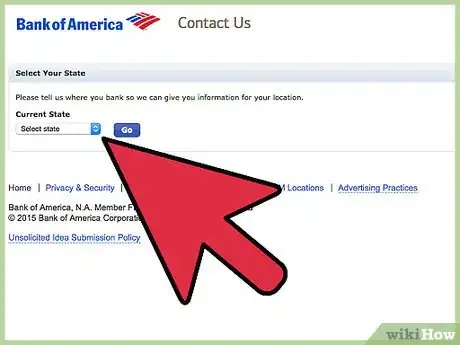

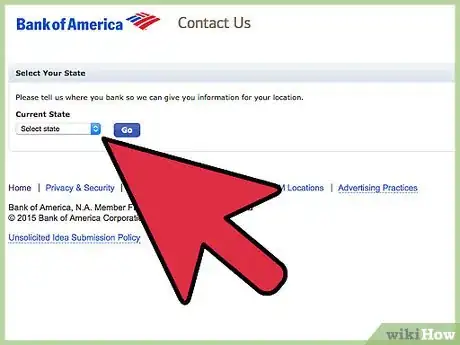

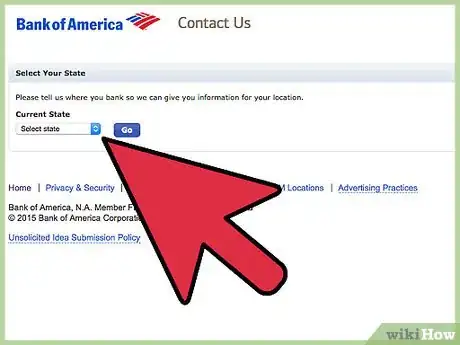

3Contact your bank or credit card company. If you've been charged for an item you did not receive, you usually can contact your bank or credit card company and have the amount charged back to the seller.

- The Fair Credit Billing Act gives you the right to dispute charges, provided you send a written dispute to your credit card company within 60 days of the date you receive the first bill with the charge on it.[8]

- If your card issuer reviews your claim and decides you don't owe the money, it will charge back the amount to the seller, which essentially gives you a rebate for the amount you paid for the goods you didn't receive.[9]

- You also might consider asking the credit card company to cancel your card and issue you a new one if you suspect fraud on the part of the seller, so you can make sure your card number is not used for additional fraudulent purposes in the future.

-

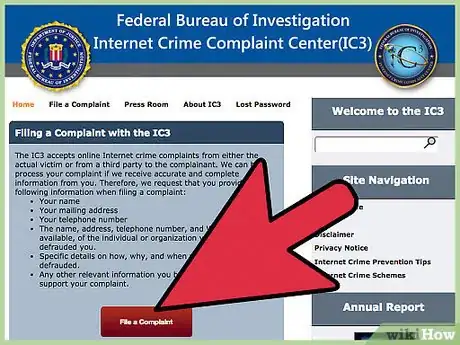

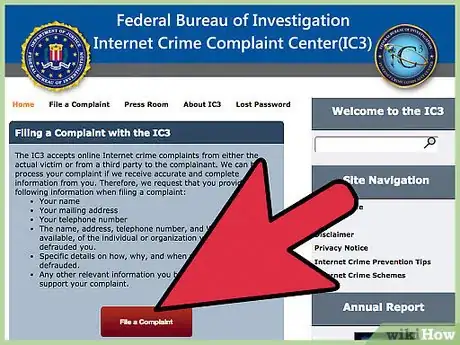

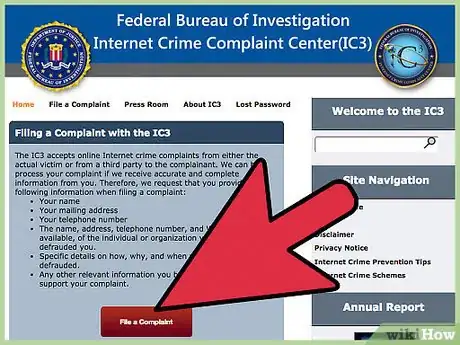

4File a complaint with the FBI. Even if the incident is resolved to your satisfaction through the private companies involved, you still have the option of filing a criminal complaint.

- Complaints filed with the FBI's Internet Crime Complaint Center (IC3) are evaluated by federal law enforcement authorities and may be referred to a federal, state, or local law enforcement agency, or to a civil regulatory agency, for investigation.[10]

- Your credit card company will not be notified of your complaint. Simply filing a federal complaint or report isn't sufficient to get the fraudulent charges removed from your credit card.[11]

- When you file your complaint, you must include your own contact information, as well as all information you have about the individual or company that defrauded you.[12]

- After your complaint is received, you will receive an ID and password via email. If you need to add information to your complaint, you can use that information to log on and update your complaint.[13]

Reporting Credit Card Fraud

-

1Collect details about the transaction. Your credit card company will need specific details about the charges you wish to dispute.[14]

- Credit card fraud includes the unauthorized use of your credit card number, overcharging you for an item you actually ordered, or advertising a product and not sending it to you after you pay for it.[15]

- If the charge appears on your credit card statement, you may want to make a copy of your statement with the charge circled. You can use that copy as evidence of the disputed charge.

-

2Call your bank or credit card company as soon as possible. You must act fast if you want to limit your liability for fraudulent charges.

- While federal law limits your liability to $50 for fraudulent credit card charges, if your debit card number is stolen you only have two business days to report the theft if you want to take advantage of the same liability limit.[16]

-

3Get a copy of your credit report. Federal law entitles you to one free credit report each year, which you can use to determine whether additional fraudulent entries have been added.[17]

- Use annualcreditreport.com, which is authorized by the federal government to get your free credit report under the Fair Credit Reporting Act.[18]

-

4Contact the credit bureau to dispute the fraudulent items. If there are any new accounts or other items on your credit report, you must contact the bureau that issues that report to have them removed.[19]

- In addition to contacting the credit bureau, you also should contact the company that reported the information to the credit bureau and alert it to the fraudulent activity.[20]

-

5File a complaint at the Internet Crime Complaint Center. Complaints about possible internet fraud schemes filed on the IC3 website are evaluated for the FBI and other law enforcement entities.[21]

- Make sure you dispute the charge with your credit card company before you file your complaint, since your credit card company will not be notified if you file a complaint with the IC3.[22]

- Your complaint must include information such as your own contact information, information about the company or individual that defrauded you, and details about the transaction and how you were defrauded.[23]

- After your complaint is received, you will receive a user name and password to access your complaint. You can use this to check the status of your complaint or add information.[24]

Reporting Spam and Identity Theft

-

1Gather all relevant information about the incident. If you believe your identity has been stolen, it's important to act as quickly as possible and pull together as much information as you can about the perpetrator.

- Online identity theft often involves the use of spam emails in which the sender impersonates another person or a company in an attempt to gain identity information, or your bank account or credit card numbers.[25]

- If you received spam emails, make copies of the emails along with any identifying information from the sender.

- If the emails included any files or attachments, make note of the type of attachment and, if possible, the file name.

-

2Change all your passwords. As a precaution, change your passwords to any internet accounts, especially those that have saved identity or billing information.

- You also might consider running anti-virus software or taking your computer to an expert to have it cleaned, particularly if you opened an email that had an attachment or may have infected your computer with a virus.

-

3Contact your bank or credit card company. If your credit card numbers or other banking information was taken, have the cards cancelled as soon as possible.[26]

- If you entered your bank account number, talk to a representative at your bank as soon as possible to have your money moved to a different account.[27]

-

4Get a copy of your credit report. You should check your credit report and make sure no additional accounts have been opened using your information.[28]

- Federal law entitles you to a free copy of your credit report each year, which you can request at annualcreditreport.com.[29]

- If you find any errors on your credit report, make sure you follow up with the credit bureaus and the companies that supplied the information to get the entries removed promptly and have any fraudulent accounts closed.[30]

-

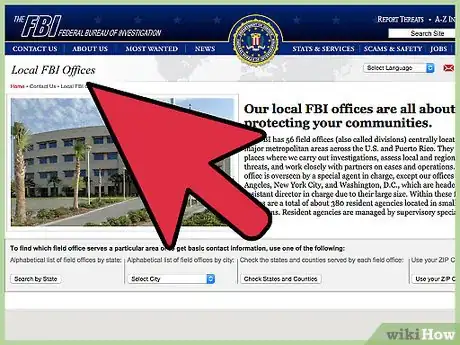

5Visit your local FBI office. If you want to report the identity theft in person, you can visit the nearest FBI field office during business hours.

- You can use the FBI's online locator to find your nearest field office at https://www.fbi.gov/contact-us/field/field-offices.

-

6File a complaint at the Internet Crime Complaint Center. Use the IC3 website to alert the FBI and the National White Collar Crime Center of attempted or actual identity theft.

- Complaints filed on the IC3 website are evaluated to determine whether the incident reported falls under federal or state jurisdiction, then forwarded to the appropriate law enforcement agency.[31]

- Include your own name and contact information in your complaint, as well as all information you have about the individual, website, or business that defrauded you. In many cases, you may not have any information apart from an email address.[32]

- Especially in cases where you have limited information about the perpetrator, include as many relevant details as you can about the incident and how you were defrauded.[33]

- Copy and paste the entire email you received, including the header information, when you file your report.[34]

- When your complaint is received, you'll get an email that contains a user name and password you can use if you want to check the status of your complaint or add information later.[35]

References

- ↑ http://www.justice.gov/criminal-ccips/reporting-computer-internet-related-or-intellectual-property-crime

- ↑ https://www.usa.gov/online-safety

- ↑ https://www.usa.gov/online-safety

- ↑ https://www.fbi.gov/scams-safety/fraud/internet_fraud

- ↑ http://www.nolo.com/legal-encyclopedia/resolving-ebay-disputes-29970.html

- ↑ http://www.nolo.com/legal-encyclopedia/resolving-ebay-disputes-29970.html

- ↑ http://www.nolo.com/legal-encyclopedia/resolving-ebay-disputes-29970.html

- ↑ http://www.consumer.ftc.gov/articles/0221-billed-merchandise-you-never-received-heres-what-do

- ↑ https://www.credit.com/blog/what-is-a-credit-chargeback-60676/

- ↑ http://www.ic3.gov/complaint/default.aspx

- ↑ http://www.ic3.gov/complaint/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ http://www.bankrate.com/finance/credit-cards/disputing-a-credit-card-purchase-1.aspx

- ↑ https://www.usa.gov/online-safety

- ↑ http://www.bankrate.com/finance/credit-cards/disputing-a-credit-card-purchase-1.aspx

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ http://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ http://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ http://www.ic3.gov/complaint/default.aspx

- ↑ http://www.ic3.gov/complaint/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ https://www.usa.gov/online-safety

- ↑ http://www.bankrate.com/finance/credit-cards/disputing-a-credit-card-purchase-1.aspx

- ↑ https://www.fdic.gov/consumers/consumer/fighttheft/

- ↑ https://www.fdic.gov/consumers/consumer/fighttheft/

- ↑ http://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ http://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ http://www.ic3.gov/complaint/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx

- ↑ http://www.ic3.gov/faq/default.aspx