This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 26,571 times.

You’ll need a merchant account if you want to accept credit card and mobile payments. This account will hold onto funds from debit and credit card sales.[1] You should first shop for a merchant account and compare providers. Look for low fees and ample customer support. To apply, provide required personal and business information. If your business is high-risk, then address any concerns the merchant account provider might have.

Steps

Shopping for a Merchant Account

-

1Decide how you want to accept credit card payments. Before you can get a merchant account, you need to decide exactly how your business will accept credit cards. Consider the following:[2]

- You’ll accept credit cards via your website.

- You’ll accept credit card payments over the phone or by mail.

- You want to swipe credit cards for customers who visit your business.

-

2Search for a merchant account. The easiest way to get an account is to stop into your bank and ask for one. If you’re a solid customer, they should explain your options. Don’t immediately sign up with your bank but research other providers.Advertisement

-

3Compare fees. Merchant accounts charge many different fees, so you need to perform thorough research before selecting a provider. Consider the following fees:[5]

- Transaction fees. Generally, there are two fees: a flat fee assessed for each credit card payment and a fee that is a percentage of each amount of the transaction. Fees might vary depending on the type of card used (e.g., a rewards card) and the number of transactions in a month.

- Monthly minimum fees. If you don’t have the minimum number of transactions, you might have to pay a fee.

- Statement fees. You’ll be charged to receive your statement.

- Early cancellation fees. In the U.S., the average merchant account agreement lasts three or five years. In Canada, it’s five years.[6] If you want to get out early, you may have to pay a fee.

- Other fees, including annual fees, setup fees, and chargeback fees.

-

4Evaluate the merchant account providers. You should consider other factors in addition to fees. For example, consider the following:[7]

- Customer support. You’ll want live support in case any problems arise.

- Experience. Look whether the merchant account provider works with other businesses like yours. If they do, then they probably have experience with your needs.

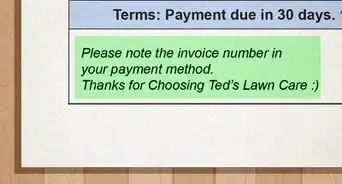

- Control. Can you customize payment forms, invoices, and client communications using the software?

- Comprehensiveness. Ideally, the software will include email invoicing, recurring billing, and other features. For example, if you want to swipe cards, you’ll need a credit card reader.

-

5Check if the merchant account comes with a payment gateway. You won’t be able to accept credit card payments unless you also have a payment gateway. The gateway receives requests and then connects with MasterCard or Visa to see if the customer has sufficient funds. If they do, then the transaction goes through and the funds are transferred from the cardholder to the merchant account.[8]

- Many merchant account providers also include a payment gateway—but not all do. You should check whether you can get an all-in-one solution.

-

6Watch out for scams. Some merchant account providers employ shady sales techniques. For example, they may promise to approve any type of business.[9] Or they offer incredibly low processing fees. You should have your antennae up if you hear anything that sounds too good to be true.

Applying for the Account

-

1Gather your financial statements. To get approved for an account, you want to show that your business is financially stable. Accordingly, you should pull together financial statements for your business.[10]

- Don’t worry if you are a new business. Believe it or not, you might benefit if you have a low sales volume. The fewer sales, the less money that will be stored in the merchant account, so the bank assumes less risk.

-

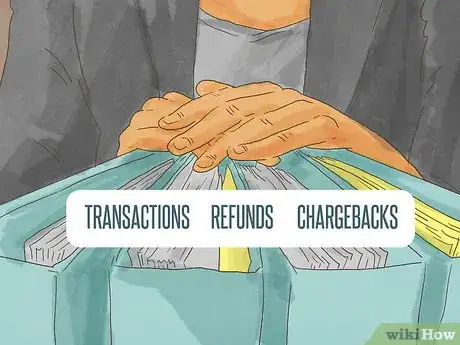

2Create your processing history. You might need to provide six months of processing statements as part of your application. Your processing statements should contain the following information:[11]

- number and volume of transactions

- number and volume of refunds

- number and volume of chargebacks

-

3Complete an application. To apply, you must provide business and personal information to the merchant account provider. Each application is different, but you generally will be asked for personal and business information, such as the following information:[12]

- business name and corporate structure

- business address and contact information

- your name and contact information

- total annual sales

- average transaction

- banking information

-

4Have your credit score pulled. The bank will want to know whether you are a good credit risk. Accordingly, they will pull your credit history and review it. You should get a copy of your credit report ahead of time to check for errors. Remember to get a copy of your personal credit report and your business’ credit report.

- If you see errors, dispute them with the credit reporting bureau.

- Once you open a merchant account, the provider has the right to take money in the case of a chargeback, as well as give you money.

-

5Address concerns in a cover letter. Some merchant account providers will communicate mostly over the phone. If they see something iffy in your application, they will reach out and call you. However, sometimes you need to include a cover letter with your application to address weaknesses.[13]

- Write it like a standard business letter, maintaining a professional tone.

- You can increase your business’ credibility by talking about your management team’s experience. This is important if you don’t have impressive financial statements.

- If you are in a high-risk industry, explain how you can minimize risks by, for example, putting up a security reserve.

- If you have high trading volumes, play up your solid processing history.

- Explain bad credit. Identify why you got into financial trouble and explain how your situation has improved. For example, your credit might have tanked two years ago as you struggled with unpaid medical debt. You can explain that you are better now.

-

6Review the terms. You should receive a Terms and Conditions sheet, which you should review closely. This sheet contains information about how fees will be calculated, among other things. Read the fine print in the T&C and the contract. If you need help understanding the terms, contact your business lawyer for help.

- Always read the fine print. The salesperson might have told you one thing, but the contract says another.[14]

- Realize that you’ll probably have to sign a personal guarantee. This means that you, as the business owner, will be personally responsible on the contract.[15] If your business can’t pay the fees, then you will have to out of your own pocket or else get sued.

- Only sign the agreement once you agree with everything in it.

-

7Install the software. If you want to process payments online, you’ll need to install the software so that it is compatible with your website. Work closely with customer support in case you run into problems.

Community Q&A

-

QuestionHow do I choose a merchant credit card?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant It helps to choose by how many points they'll give back to you, and how much you have to spend to get those points. Some people really like to travel and opt for the travel points card, but that type of card isn't as good as the cashback rewards card. Travel cards don't really give you discounts on travel—you could find a better discount if you just looked for the same travel deals on your own.

It helps to choose by how many points they'll give back to you, and how much you have to spend to get those points. Some people really like to travel and opt for the travel points card, but that type of card isn't as good as the cashback rewards card. Travel cards don't really give you discounts on travel—you could find a better discount if you just looked for the same travel deals on your own.

References

- ↑ https://www.shopify.com/blog/6614567-how-to-ensure-your-merchant-account-application-is-approved

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://www.braintreepayments.com/blog/merchant-account-basics/

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://www.shopify.com/blog/4378162-4-serious-mistakes-business-owners-make-with-their-credit-card-processor

- ↑ https://paysimple.com/blog/how-to-set-up-a-merchant-account/

- ↑ https://www.shopify.com/blog/6614567-how-to-ensure-your-merchant-account-application-is-approved

- ↑ https://www.shopify.com/blog/6614567-how-to-ensure-your-merchant-account-application-is-approved

- ↑ https://www.shopify.com/blog/6614567-how-to-ensure-your-merchant-account-application-is-approved

- ↑ https://www.shopify.com/blog/6614567-how-to-ensure-your-merchant-account-application-is-approved

- ↑ https://www402.americanexpress.com/merchant/online/wth/CANEng/Setup.do?request_type=main

- ↑ https://www.shopify.com/blog/6614567-how-to-ensure-your-merchant-account-application-is-approved

- ↑ http://www.creditcards.com/credit-card-news/tips-breaking-merchant-services-contract.php

- ↑ https://www.braintreepayments.com/blog/merchant-account-basics/