This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 3,484 times.

If you're unable to pay the taxes you owe in full, you may be able to set up a payment plan with the IRS that allows you to make monthly installments towards your total balance. While you make installments, penalties and interest may continue to accrue on the amount you owe, so do everything you can to pay off your tax debt as soon as possible. Depending on how long you need to pay off your tax debt, you may also have to pay a fee to set up the plan.[1]

Steps

Using the Online Payment Agreement Tool

-

1Confirm that you qualify to set up an online payment agreement. Your specific tax situation determines what payment plan options are available to you. However, you must file your return before the deadline to take advantage of these options. You generally qualify to set up an installment plan provided you owe less than $100,000 in taxes.[2]

- If you owe less than $50,000, you can set up a long-term payment plan with your payments spread out over more than 120 days. Businesses are eligible for long-term payment plans if they owe less than $25,000.

- If you owe more than $50,000 but less than $100,000, you are only eligible for a short-term payment plan. Generally, you must pay the full amount you owe to the IRS in less than 120 days.

-

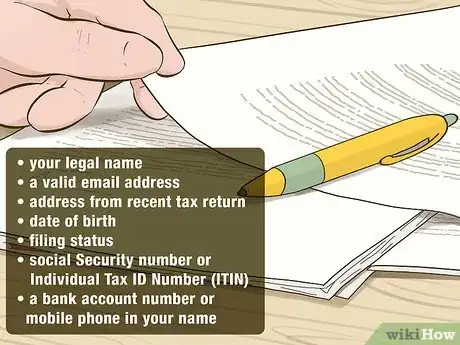

2Gather the information you'll need to apply online. The payment agreement requires you to provide information about yourself that will help the IRS to locate your tax account and the particular return you want to set up a payment plan for. Generally, you will need the following:[3]

- Your name as it appears on your most recently filed tax return

- A valid email address

- Your address from your most recently filed tax return

- Your date of birth

- Your filing status (single, married, married filing separately)

- Your Social Security number or Individual Tax ID Number (ITIN)

- A bank account number or mobile phone in your name, to confirm your identity

Tip: If you previously registered an online account with the IRS, you should be able to use the same user ID and password.

Advertisement -

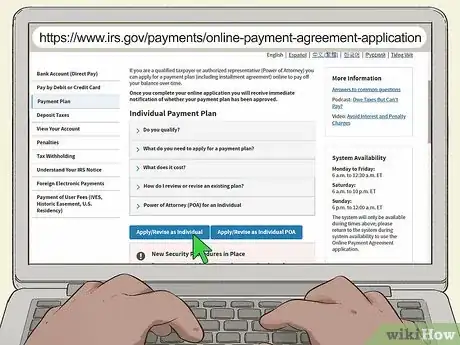

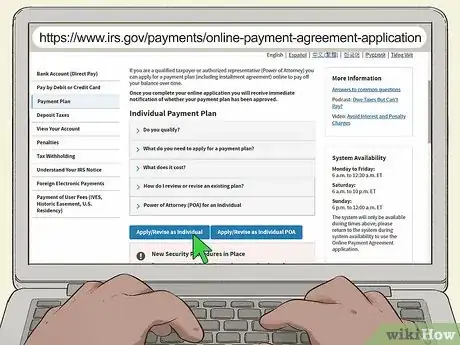

3Visit the IRS website to complete an application. To complete an online payment agreement application, go to https://www.irs.gov/payments/online-payment-agreement-application and click the blue "Apply/Revise as Individual" button. The system is available Monday through Friday from 6:00 a.m. to 12:30 a.m. ET, Saturday from 6:00 a.m. to 10:00 p.m. ET, and Sunday from 6:00 p.m. to 12:00 a.m. ET.[4]

- If you are a sole proprietor or independent contractor, apply as an individual rather than as a business.

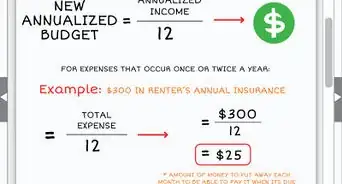

- The application requires you to choose your monthly payment due date. It's a good idea to check your due dates for other bills so you can pick the best day for your budget and expenses.

-

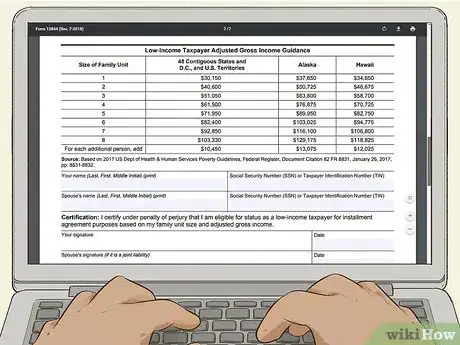

4Complete Form 13844 if you believe you qualify for a reduced user fee. For some types of payment plans, a user fee will be added to the total amount you owe the IRS. As of 2019, the fee for online payment agreements is typically less than $100. Low-income taxpayers may qualify for a lower fee. Form 13844 and the accompanying instructions provide guidance to help you determine whether you qualify for the reduced fee.[5]

- Download the form at https://www.irs.gov/pub/irs-pdf/f13844.pdf.

- If you qualify as a low-income taxpayer, the IRS may also reimburse your fees if you make your payments through direct debit from a US bank account.

-

5Provide payment information. When you complete your online application, you will find out immediately whether your payment plan request was approved. If the plan is approved, you'll need to let the IRS know how you're going to make your payments each month.[6]

- If you choose direct debit, you'll need to provide the routing number and account number for your checking or savings account.

Submitting Form 9465 to Request an Installment Agreement

-

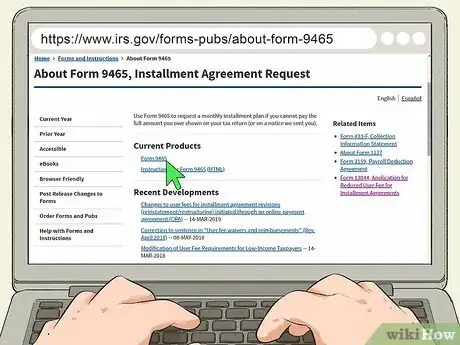

1Get a copy of Form 9465 and the instructions. You can download a copy of Form 9465 and the instructions at https://www.irs.gov/forms-pubs/about-form-9465. You can also pick up a copy in person at the nearest IRS office.[7]

- Read the instructions carefully. They include general instructions as well as specific instructions on how to complete each item on the application.

-

2Fill out your form neatly and accurately. If you've downloaded the form online, you can either fill it out on your computer or print it and fill it out by hand. If you complete the form by hand, write neatly using blue or black ink.[8]

- On the form, you have the option of choosing the due date for each monthly installment. Look over your budget and bills so you can choose the best date for your financial circumstances.

-

3Include payment of the applicable user fee. The user fee is higher if you request an installment agreement using Form 9465 than it would be if you applied online. The fee also varies depending on how you've agreed to make your monthly payments.[9]

- If you set up payments through direct debit from your US bank account, the user fee is $107, as of 2019. For any other method of payment, you'll pay a user fee of $225 to make your request in writing.

Tip: If you have low income, you may qualify for a reduced fee. Complete Form 13844, available at https://www.irs.gov/pub/irs-pdf/f13844.pdf, to see if you qualify.

-

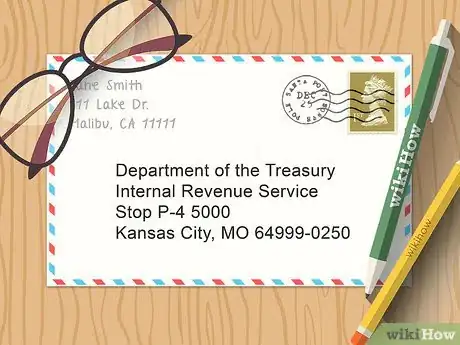

4Mail your form to the appropriate address listed in the instructions. If you've already filed your return, the address you use to send your Form 9465 to the IRS depends on which state you live in and the tax forms you filed.[10]

- There are 2 tables in the instructions for Form 9465. One applies to taxpayers who filed Form 1040 with Schedules C, E, or F. The other table applies to all other taxpayers.

- If you haven't yet filed your return, attach your form to the front of your return and send it to the address listed in your tax return instructions.

Changing an Existing Payment Plan

-

1Log into your online payment agreement account. If you applied for a payment agreement online, you can go back to https://www.irs.gov/payments/online-payment-agreement-application and click the "Apply/Revise" button to make changes to your existing payment plan.[11]

- Even if you applied through the mail using Form 9465, you can still make changes to your payment agreement online. You will need to provide enough information about your payment agreement for the IRS to find the agreement you want to modify in its files.

- Keep in mind that the system is only available Monday through Friday from 6:00 a.m. to 12:30 a.m. ET, Saturday from 6:00 a.m. to 10:00 p.m. ET, and Sunday from 6:00 p.m. to 12:00 a.m. ET.

-

2Submit your proposed revision to your plan. Once the system brings up the correct payment plan, you can review it and request changes. As long as your existing payment plan isn't paid using direct debit, you can use the online payment agreement tool to change any of the following:[12]

- Your monthly payment amount

- Your monthly payment due date

- Your method of payment (from any other method to direct debit)

Tip: If you missed payments and your agreement was canceled, you can also use the online payment agreement tool to reinstate your agreement. You'll have to pay a reinstatement fee, and may also have to bring it up to date.

-

3Contact the IRS directly if you're making payments through direct debit. If you set up direct debit of your monthly installments when you initially set up your payment plan, you can't make changes to it online. Instead, you can call the IRS or make an appointment at a local office.[13]

- Call 800-829-1040 for the individual help number. Phone lines are open Monday through Friday from 7:00 a.m. to 7:00 p.m. local time. If you are deaf or hearing impaired, call 800-829-4059 for TTY/TDD.

- If you're calling about a payment plan set up for a business tax return, call 800-829-4933.

- If you prefer to make an appointment at a local office to meet with an IRS officer in person, call 844-545-5640 to schedule an appointment. Visit https://apps.irs.gov/app/officeLocator/index.jsp before you call to locate the office closest to you.

-

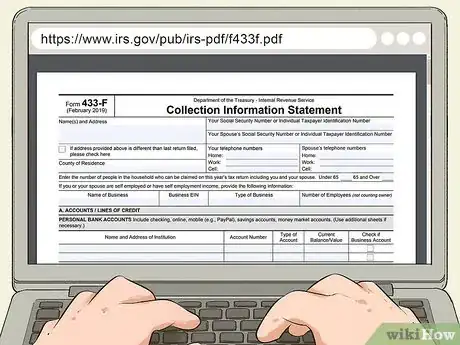

4Complete Form 433-F if your new payment is less than the required minimum. Form 433-F allows the IRS to determine whether you're able to satisfy your existing tax obligations. You must provide information about your current income and assets, as well as your monthly living expenses.[14]

- The online system will alert you if the payment amount you've requested is below the required minimum.

- You can download Form 433-F online at https://www.irs.gov/pub/irs-pdf/f433f.pdf.

-

5Pay the required fee to modify your installment agreement. As of 2019, there is an $89 fee to make changes to an existing installment agreement. The fee is charged per request, not per change, so if you have multiple changes you want to make it's better to make them all at once.[15]

- If you have low income and qualified for a reduced fee on your payment plan, you may be able to get this fee waived or reimbursed if you set up a direct debit plan. If you can't do a direct debit plan, your fee will be reimbursed once you've paid your tax obligation in full.

References

- ↑ https://www.irs.gov/payments/payment-plans-installment-agreements

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/payment-plans-installment-agreements#q05

- ↑ https://www.irs.gov/pub/irs-pdf/i9465.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i9465.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i9465.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i9465.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i9465.pdf

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/payments/online-payment-agreement-application

- ↑ https://www.irs.gov/pub/irs-pdf/i9465.pdf