wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 97% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 59,864 times.

Learn more...

A sole proprietorship is the simplest way to start a business in Illinois. In the eyes of federal and state law, the business and the owner are considered 1 entity. Unlike partnerships, limited liability corporations (LLC) and corporations, you are not required to file annual reports or renew a state business license. The steps you must take to become an Illinois sole proprietor differ slightly depending upon the type of business you plan to run; however, it is a good idea to plan your business strategies before filing documents and paying fees. Read more to find out how to set up a sole proprietorship in Illinois.

Steps

-

1Create a plan for your Illinois business. Even though a sole proprietorship is often seen as an informal structure because you are not required to register it with the state, all businesses require a plan in order to be successful. Outline your marketing, cost, employee and sales strategies before paying the applicable costs of starting a business.

-

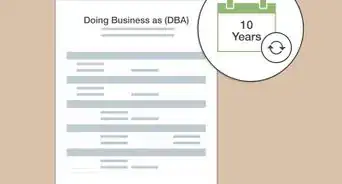

2Decide if you will run your business under your legal name or under an assumed business name. If you plan to name your business according to its services, you are required to file an assumed name certificate within the county where you conduct business. You need not file any documents if you conduct all business under your name, as filed on your federal income tax returns.

- For example, if a business is listed and billed under "Jamie R. Hill," then no documents are required for the name. If a business is listed as "Jamie Hill Lawn care," then an assumed business name filing is necessary.

Advertisement -

3File an assumed business name certificate with your local county clerk's office. Call the office or go online to find directions to the assumed business name form. Fill out personal and business information, sign it and have it stamped by a notary.

- Pay a fee to file the form. These fees vary from county to county. In Marshall County, the fee is only $5, but it can be around $150 in some municipalities. A notary public's services usually require a fee as well.

-

4Run a newspaper announcement in a local paper. After filing the assumed business name form, you will be required to place a newspaper ad in a paper once per week for 3 consecutive weeks. This must be done within 15 days of filing and you will be responsible for all costs.

-

5Register for applicable business taxes with the Illinois Department of Revenue. All business owners are required to register at tax.illinois.gov/Businesses/register. After registering your business and filling out tax schedules, you will receive a tax ID and a certificate of registration.

- In addition to a simple business registration for a tax ID, you will also need to apply to pay all applicable taxes according to the type of business you plan to run. These taxes include liquor, sales, tobacco, electricity, gas and telecommunications tax.

- Make sure you fill in a schedule for Illinois business location information, responsible party information and owner, officer and general partner information.

-

6Open a bank account with your assumed business name. This is an optional step, but it is the first precaution in separating your business and personal assets. You must bring your official assumed business name certificate in order to open an account with the bank.

-

7Register with state and federal agencies if you plan to have employees. These are optional steps if you do not intend to employ others. There are a number of steps you must take to ensure the safety of your company and your employees.

- Apply for an Employment Identification Number (EIN) at IRS.gov. This will separate your tax filings from your social security number. Employee wage withholding will be under this EIN. Some sole proprietors without employees also choose to apply for an EIN as a preventative measure against identity theft.

- Register with the Illinois Department of Employment Security. This is required by law if you plan to have any employees. Visit the Illinois Business Portal to file electronically.

- Report all new employees to the IRS and the State of Illinois. You must fill out withholding certificates for each new employee. You can report them online at the "New Hire Reporting" section of the Illinois Business Portal.

- Obtain worker's compensation insurance. Illinois state law requires this insurance for any business with employees. You can go online and compare quotes from various insurance companies to find the best deal.

-

8File your taxes either annually or semi-annually, according to IRS guidelines. You will report all profits and expenses on your personal IRS Form 1040, Schedule C. You will also need to pay the 13.3 percent self-employment tax, which covers your contributions to social security and Medicare.

- Half of the 13.3 percent self-employment tax is deductible when you are calculating your adjusted gross income. Only the first $106,800 of your earnings are subject to this tax.

- Use the same gross income totals for your personal Illinois state tax return.

Community Q&A

-

QuestionIf I want to name my business Vaughn Photography. Do I have to file an assumed name certificate?

Community AnswerYes. Anything that includes a word or nickname variant will be required to file an assumed name certificate.

Community AnswerYes. Anything that includes a word or nickname variant will be required to file an assumed name certificate.

Warnings

- The disadvantage of a sole proprietorship is that your personal and business assets are considered the same. Your personal assets can be seized in the case of debt or lawsuits.⧼thumbs_response⧽

Things You'll Need

- Business plan

- Assumed business name

- Money

- Newspaper ad

- Illinois Department of Revenue registration

- Illinois Department of Revenue tax and information schedules

- Employment Identification Number (optional)

- Bank account (optional)

- Worker's compensation insurance (optional)

- IRS Form 1040

- IRS Publication 535

- Notary public

-in-the-USA-Step-20.webp)