X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 33,515 times.

Learn more...

Creating wealth is not as difficult as people think. If you are currently in the habit of creating debt, then you have the ability to just as easily create wealth. You just have to refocus your priorities and get disciplined. Follow some proven steps in your endeavor to transform debt into wealth, and you may just find that saving and investing your money is more fun than spending it.

Steps

-

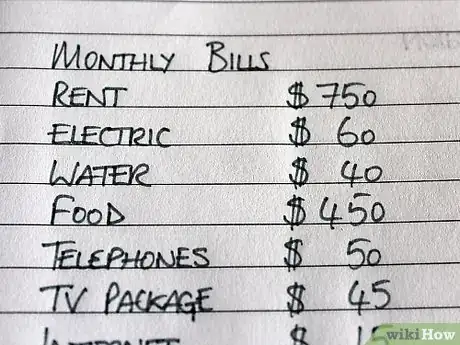

1Take time to sit down and evaluate your current financial situation. Determine what you have in credit card debt, what loans you have to pay off, and what you have in savings. You also want to get a good idea of what you pay every month in regular bills. With all this information, you need to decipher what you need every month to pay off your bills. You can do this by adding up your monthly bills, multiplying that by 12 to get your annual amount, and then divide that by 52 to get your weekly obligation. If you get paid weekly, this is what you need to take out of your income every week. If you get paid biweekly, multiply the amount by 2, and you have what you need to put aside for bills from every paycheck. If you find that your expenses far outweigh your income, you are living above your means, and you need to make some serious changes.

-

2Understand your spending habits, and if you are living above your means, then you need to cut back by reducing your wants and sticking to your needs. Your needs are those things that you need to survive, such as utilities and necessary foods. Be realistic about what you need because if you honestly think you are spending your bare minimum, and the cost of your needs is still more than your income, you may need to get a second job. Therefore, look at your phone bill, your cable and your electricity, and ask yourself if you can cut back. If you find that you have money left over after deducting your expenses, then this true monthly cash flow is what you will use to turn liability into capital.Advertisement

-

3Determine which of your credit cards has the lowest payment, and start paying it off with additional amounts toward the principal. You should be paying more than the minimum amounts on all of your credit cards, as principal, but pay larger amounts towards the smaller balances. You may want to think about applying for 0% credit cards if you are eligible. This way you can consolidate your current cards, or at least higher balances so that they don't accumulate interest while you pay off the lower balances. Just make a note of when the interest on 0% credit cards kicks in because often times they have really high interest rates; you may need to move the balance again. The focus is to pay off these balances, and in doing so, you cannot use your credit cards.

-

4Learn to pay for everything with cash. If you don't know how to use a credit card to benefit you, you should not use one at all. Your objective in turning your debt into wealth is to get rid of all debt so that the payments used to pay off debt are now building your savings.

-

5Start to save money as you pay off your debt. You may not have much to start off with. But as you pay off each credit card and loan, take that amount that went toward the now-paid-off debt and divide it. Use part of it to go toward paying off your next debt, and put the other half in savings. Once you have paid off all your debts, you should be putting everything into savings. You should have at least 6 months worth of bills in your savings as an emergency fund. Ideally, you should have a year's worth in this economy. As you start to build your emergency fund, take a portion of your true money cash flow and start investing it in a retirement fund. If you follow these steps religiously, then you will pay off all your debt. Your money will be better invested in resources that will build it, thus transforming debt into wealth.

Advertisement

About This Article

Advertisement