X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 16 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 41,380 times.

Learn more...

The Morningstar service is well-known for its "star ratings" of mutual funds. What is not commonly realized is that it is a great place to get some important fundamental information on stock investments.

Steps

-

1Go to the Morningstar website.

-

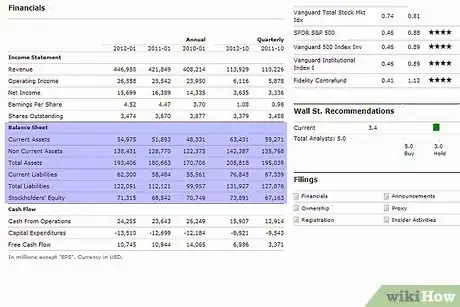

2Under the Morningstar logo is a small white box titled "Quotes." Enter the symbol of a stock you're interested in. This is usually a three- or four-letter symbol (such as "AAPL" for Apple, Inc. or "XOM" for Exxon Mobil Corp.) If you don't know the symbol, enter the name of the stock. This will bring you to a page of symbols and allow you to click on the appropriate one. You'll then be shown a summary page, "Quote and News." This provides you with the latest price, market capitalization, P/E ratio, price/sales ratio and even a price/cash-flow ratio.Advertisement

-

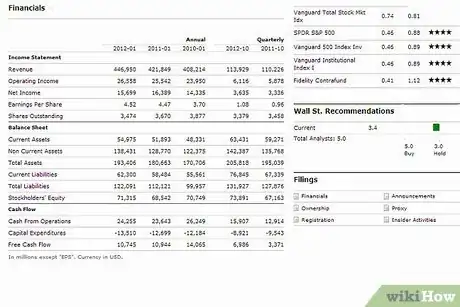

3Click on "Financial Statements" along the left side of that page. This takes you to the "10-Yr Income" tab. For an interesting long-term view, the "5-Yr Restated" page is helpful. Click on the fourth tab over above the bar graph which is the "5-Yr Restated" financials page.

-

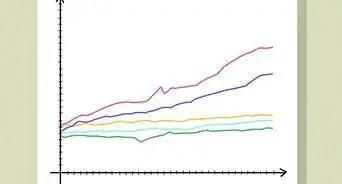

4Examine the bar graphs representing the revenue picture. Figure out what you're looking for: it depends on what type of growth you want.

-

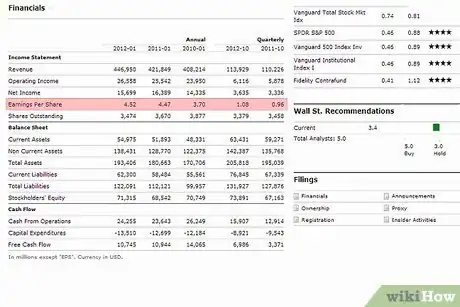

5Look at earnings, the fifth line down. Again, what you are looking for will determine the value of the stock.

-

6Review the dividends line. While not essential for a successful stock investment, a stream of increasing dividends may suggest a future stock price increase.

-

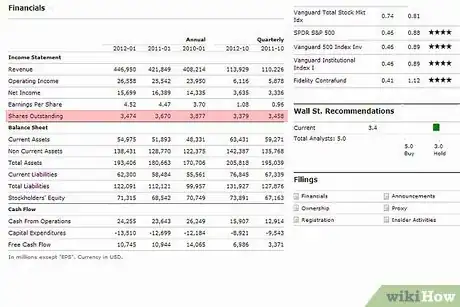

7Monitor the number of shares outstanding. A solid company usually will not need to be rapidly increasing its number of shares. This dilutes the earnings of existing stockholders and may be a negative influence on stock price performance. On the other hand, a company that is reducing its number of shares may cause its stock price to increase.

-

8The next section is called "Cash Flow $Mil". This section lets you know whether the company is generating or "burning" its available cash. You might want to stick to companies that are "free cash flow" positive (and even growing).

-

9Look at the balance sheet. Simply put, a company is healthier if it has more assets than liabilities and more cash and current assets than current and long-term liabilities.

-

10Calculate the "current ratio" by dividing the total of cash and current assets by the current liabilities. A company that is able to pay off all of its current and long-term liabilities with its cash is the most financially solvent of all.

Advertisement

Community Q&A

-

QuestionHow do I compare my current portfolio with other mutual funds?

Shams_afnaanCommunity AnswerCheck your portfolio P&L ratio, and check the P&L ratio of the mutual fund you want to compare your portfolio with. If your Profit percentage is greater than the profit percentage of the mutual fund, your portfolio is performing better than the mutual fund.

Shams_afnaanCommunity AnswerCheck your portfolio P&L ratio, and check the P&L ratio of the mutual fund you want to compare your portfolio with. If your Profit percentage is greater than the profit percentage of the mutual fund, your portfolio is performing better than the mutual fund.

Advertisement

Warnings

- Unless you truly know exactly what you're doing in the stock market, don't be afraid to consult with a certified, fee-based investment advisor prior to making expensive investment decisions.⧼thumbs_response⧽

Advertisement

References

About This Article

Advertisement

-Step-14.webp)

-Step-3.webp)