This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 24,676 times.

Learn more...

Tax havens are countries with little or no taxation of income (particularly corporate income) and enhanced privacy restrictions. To use a tax haven, form a corporation in that country and funnel your income to that corporation. That income then becomes subject to the tax laws of the tax haven, rather than the tax laws in your home country. However, you'll still have to pay taxes on any money you transfer back to your home country. Technically, what you're doing is deferring payment of taxes – which is not illegal. Failing to report income for the purposes of evading taxes, on the other hand, can come with severe legal consequences.[1]

Steps

Choosing a Tax Haven

-

1Speak with an attorney or financial advisor. Before you decide to use a tax haven to protect your wealth, make sure your plans don't violate national laws in your home country. An attorney or financial advisor can also advise you on strategies to get the most benefit out of using a tax haven.[2]

- Look for an attorney or financial advisor who has experience with tax havens and offshore corporations. If they don't have offshore finance mentioned on their website, ask if they have clients who use tax havens.

-

2Ask colleagues for recommendations. If you know anyone who is using a tax haven, get their advice. They may be able to recommend countries that would make ideal tax havens for you. They may also be able to tell you which countries to avoid.

- Colleagues may also have recommendations on foreign banks to use. Keep in mind that your bank account doesn't necessarily have to be located in the tax haven. For example, you could have a shell company in the Bahamas that uses a Swiss bank account.

Advertisement -

3Make a list of preferred tax havens based on location. It may be that you never have to set foot in your tax haven to set up business and keep your money there. However, it's more likely that you'll have to visit at least once to verify your identification and set up your bank account. You may also want to travel there on occasion, even if you aren't legally required to do so. There's a reason many tax havens are also beautiful vacation spots.[3]

- For example, if you live in Europe, you might consider Andorra, which is located in Western Europe between France and Spain. This tiny country has no gift, inheritance, or capital transfer tax.

- If you live in North or South America, you might consider islands in the Caribbean, such as Belize (no capital gains tax) or The Bahamas (no personal income tax, capital gains tax, or inheritance tax).

Tip: You might also consider what languages are spoken in the country. For example, if you speak English, you may want to look at English-speaking countries, such as The British Virgin Islands or The Isle of Man.

-

4Evaluate the country's political and economic stability. Often, developing countries will lower their tax rates for foreign corporations and advertise themselves as tax havens. This can bring money to the country and help it grow. However, if the country has frequent political upheaval or a history of inflation and unrest, it may not be the best place to keep your money.[4]

- Any tax savings will be worthless if, for example, there's a coup and the new leader seizes all foreign assets in the country. Research the country's history of stability to make sure your money is safe there.

- If you like the country's tax profile but question whether your money will be safe, you can always incorporate there, then open a bank account in another country. Depending on that bank's privacy policies, your assets may be safer.

-

5Compare tax rates in tax havens of interest. Look for the tax haven that offers the best tax incentives for you. The particular tax rate that's most important to you will depend on your reasons for seeking a tax haven. You'll typically still have to pay taxes in your home country eventually, but you can use a tax haven to reduce the taxes you'll ultimately pay.[5]

- For example, suppose you want to stash money in an offshore account so your children can later inherit it, and your home country has an inheritance tax. You might choose a tax haven with no inheritance tax, such as Andorra, The Bahamas, or The Isle of Man.

- Large corporations that want to use an offshore shell company to defer tax liability and reinvest in their companies typically choose tax havens that have no capital gains tax, corporation tax, or capital transfer tax, such as Bermuda, The British Virgin Islands, or the Isle of Man.

-

6Determine whether the bank shares information with your government. Privacy and confidentiality are important for tax havens. Most of them have significant legal protections designed to ensure the confidentiality of account holders. Often, these banks won't even reveal that you are an account holder there unless there's a court order for them to do so. Most tax havens also do not share any information with foreign tax authorities or international financial authorities.[6]

- If you live in the US and you're looking at a bank that has a presence in the US, you can assume it will report information about your account to the US Treasury. Under US laws, all foreign banks must report this information or they won't be able to operate in the US.

- Keep in mind that if your home country requires you to report foreign income on your taxes, you still must report it and pay taxes on it, regardless of whether the bank reports it. Failure to do so amounts to tax evasion, which carries stiff criminal penalties.

Tip: If you are a US citizen, you should also be aware of another law, the Foreign Bank and Financial Accounts Regulation (FBAR). Under this law, you are required to declare any foreign bank accounts you control that have more than $10,000 in assets on your taxes. Failure to do so results in stiff criminal penalties.

-

7Review whether you need a local representative. Some countries with relatively low tax rates also require you to have a local representative who is a citizen of that country. Since you typically will have to pay that person, this can make using a tax haven more expensive. If you use a country that doesn't have this requirement, you can save some money.[7]

- Some countries also require you to have a more significant local presence if you want to register a corporation there. For example, you may have to actually produce goods or services to local consumers. Unless you have an interest in actually setting up shop in that country, a place like that isn't a good option to use as a tax haven.

Incorporating in the Tax Haven

-

1Look at offshore service providers. Unless you're looking to hold billions of dollars offshore, using an offshore service provider may be your best option. These companies will set up a corporation in the tax haven of your choice for you. The corporation is essentially a shell company – it exists on paper and receives money, but doesn't actually have offices or conduct business operations.[8]

- You can typically get a shell company and a bank account set up in a tax haven for less than US$4,000 through an offshore service provider. All you have to do is answer a few questions and choose a name for your shell company and the service provider will take it from there.

- Some offshore service providers also offer other privacy protection services for additional fees. Choose what you think would be useful to you, but don't feel pressured to pay more for services you don't think you'll get any benefit from.

- You may need to send your service provider certified copies of your passport or other identification documents as well as verify your residency. These requirements depend on the country you've chosen as your tax haven.

Tip: Research the background and reputation of an offshore service provider thoroughly before you decide to use them. Many of these companies are scams.

-

2Complete the necessary paperwork to incorporate your shell company. To take advantage of the tax benefits of a tax haven, you need to set up an incorporated business. A corporation is a separate entity from you personally, so any money paid to the corporation is not considered your personal income. In most tax havens, setting up a corporation is a fairly simple task. You likely won't even have to go to the country in person.[9]

- You'll typically have to create a unique name for your company. Check online to see if your preferred tax haven has a business names database available. You can typically find it by searching the name of the country followed by "business register" or "company register." With a shell company, having a catchy or memorable name typically isn't the goal, since you won't be advertising under this name. You just want one that no one else is using.

- You also typically need a registered address in the country. This doesn't mean you have to open up an office or set up shop. You can rent a post office box and have all mail delivered to that box forwarded to you. You can also hire a local agent to receive mail for you and forward it.[10]

- If you use an offshore services provider, they'll take care of all these details for you. All you have to do is answer a few questions, choose your tax haven, and choose your company name.

-

3Find a representative in the tax haven to help set up your corporation. The other, more expensive way to set up a shell corporation is to hire a professional who actually lives in the tax haven you've chosen. This is typically an attorney or an accountant. They will serve as your representative and complete the paperwork to set up your corporation.[11]

- You'll typically pay this kind of representative more than you would pay an offshore service provider. However, you can have more confidence that everything was set up correctly. In some tax havens, this is required.

- Some attorneys and accountants in tax havens advertise themselves as offshore company representatives. If you talked to an attorney or financial advisor about using a tax haven, they may also be able to recommend a local representative you could work with.

-

4Open a bank account in the tax haven. Once your company is registered, you'll need a bank account in the company's name so you can direct income there and start enjoying the tax benefits. You can open an account at a local bank in the country where your corporation is registered or in another country.[12]

- You will have to provide documents to verify your identity, such as a certified true copy of your passport. This information is kept confidential by most banks in tax havens. The account itself wouldn't be in your name but in the name of your shell company.

- Opening a bank account may require you to make a trip to the country where the bank is located. This depends on the policies of individual banks, as well as the country's laws on verifying the identification of people opening bank accounts there.

-

5Direct payments to the shell company. Once your shell company and your bank account are set up, do your business through the shell company. All or most of your income should be paid to your shell company rather than to you. If you have existing contracts, you might want to renegotiate them so you can redirect that income as well. When your shell company receives money, it falls under the tax laws of the country where the company was incorporated.[13]

- For example, suppose you are a freelance writer in the US. You set up a shell company in the Cayman Islands and direct all payments for your work to the shell company. Then you list yourself as an employee of the shell company and pay yourself a salary. In the US, you would only have to pay personal income taxes on that salary. The rest of the money would belong to the shell company.

- If your home country has citizen-based taxation, as the US does, you are still responsible for paying taxes on the income when you make payments to yourself in the US, or when you transfer the money to another company organized under US law. However, if you keep your money in the tax haven you can defer taxes, potentially indefinitely.

-

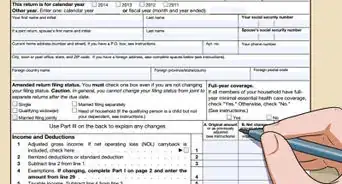

6Report income earned and pay taxes in your home country. It may sound counter-intuitive, but you do still owe taxes on any income that you personally receive from your offshore company. You don't have to report income that remains parked offshore. However, you do have to report and pay taxes on any money you bring back to your home country.[14]

- For example, suppose you created and marketed a smartphone app and made $1 million in sales last year. If all of that money was paid directly to your offshore company in a tax haven, you wouldn't owe any taxes on it in your home country. If, on the other hand, you withdrew $500,000 from your offshore coffers to fund an expansion of your app, you would have to report that $500,000 as income and pay taxes on it.

- Some countries, including the US, also require you to disclose any ownership interest you have in a foreign corporation. However, you only have to pay taxes on your share of the profits – the money you paid yourself, or the money you transferred into a US bank account.

Recovering Your Money Tax-Free

-

1Consider renouncing your citizenship, if possible. Some countries, such as the US, have citizen-based taxation. This means that if you are a US citizen, you owe US taxes on all income regardless of where in the world you earn it. By renouncing your citizenship, you can avoid taxation on money held in a tax haven. However, it's becoming increasingly difficult to do this without violating the law.[15]

- When you renounce your citizenship, you may have to pay a type of capital gains tax known as the "expatriation tax" before the renunciation process is finalized. This tax is levied against high-income citizens, in part to discourage them from moving their assets overseas.

- Expect a lengthy process and high fees if you want to renounce your citizenship. US fees are the highest among high-income countries. At $2,350 as of 2019, these fees are 20 times the average cost of fees to renounce your citizenship in other countries.

- Once you renounce your citizenship, you'll have to move to a country that doesn't tax income you've already earned, such as the UK or Singapore. You may also want to move to the tax haven where you set up your shell company, if that tax haven has no personal income tax or wealth tax.

-

2Leave the money to your children or other beneficiaries. You can pass your interest in the shell company on in a will or trust rather than spending the income yourself. If you use a tax haven that has no inheritance or transfer taxes, your heirs may acquire this money tax-free.

- If you do this, keep in mind that your heirs still may end up paying taxes on that income, particularly if tax laws change in your home country in the meantime. They may be able to avoid those taxes if they expatriate to the country where your shell company is headquartered. However, they may not be interested in doing that.

-

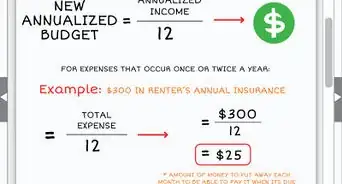

3Reinvest the money to build and expand your corporation. In most countries, the money your shell corporation earned would not be taxed until you brought it back to your home country. This enables you to defer taxes, potentially indefinitely, simply by leaving the money in the tax haven.

- Since your shell company is located in the tax haven, you can expand that company without spending money at home. For example, you could use the money to buy real estate in the tax haven in the name of the shell company. If you rented out those properties, that income would be earned by the shell company.

Warnings

- Avoiding or deferring the payment of taxes is perfectly legal. However, tax evasion is illegal. While you can use tax havens to stash money for short-term financial gains, it is generally not legally possible to extend your tax savings in perpetuity.[16]⧼thumbs_response⧽

- Funneling money towards an offshore shell company to decrease your taxable personal income is considered tax evasion and is subject to criminal prosecution.[17]⧼thumbs_response⧽

References

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/other/what-is-tax-haven/

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ http://blog.transparency.org/2013/04/09/how-to-set-up-an-offshore-company-in-10-minutes/

- ↑ http://blog.transparency.org/2013/04/09/how-to-set-up-an-offshore-company-in-10-minutes/

- ↑ http://www.gov.ky/portal/pls/portal/docs/1/12316374.PDF

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ http://blog.transparency.org/2013/04/09/how-to-set-up-an-offshore-company-in-10-minutes/

- ↑ https://www.investopedia.com/terms/s/shellcorporation.asp

- ↑ https://www.investopedia.com/terms/s/shellcorporation.asp

- ↑ https://www.investopedia.com/articles/personal-finance/060515/why-people-renounce-their-us-citizenship.asp

- ↑ https://www.investopedia.com/articles/tax/09/tax-havens.asp

- ↑ https://www.investopedia.com/terms/s/shellcorporation.asp