This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

This article has been viewed 122,088 times.

A Chase credit card provides you with the flexibility to handle financial emergencies with the backing of a globally recognized bank. Chase offers a wide range of credit card choices, allowing you to select the card that best suits your financial needs. Chase credit cards are accepted at major retailers worldwide, and also allow you to make online purchases and secure travel reservations.

Steps

Choosing a Credit Card

-

1Visit the Chase website. On the Chase website, you will be able to explore all of the banking products they offer, but more importantly, you will be able to choose and apply for a credit card.

-

2Find the credit cards page. On the top left of the page, you will see a drop-down box called “explore products”, hold your mouse over this, and then select the left most option, “credit cards”.[1]Advertisement

-

3Browse the different options available. You will be taken to the credit cards homepage, where a few options are shown. The website allows you to view all the credit cards they have available, compare different cards based on their features, and to sort them based on specific criteria.

- Chase offers many different types of credit cards. For example, cards with no annual fee, credit cards for business owners, cards with various rewards (cash back, hotel or airlines points, etc.), cards with no foreign transaction fees, which can be great if you travel internationally, in addition to several other types.

- If you know what features you are looking for, you can use the, "credit card finder" to help narrow your selections. You can find this tool on the top left hand side of the page.

- You can also browse all of the available cards by selecting, "browse all credit cards" on the left hand side of the page.

-

4Narrow your search. After you have browsed the different cards available, you should narrow your choices down to a few good options.

- If this is your first time applying for a card, you should start with a very basic one. For example, cards with no annual fees (such as the Chase Freedom card) tend to be a good option, but they typically come with very few frills.

- One thing to consider is how you will use the card. If you plan to use the card for small purchases, and to pay the balance in full each month then the interest rate of the card is not so important. However, if you plan to use the card for a big purchase, which will require you to pay the balance slowly over time, make sure you look for the lowest interest rate.[2]

- Also consider your credit history when choosing your card.[3] If you don’t have a good credit history, or you have fewer than five years of history, your options will be limited to the most basic cards with small credit limits.

-

5Read about the card thoroughly. Be sure to thoroughly read and understand the fine print associated with your choices. Not only is it important to understand what you are getting in to when getting a credit card, it can also be helpful for finding the perfect card for you.

-

6Choose a credit card. Finding the right credit card can be a daunting task. However, after reading about each card’s advantages and benefits, you will be able to come to a good conclusion about which one is most suitable.

Applying for a Chase Credit Card Online

-

1Click “Apply Now”. Once you have chosen a suitable card, go to the web page of that particular card and click the “Apply Now” button. This button is green and located to the right of the picture of the card.

- You may also apply for a card by calling the customer service line. In the US, this number is: 1-877-242-7372. Outside the US, you can reach them at: 1-713-262-3300.[4]

- Understand, though, that this method can take longer and may result in mistakes because you won’t get to see what the representative has inputted into the screen. It will require you to speak the information to the representative who will read it back to you for accuracy. In addition, you will likely be required to wait on hold for several minutes if they are very busy.

- You may also apply for a card by calling the customer service line. In the US, this number is: 1-877-242-7372. Outside the US, you can reach them at: 1-713-262-3300.[4]

-

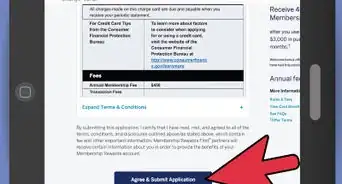

2Follow the instructions carefully. The application will guide you through several pages. Make sure that you fill in each box carefully, and double check to make sure you have not made any mistakes.

- Make sure all your information is correct. Transposed digits or missing information can cause Chase to deny your application.

-

3Complete the application. In the online application, you will be asked to provide information about you, where you live, how much you earn, who you are employed by, your social security number, as well as a wealth of other information.[5]

- This information will be used to help the bank make a decision about how likely you are to use the credit card responsibly.

- If you're not retired, have no alimony or child-support payments, or do not need a card for an additional user, leave these sections of the form blank.

-

4Submit the application. Usually, you will receive an email after submitting your application confirming that they received it. This email will usually contain information about how long a decision will need.

-

5Wait for a decision. With the technology of today, Chase can typically make a decision about your application in a matter of minutes. If you are approved, you will usually receive your card within a few days via mail.[6]

- Once you receive your new card you will need to go online to www.chase.com/verifycard (you need to have an online account, or you can easily create one), or call the number on the card to activate it. Don’t forget to sign the card, too!

Warnings

- Do not miss monthly payments, as this will ruin your credit history!⧼thumbs_response⧽

- Make sure you understand the risk and responsibility inherent in owning a credit card. While having a credit card can be very good for building a good credit history, and for unexpected emergencies, many people get into trouble because they spend more money than they can afford to pay back.[10]⧼thumbs_response⧽

References

- ↑ https://www.chase.com/

- ↑ https://www.creditkarma.com/article/choose_a_credit_card

- ↑ http://www.moneyunder30.com/how-to-choose-a-credit-card

- ↑ https://www.chase.com/

- ↑ https://www.chase.com/

- ↑ https://www.chase.com/

- ↑ https://www.credit.com/credit-cards/content/your-first-credit-card/

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

About This Article

Depending on what your needs are, Chase has several different credit cards you can apply for. You can get cards with no annual fee, cards for business owners, cards with rewards like cash back, hotel or airlines points, and cards with no foreign transaction fees if you travel a lot. To apply, all you need to do is go to Chase’s website, choose your card, and follow the prompts. You can also apply over the phone by calling 1-877-242-7372. You’ll need to provide some personal information, like where you live, how much you earn, your employer, and your social security number. If your application is approved, you should receive your card in the mail within a few days. For more tips, including how to choose a Chase card for making big purchases, read on!