Explore this Article

IN THIS ARTICLE

Other Sections

X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 12 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 307,660 times.

Learn more...

To be approved for a Kohl's credit card (issued through Capital One), you need a credit score of 640 or higher. The approval process is quick, and in some cases can take less than one minute after applying! This article provides a simple walkthrough to guide you through the application process.

Steps

1

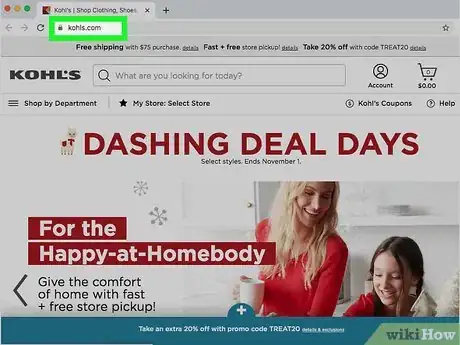

Visit the Kohl's website.

-

Open Kohl's website in a new window by pressing Shift and clicking this link: Kohls.com

- At the top of the page, click on the link that says "my kohl's charge" and you'll be directed to the first signup page:

Advertisement

2

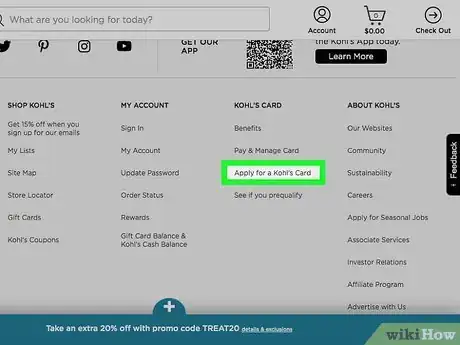

Click the "Apply for a Kohl's Card" button.

-

This will open up a secure connection where you can begin the signup process.

- Consider reading the Security and Privacy Policy before applying for a Kohl's charge card—or any charge card—online. Click on the "Security and Privacy Policy" link at the bottom of the page to learn more about how the company may use your personal information.

- When you apply for a Kohl's credit card, the store may collect and store information, including your name, birth date, telephone number, address, email address and social security number.

- If you feel comfortable with what you read, close the "Security and Privacy Policy" page to return to the online credit application page.

- Click the "Apply Now!*" button when you're ready to continue.

3

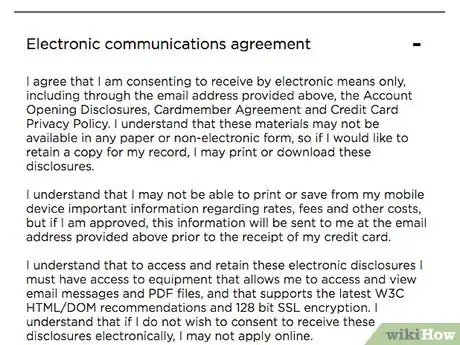

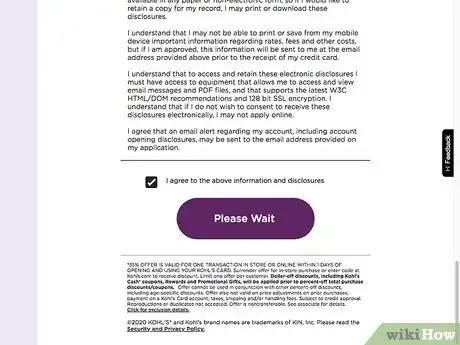

Review the "Consent to Electronic Disclosures" page.

-

This allows you to receive an electronic copy of the Kohl's card member agreement. You can view it by using Adobe Acrobat Reader.

- The card member agreement usually includes useful information about interest rates, billing statement periods, late payment fees and other items pertaining to your account.

Advertisement

4

Select "Continue."

5

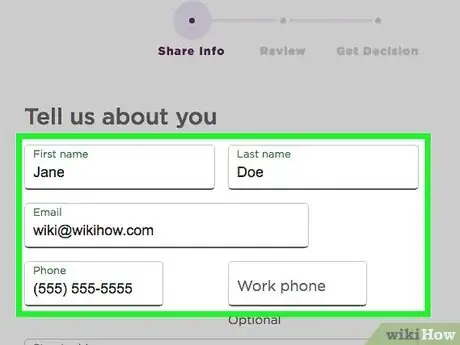

Fill out the "Application Information" section.

6

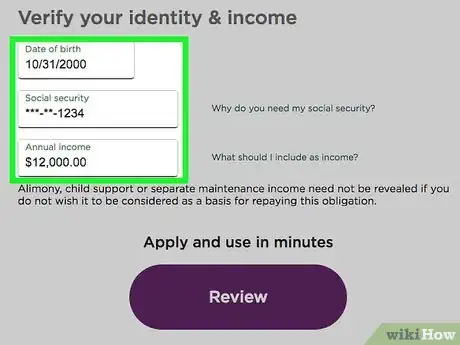

Enter data in the "Verification Information" section of the Kohl's online application.

7

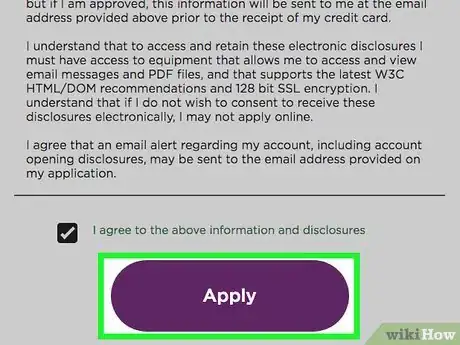

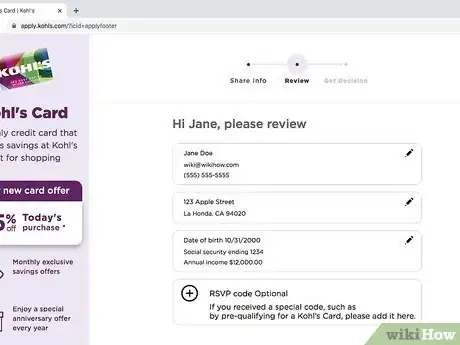

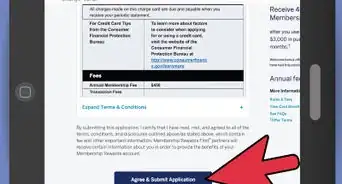

Review your information.

-

Make sure it is accurate before going to the next step in the application process.

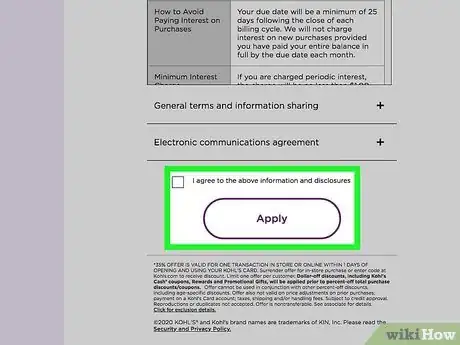

- Also review the fine print at the bottom of the application. Check the related box to indicate that you have read the credit card agreement, verified the information in your credit application and granted permission for Kohl's to obtain information about your credit profile.

Advertisement

8

Select "Apply".

9

Wait for confirmation.

Community Q&A

-

QuestionCan I re-open a Kohls card after a bankruptcy?

Community AnswerIf your Kohl's card was part of your bankruptcy filing and therefore left unpaid, it's highly unlikely they will allow you to open another card.

Community AnswerIf your Kohl's card was part of your bankruptcy filing and therefore left unpaid, it's highly unlikely they will allow you to open another card. -

QuestionHow do you increase your credit card limit?

DonaganTop AnswererIf an increase isn't given automatically after a year of on-time payments, just call and ask the company for one. They will decide based on your income and credit history.

DonaganTop AnswererIf an increase isn't given automatically after a year of on-time payments, just call and ask the company for one. They will decide based on your income and credit history. -

QuestionHow much credit is available once you are approved for the card?

DonaganTop AnswererThere isn't a standard amount. It depends on your income and credit history.

DonaganTop AnswererThere isn't a standard amount. It depends on your income and credit history.

Advertisement

You Might Also Like

How to

Add a Credit Card to a PayPal Account

How to

Use a Credit Card Online

How to

Buy a Prepaid Credit Card With a Credit Card

How to

Apply for a Best Buy Credit Card

How to

Apply for a Macy's Credit Card

How to

Get an American Express Platinum Card

How to

Get a Credit Card

How to

Buy a Prepaid Credit Card With a Check

How to

Get a Credit Card Without a Bank Account

How to

Apply for a Chase Credit Card

Advertisement

About This Article

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 12 people, some anonymous, worked to edit and improve it over time. This article has been viewed 307,660 times.

9 votes - 44%

Co-authors: 12

Updated: October 3, 2022

Views: 307,660

Categories: Getting a Credit Card

Advertisement