This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 288,602 times.

Payroll tax calculations have a huge impact on both the employer and the worker. These calculations impact the total wage expense incurred by the employer. The tax calculations also affect the worker’s taxable income, personal tax liability, and net take-home pay. Payroll taxes are made up of federal and state tax withholdings, Social Security taxes, and Medicare taxes. It’s critical that the employer and the worker understand how payroll taxes and withholdings are calculated.

Steps

Calculating Federal Income Tax Withholding

-

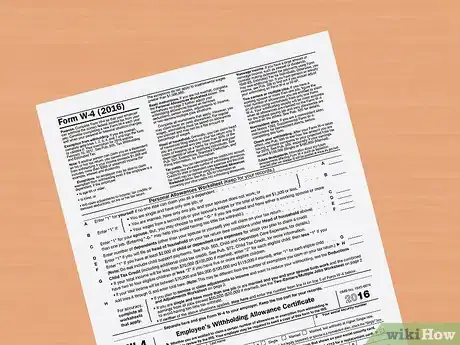

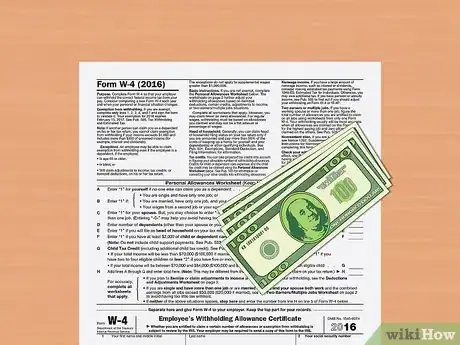

1Have each worker complete a W-4. The W-4 form has a detachable portion that allows employees to indicate their filing status and how many allowances they plan to take. Employees will provide their personal information, such as address, social security number, and marital status. Then, they'll specify how many allowances they want to take based on the credits they plan to claim. There is a worksheet to help them determine their allowances.[1]

- The allowances worksheet will ask you if you are married, if you are eligible for the child tax credit or other dependent credits, and if you plan to claim other credits when you file your taxes.

- You no longer claim yourself and your dependents as exemptions on your taxes.

-

2Apply the IRS rules to compute federal tax withholdings from gross pay. The worker provides the employer with their filing status and the number of allowances they are qualified to take. The allowances are used to calculate the amount held from gross pay.[2]

- Determine the employee's gross pay. Verify the employee’s total pay for the pay period. Gross pay includes any hourly wages, tips, and bonus compensation.

- Locate the employee's filing status. This can be found on the employee's W-4 form. The status may be married, single or some other status listed on the form.

- Find the number of allowances. Allowances are located on the employee's W-4. Allowances are claimed by the employee, and determine how much is withheld from the employee's pay to cover their income taxes. More allowances mean that less money is withheld for taxes.

Advertisement -

3Calculate the federal withholding tax. First, calculate the total of the allowances. Then, subtract the allowances from the gross pay to determine the amount of money that is subject to withholding. Next, check the official IRS withholding tables for the current year to determine how much money you should withhold. Make sure to look at the table that relates to the employee's filing status, as well as their pay period.

- As an example, let's assume an employee is single and paid $1,000 weekly. If they have 3 allowances that each equal $80.80, then they'd have a total of $242.40 in allowances ($80.80 multiplied by 3 allowances = $242.40). Subtract this amount from their gross pay to get the taxable amount, which is $1,000 - $242.40 = $757.60. Finally, check the IRS table to find out how much to withhold, which is $79. You'd then withhold $79 from each check.[3]

-

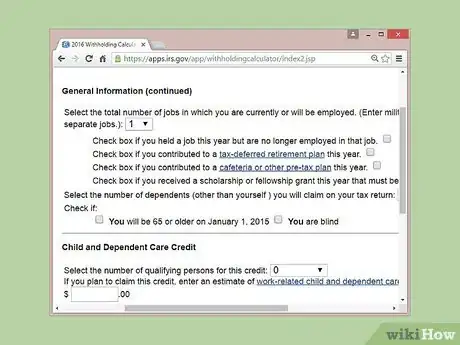

4Use the IRS withholding calculator for an easy option. Enter the requested information to compute the correct withholding amount. The calculator asks for the worker’s tax filing status, and the number of allowances the individual is claiming. The app also requires your gross wages and how often you are paid (weekly, bi-weekly, monthly, etc.)[4]

Adding Up Deductions and Withholding

-

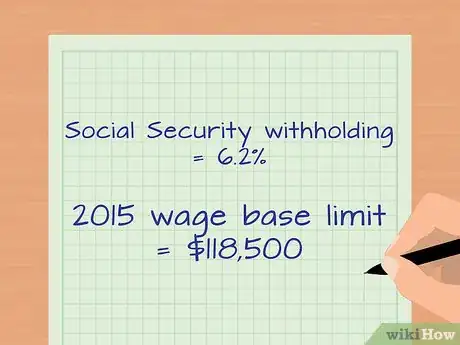

1Determine Social Security withholding. Social Security is a federal program that provides retirement income and disability income. The program is funded through tax withholdings.[5]

- In 2019, Social Security withholding is 6.2% of the employee's gross pay.

- The employee must pay this until they reach the wage base limit. Earnings above the wage base limit are generally not subject to social security tax.

- The wage base limit for 2019 is $132,900.

-

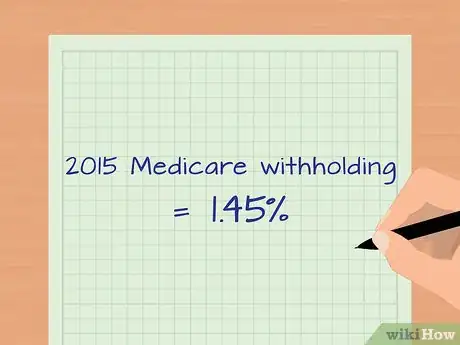

2Figure out the Medicare withholding. Medicare provides medical coverage to both the elderly and disabled. This program is also funded through payroll tax withholdings.[6]

- In 2019, Medicare withholding is 1.45% of the employee's gross pay.

- There is no wage base limit for the Medicare withholding. This means that each dollar of gross pay is assessed the Medicare withholdings tax.

- Single employees making over $200,000 a year have an additional 0.9% Medicare tax for every pay period after $200,000 in wages have been paid. The dollar threshold is $250,000 for married couples filing jointly. This includes all pay for a calendar year. However, only the employee pays this tax. The employer does not need to pay any additional tax.

-

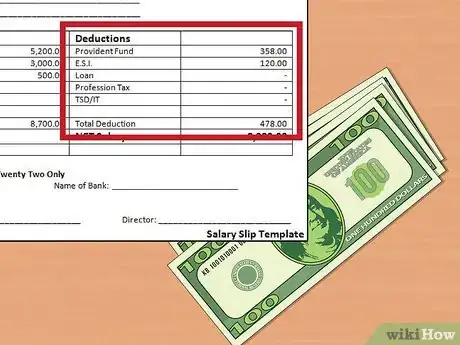

3Consider other deductions that reduce gross pay. Your employer may offer benefits that are funded through payroll deductions. Some of these deductions are made on a pre-tax basis. That means that the dollars deducted have not yet been taxed. The pre-tax deductions reduce the amount of pay that is subject to tax.

- Contributions to certain types of retirement plans can be made on a pre-tax basis. The most common plan is a 401(k) plan. A 401(k) plan is a retirement plan available in many for-profit companies. However, contributing to these plans usually reduces your federal income taxes, but it won't reduce the amount you owe for Social Security and Medicare.

- People who work for non-for-profits or government agencies may participate in a 403(b) plan.

- In both cases, the worker is contributing a larger amount into their retirement plan. Say, for example, that the worker wants to contribute $100. The contribution will be $100 before taxes, but less than that on an after-tax basis (maybe $80).

- Since the employee contributes more at the beginning, they will accumulate a larger retirement balance. The taxation on these plans occurs when dollars are taken out at retirement.

- A health flexible spending arrangement (FSA) is another benefit that may affect your gross pay. An FSA is a voluntary arrangement with your employer that allows you to be reimbursed for medical expenses. This account is funded by payroll deductions, though your employer may also contribute.[7] Any contributions from your employer do not have to be added to your gross income. The funds in this account do not roll over if not used within the year.

- A health savings account (HSA) is similar to an FSA, though the money in this account does roll over from year to year, allowing you to accumulate savings specifically set aside for health care. An HSA remains with you if you change employers or leave the workforce.[8]

Figuring Out State and Federal Unemployment Taxes

-

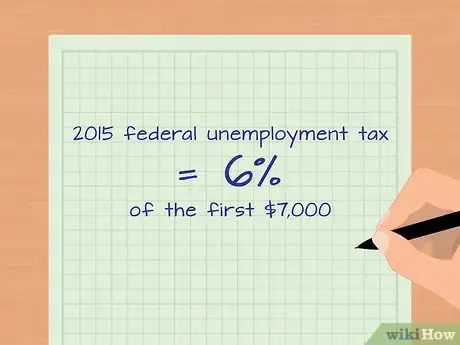

1Keep in mind that unemployment tax is paid for by employers. In most states, just the employer pays the unemployment tax. This system, however, combines a federal unemployment tax system with a state program.[9]

- Pay your state unemployment tax first. Your company can take a credit on your federal unemployment tax if you've already paid the state unemployment tax.

- The 2019 federal unemployment tax is 6% of the first $7,000 you pay in wages to an employee.

- If you've paid state unemployment taxes, you can take a credit of up to 5.4% on the federal calculation. If you take the full credit, the federal tax would decline to 0.6% of the first $7,000 in wages paid.

-

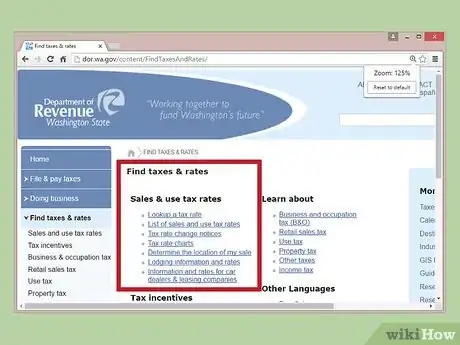

2Find the state guidelines for each of your employees. Each state has different tax rules, so you'll need to find the proper tax information for your employees. If you have employees in multiple states, each one is governed by a separate set of state tax laws.[10]

- You can find the tax information through the state's Department of Revenue or Taxation.

- Calculating state tax is very similar to calculating the federal tax. The tax rates, however, are different.

- Be aware that not all states count the same wages as federal when calculating state tax. Make sure that you check the state rules when you’re processing taxes.

-

3Report and pay your tax withholdings. Each type of payroll tax uses a different tax form. You also will pay each type of tax through a different system. Consider hiring a payroll company to help you stay on top of this process.[11]

- Accounting software is available to help you with these calculations. If you use software, make sure that the company sends you any necessary updates. As the tax law changes, the payroll tax software must be updated.

- Most of the taxing authorities allow you to pay taxes electronically. Many of the required tax forms can be completed online.

- A payroll company can take your employee data and make the necessary payroll calculations. They can also set up a system to pay each worker electronically. The payroll company will update their software for changes in the tax code.

Expert Q&A

-

QuestionHow do I withhold taxes on a payroll?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor The amount of taxes due for an individual employee are deducted from his or her gross pay. If the employee's pay is $100 and the tax on that amount is $25, you would write the employee a check for $75. The $25 difference is the amount withheld, and will be paid to the government by you, the employer, along with your portion of the tax.

The amount of taxes due for an individual employee are deducted from his or her gross pay. If the employee's pay is $100 and the tax on that amount is $25, you would write the employee a check for $75. The $25 difference is the amount withheld, and will be paid to the government by you, the employer, along with your portion of the tax. -

QuestionHow do I know what taxes to pay for my employees?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor Each employee's tax withholding would have to be calculated. Follow the guidance in this article to determine the correct amount.

Each employee's tax withholding would have to be calculated. Follow the guidance in this article to determine the correct amount. -

QuestionHow do I calculate the payroll taxes I will have to pay for my husband and my payroll checks for our own corporation before doing it in quickbooks?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor Determine your withholding allowance by calculating your pay and deducting the amount from the appropriate table in the IRS guide. Use the instructions in this article to help.

Determine your withholding allowance by calculating your pay and deducting the amount from the appropriate table in the IRS guide. Use the instructions in this article to help.

Warnings

- Make sure you collect and remit the payroll taxes to the correct government agency by the due date. Otherwise, you will likely owe heavy penalties and fees.⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/publications/p17/ch04.html

- ↑ https://www.irs.gov/pub/irs-pdf/p15.pdf

- ↑ https://apps.irs.gov/app/withholdingcalculator/

- ↑ http://www.ssa.gov/planners/taxwithold.html

- ↑ https://www.irs.gov/taxtopics/tc751.html

- ↑ https://www.irs.gov/publications/p969/ar02.html#en_US_2015_publink1000204174

- ↑ https://www.irs.gov/publications/p969/ar02.html#en_US_2015_publink1000204020

- ↑ https://www.irs.gov/Individuals/International-Taxpayers/Federal-Unemployment-Tax

About This Article

To calculate your payroll taxes, start by using the withholding calculator tool on the IRS website to calculate the federal tax withholdings from your gross pay. Next, figure out your Social Security and Medicare withholdings based on the federal guidelines listed on the IRS website. Then, add up the withholdings to find out the total amount held from your check. Additionally, account for any payroll funded benefit plans you participate in, like a 401(k) or a health savings account (HSA), to figure out your take-home pay from your gross pay. For more advice from our Accounting reviewer, including how to figure out your state and federal unemployment taxes, keep reading.

-Step-9.webp)

-Step-13.webp)