This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 155,868 times.

The Internal Revenue Service requires you to prepare a 1099-MISC form for a contract worker if you paid the person more than $600 during the fiscal year. That $600 figure includes all trade- or business-related payments, including money you gave to a contract worker for materials and parts—unless the materials and parts were broken down separately on the invoice from your contractor. You cannot give a 1099 form to a worker who is an actual employee of your company.

Steps

Completing the Form

-

1Obtain a 1099-MISC form from the IRS or another reputable source. You can ask the IRS to send you the necessary form by calling 1-800-TAX-FORM (1-800-829-3676) or navigating to their online ordering page.[1]

- You can also buy 1099-MISC forms at your local office supply store, although most only come in batches of 25 or 50. These are perfectly compatible with IRS scanners.

- Note: You cannot just download a 1099-MISC form from the internet or from the IRS sample page and use it to fill out information. The 1099 form that you send the IRS has to be readable in its scanners. If you send the IRS a non-sanctioned 1099 form, you could face a penalty.[2]

-

2Fill out your federal tax ID in the appropriate box. This is either your personal Social Security Number or your Employer Identification Number, depending on your business's structure. If you don't know your federal tax ID, read more about how to get it here.[3]Advertisement

-

3Fill out the worker's identification field out using their tax ID. This may be their Social Security Number, their Taxpayer Identification Number, or their Employer Identification Number. When you hired the contractor, you should have requested that they fill out a W-9 form.[4] Along with information about person’s address, the W-9 will tell you what identification number they use for tax purposes.

- If the contractor doesn’t give you their W-9 form or fails to provide an tax identification number, the IRS expects you to start withholding taxes on their behalf. You are expected to withhold 28% of the contractors pay and then remit it to the IRS.[5]

-

4Enter the amount you paid the contractor throughout the year. This information goes in Box 7. Box 7 should be titled "Non-employee compensation."

-

5Write down any amount you withheld from their pay. Indicate how much federal or state income tax you withheld from the contract worker's pay in Box 4. Given the fact that you worked with an independent contractor, it isn't likely that you withheld any taxes, although you may have for either of the following 2 reasons:

- The contractor failed to return a W-9 form or didn't provide an accurate Social Security Number or other ID number in the W-9. In this case, the IRS expects you to withhold 28% of their pay.

- The contractor is a foreign national. The IRS expects you to withhold about 30% of the non-US citizen's pay unless that contractor's home country is exempted because of a tax treaty with the US.

-

6Fill in the contact information fields for your company and the contractor. A phone number is only required for your business, not for the contractor. Provide the contractor’s name and full address.

Sending the Form

-

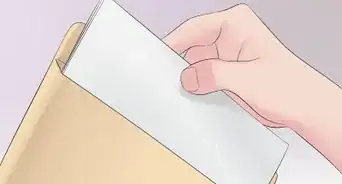

1Mail or give the 1099 to your contract worker by January 31. You’ll need to get the form to your contractor no later than January 31 following the tax year. If you do not mail our or give 1099s to your contract workers before this date, you could face a penalty from the IRS.[6]

- Send “Copy B” of the 1099 form to your contract worker.

-

2Send Copy A of the 1099 to the IRS no later than February 28.[7] Copy A is the red copy of the 1099 form. If you complete your taxes electronically, the deadline for filing is March 31st.[8] The 1099 filing process is separate from your business’s income tax filing, which may or may not need to be done electronically.

- If applicable, send Copy 1 of the 1099 to your contract worker’s state tax department. You do not have to do this if income tax is not deducted from the worker's pay in the state in which he or she resides.

-

3Keep Copy C of the 1099 for your own records. It is recommended that you retain copies of all of your tax documents for at least 4 years.[9]

Expert Q&A

-

QuestionI paid money to a non-employee for services and gave her a filled out 1099 Misc. Do I have to send anything to the IRS myself?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Yes. You need to send Copy A of the 1099-MISC to the IRS, to the address listed in the 1099-MISC instructions.

Yes. You need to send Copy A of the 1099-MISC to the IRS, to the address listed in the 1099-MISC instructions. -

QuestionThe recipient is the person you contracted, right?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Correct. The recipient is the individual or business that you paid to provide services.

Correct. The recipient is the individual or business that you paid to provide services.

Warnings

- Contact the IRS if you are not sure about the difference between an actual employee and a contract worker. The IRS takes an employer's obligations to their employees very seriously. It is illegal to classify a person who is actually an employee as a contractor.⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1099msc.pdf

- ↑ https://www.sba.gov/business-guide/launch-your-business/get-federal-state-tax-id-numbers

- ↑ https://www.irs.gov/pub/irs-pdf/fw9.pdf

- ↑ https://www.irs.gov/individuals/international-taxpayers/tax-withholding-types

- ↑ https://www.irs.gov/newsroom/irs-reminds-employers-other-businesses-of-jan-31-filing-deadline-for-wage-statements-independent-contractor-forms

- ↑ https://www.irs.gov/instructions/i1099gi

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/which-forms-must-i-file

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/how-long-should-i-keep-records

-Step-13.webp)

-Step-9.webp)