This article was co-authored by Brandy DeOrnellas, PCC, ESQ.. Brandy DeOrnellas is a Professional Certified Coach specializing in life and career aspirations and transitions. She also serves company founders and small business owners. She is a former attorney with more than three years of experience as a coach. Brandy holds a JD from Harvard Law School. She also holds a BA in Social Welfare and a BA in Political Science from The University of California, Berkeley. In addition to her formal education, she has multiple coaching certifications, including a Professional Coaching Certification from The University of California, Davis, and a Relationship Coach Certification from Prepare/Enrich. She is a Professional Certified Coach (PCC) with the International Coaching Federation.

This article has been viewed 523,878 times.

For many, finding their hourly pay rate is as simple as looking at a recent pay stub. However, if you’re a salaried employee or are self-employed, calculating your hourly wage[1] takes a few steps. You can calculate your hourly rate based on a single project, a certain period of time, or a salary. If using a salary, you can also figure in variables to get a more accurate rate.

Steps

Determining Your Hourly Rate if You're Self-Employed

-

1Keep track of how many hours you've worked. For this to be helpful, you'll need to decide what your pay period is. You can figure out your hourly rate based on an annual income, for a more accurate figure, or you find your hourly rate for a specific job or time period.

- For example, if you get paid by the job or project, you may just want to keep track of the hours for that project to determine your hourly rate for that job. Or you can determine your hourly rate for a shorter period of time, such as a month or a few weeks.

-

2Calculate your income. Keep track of your paychecks. Be sure to use the same pay period that you selected to figure up hours. Again, this could be for a single project or several paychecks.

- You can choose whether or not to include taxes in your calculations. Note that if you don't include taxes, your hourly rate will appear higher.

Advertisement -

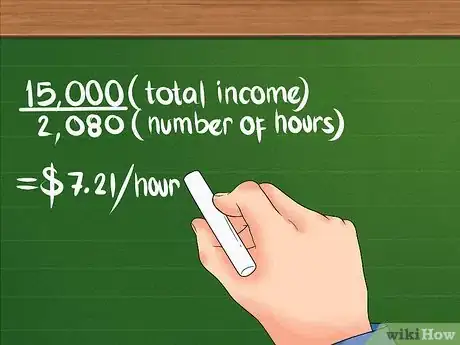

3Divide your income by your hours. This will give you your hourly rate, based on the project or time period you selected.

- Income / Hours = Hourly Rate

- Example: $15,000 / 2114 = $7.10 per hour

- You can check your results against this salary converter, which also allows you to correct for several different variables.

- If you want to determine what to charge for your hourly rate, start with market research.[2]

- See what other professionals in your area are charging for a similar service or skill. Charge at the median rate.[3]

- Also consider the demand for your services. If it increases, you can increase your rate according to it.[4]

Determining Your Hourly Rate if You're Salaried

-

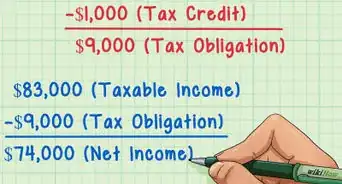

1Calculate your yearly income. Many people may already know their yearly salary, but in the event that you don’t, check your most recent pay stub. Use your gross (not net) pay—that is your amount before taxes—and multiply the number by the number of pay periods in a year.

- For those on a bi-weekly schedule, you would multiply the number by 26.

- For those whose companies offer two scheduled paydays per month, such as the 15th and 30th/31st, you will only multiply the number by 24.

-

2Calculate how many hours you work in one year. For a quick rule of thumb, you can use a standard formula such as:

- 7.5 hours per day x 5 days per week x 52 weeks per year = 1,950 hours worked per year.

- 8.0 hours per day x 5 days per week x 52 weeks per year = 2,080 hours worked per year.[5]

-

3Calculate your hourly wage. Once you have these two numbers, you can divide your totally yearly income by your total number of yearly hours to reach an approximate hourly wage.[6]

- For example, if your total income was $15,000 and your total number of hours was 2,080, then 15,000 / 2,080 = approximately $7.21 per hour.

Using Advanced Calculations to Figure Your Hourly Rate From a Salary

-

1Adjust your yearly income. If applicable, add any additional money stemming from your job to your yearly salary total. This can include tips, bonuses, work-based incentives, etc.[7]

- Any bonuses or extra work-based incentives you expect to receive should be added directly to your yearly total as well.

- If you happen to work a salaried position where you also receive tips, the process becomes a bit more complicated. Keep track of your tips for several weeks or even months, and divide the total by the number of weeks you have been tracking the data. This will give you an average tip total per week. Multiply this number by the number of weeks you will earn tips for the year, remembering to subtract weeks where you won’t earn tips such as when you are on vacation.

- The rule of thumb for calculating tips is that the more weeks you can use to tabulate your average, the more accurate it will be.

-

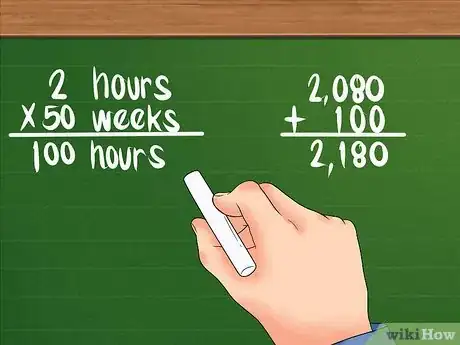

2Add hours to your calculation if you work overtime.[8] For overtime pay, multiply the number of overtime hours you worked by the rate you receive for additional work, and then add this total to your yearly salary.

- Your overtime hours can be either paid or unpaid depending on your position. Add the additional hours worked regardless.

- Example: Say you work an average of an extra two hours every week except when you are on leave, which is two weeks every year. Your extra hours are 2 hours x 50 weeks = 100 hours per year.

- In this example, your adjusted hours worked per year would be: 2080 + 100 = 2180

-

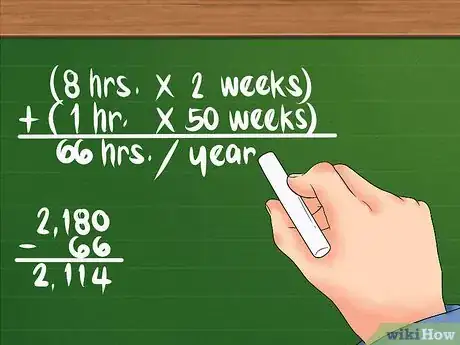

3Subtract hours from your calculation if you receive paid time off. Add together the number of hours you take off work each year and subtract this number from the total number of hours you worked in the year. Remember to include holidays, sick leave, special leave, and any time when you start late or finish early.

- Remember only to include paid time off that you will actually use. As an example, you may have accrued two weeks of sick time, but you also aren’t likely to use all of it.

- For example, say that you take two weeks of paid vacation every year, that you are never sick, and that you always leave one hour early on Friday afternoons. Your reduced hours would be (8 hours x 2 weeks) + (1 hour x 50 weeks) = 66 hours per year.

- Your adjusted hours worked per year for this example would be: 2180 - 66 = 2114

Community Q&A

-

QuestionHow can you calculate the monthly rate?

Community AnswerTake your annual salary and divide by twelve.

Community AnswerTake your annual salary and divide by twelve. -

QuestionI know my hours, and my monthly salary, but have yet to find a formula that tells me what I make hourly with (lots of) overtime hours. What can I do?

C GraceCommunity AnswerYou have not indicated whether you are paid extra for overtime or whether you get a flat monthly salary and are expected to complete your work regardless of the number of hours. If it's a flat monthly salary, then the hourly rate will vary depending on how many overtime hours you worked. Otherwise, it is two different hourly rates; for example, basic for standard hours, say 40 per week and time and a half for hours over 40.

C GraceCommunity AnswerYou have not indicated whether you are paid extra for overtime or whether you get a flat monthly salary and are expected to complete your work regardless of the number of hours. If it's a flat monthly salary, then the hourly rate will vary depending on how many overtime hours you worked. Otherwise, it is two different hourly rates; for example, basic for standard hours, say 40 per week and time and a half for hours over 40. -

QuestionHow do I convert my annual pay into hourly?

C GraceCommunity AnswerCalculate how many hours you work at your job every week. Divide your annual pay by 52. Now you have both hours and wages for 1 week. Divide wages by hours and that is your hourly rate. If you work longer hours at certain times of the month, then track your time for a month, and divide your annual pay by 12. Divide wages by hours.

C GraceCommunity AnswerCalculate how many hours you work at your job every week. Divide your annual pay by 52. Now you have both hours and wages for 1 week. Divide wages by hours and that is your hourly rate. If you work longer hours at certain times of the month, then track your time for a month, and divide your annual pay by 12. Divide wages by hours.

References

- ↑ https://www.accountingcoach.com/blog/wages-salaries

- ↑ Brandy DeOrnellas, PCC, ESQ.. Career & Life Transition Coach. Expert Interview. 15 December 2021.

- ↑ Brandy DeOrnellas, PCC, ESQ.. Career & Life Transition Coach. Expert Interview. 15 December 2021.

- ↑ Brandy DeOrnellas, PCC, ESQ.. Career & Life Transition Coach. Expert Interview. 15 December 2021.

- ↑ https://bizfluent.com/how-5896117-calculate-number-work-hours-year.html

- ↑ https://www.opm.gov/policy-data-oversight/pay-leave/pay-administration/fact-sheets/computing-hourly-rates-of-pay-using-the-2087-hour-divisor/

- ↑ https://turbo.intuit.com/blog/real-money-talk/what-is-annual-income-765/

- ↑ https://www.accountingtools.com/articles/2017/5/16/overtime-pay-calculation

About This Article

If you’re self-employed and need to calculate your hourly rate, you’ll need to decide the length of your pay period. For example, take a stretch of time where you were working, like a month or a week, and consider that your pay period. As you work during that length of time, hold on to all of the paychecks you earn. To get your hourly rate, divide the income you made in that period by how many hours you worked in that time. If you’re salaried, figure out roughly how many hours you work in a year, then divide your yearly salary by that number. For more help, like how to account for overtime and paid time off, read on.