wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 60 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 21 testimonials and 85% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 2,116,743 times.

Learn more...

ATMs, or Automated Teller Machines, provide a simple, convenient way to access your bank account from just about anywhere. Though ATMs may seem confusing at first, they’re actually incredibly straightforward and easy to operate.

Things You Should Know

- Always use an ATM that's in a well-lit area. Stand really close to the machine so no one can see which buttons you press.

- Aim to use an ATM managed by the bank that issued your debit card.

- Use an ATM to take out cash, deposit money, check your account balance, transfer funds, or submit payments.

- Follow the ATM's instructions to completely end your session. Don't forget to grab your card and any withdrawn cash before you leave.

Steps

Starting the Process

-

1Practice basic safety procedures. People using ATMs will occasionally be targets of robberies and other crimes, so you'll want to be sure to be safe. First, make sure that the area is well lit and you are alone. Be on your guard if other people show up. Stand so that your screen and key presses are masked.

- You'll also want to look at the machine itself. Devices called card skimmers are becoming more common and, while there is no universal signal that an ATM is compromised, if something seems off about how the card slot looks then you'll just want to find another machine to use.

- Only use ATMs during the day in well trafficked areas, if possible.

-

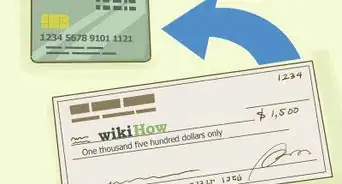

2Insert your debit card into the ATM. Mobile banking cards come in two varieties — debit cards and credit cards. Debit cards are most frequently used in ATMs; they're linked to the exact amount you have in your bank account. Credit cards can be used in some cases, but fees and interest rates usually make them expensive to use. Insert your card into the card slot, ensuring that the chip side is facing inward.[1]

- Particular machines may have a special fee (usually when in a tourist area) which should be labeled on the machine.

- If you travel out of the country, there may be additional fees associated with the distance or currency change.

Advertisement -

3Try to use ATMs and debit cards that are issued by the same bank. For example, if you own a Chase debit card, look for a Chase ATM or local branch. Although you can use almost any debit card on almost any ATM, you will likely be charged an additional fee for withdrawing money if the ATM is for a bank other than one you have an account with. Additionally, some of the services offered by the ATM may not be available if your card and ATM don't match.[2]

- In addition, when the branch is closed, you will still be able to access the ATM by swiping your bank's card on the card reader, giving you added security.

-

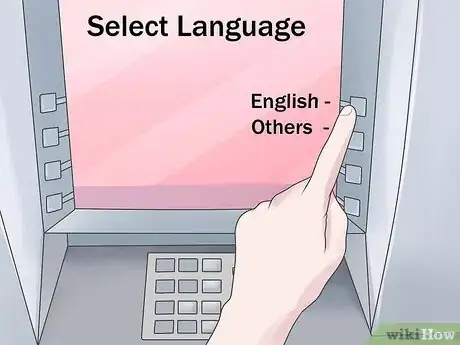

4Select your language. Most ATMs will offer transactions in several different languages, usually at least three or more dependent on where you live. Where in the process you change the language can depend on the machine, but it is usually directly after inserting your card.

-

5Enter your PIN when prompted. "PIN" stands for "personal identification number," and it's typically a four- to six-digit password people use to access their bank account. Enter your PIN number when asked to by the machine, making sure to shield the pad with your hand so that nearby onlookers can't see it. You should also watch out for cameras that are placed on the ATM itself, as these can be placed by criminals in order to steal your card information.[3]

- While PINs are typically four or six digits long, note that this length may vary depending on the financial institution associated with your ATM card.

Completing Transactions

-

1Withdraw money. You can withdraw money for almost any ATM, regardless of the associated bank (though this may incur fees). You will usually have two withdrawal options:[4]

- Fast cash - which allows you to quickly withdraw a set amount as labeled on the machine. This is usually either $40, $50, or $60.

- Targeted withdrawal - which allows you to specify how much you want to withdraw by typing in the amount.

- Be careful of your limits. Most ATMs and banks limit how much you can withdraw from an ATM in a given day. The limit varies widely based on your bank and your account type, but limits between $300-$1000 are common.

-

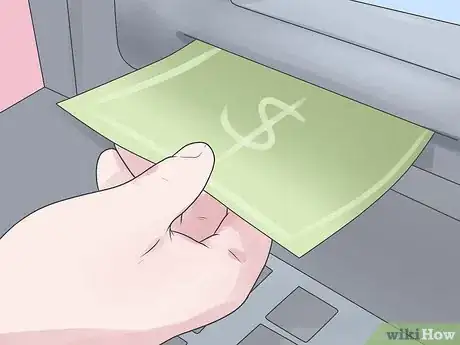

2Deposit money. You can deposit money as well, as long as you are using an ATM associated with your bank. You should be presented with the choice of what account you want the money deposited in to. The funds may not be immediately available, or only some of them may be immediately available. There are two ways that you can deposit money:[5]

- Deposit cash. This is usually fed into the machine, though sometimes a deposit envelope may be required. If you are using a modern ATM, you should be able to insert a stack of bills, often between 30-50 bills at a time, and the machine will count them up automatically.

- Deposit checks. Older machines may require that you use a deposit slip in order to deposit a check, but for most modern machines you can simply feed the check into the ATM. The ATM will provide you with specific instructions, and a deposit envelope if you don't have one.

- If you do need to fill out a deposit envelope, it's better to get the envelope from the machine and then exit out of the transaction, filling out the details and inserting the check into the envelope in your car or other safe location. Simply return to the machine, reinsert your card, and start the process over again once the envelope is prepared.

-

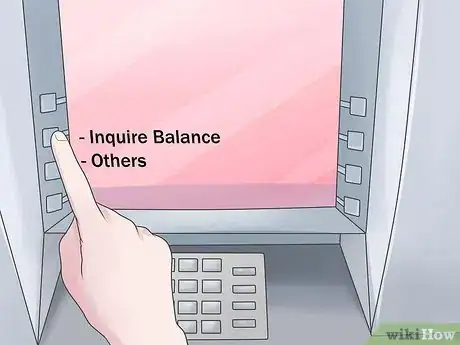

3Check your account balance. You should have the option to check your account balance, or how much money you have available in your account, so long as you are using an ATM associated with your bank. This balance is often printed out on a receipt or sheet of paper, although it may be displayed on the screen as well.

-

4Transfer money or make payments. Many bank's ATMs will allow you to transfer money between multiple accounts you hold with the same bank, or even transfer money to other people's accounts. Occasionally you may also have the option to make payments, such as paying pre-set up bills or fees on your bank account itself.

Ending Your Session

-

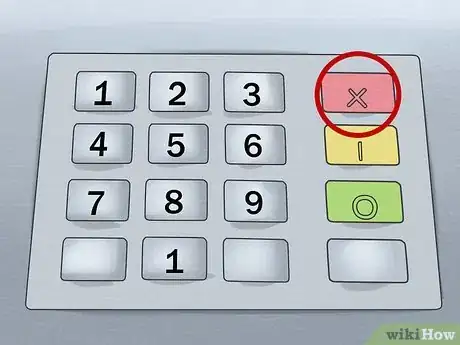

1Follow the prompts to end your session. Once you've completed your transaction, you'll have to follow the on-screen prompts in order to exit out and get your card back. Often times, a short cut can be to simply press the red X on the keypad, which is similar to the "back" option on a computer.

-

2Don't forget to take your card and money! It's easy to forget to take your money or card when you're in a hurry, but be careful and be extra sure to take all of your belongings when you're done. This includes a cell phone you might have set down on the machine!

-

3Switch to mobile banking. Be aware that for everything but withdrawing money, you can now use mobile banking if you bank with one of the major banks. Mobile banking, which uses your smart phone, allows you to deposit checks, check your balance, transfer money, and includes many of the other services of the ATM.[6]

Community Q&A

-

QuestionHow do I use a debit card in an ATM for the first time?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerFirst, you’ll need to select a PIN. You may need to call or visit your bank to do this, or there may be instructions on the paperwork that came with your card. Typically, you can activate your new card by using it in an ATM and entering the PIN. If that doesn’t work, you may need to call the number on the card and activate it over the phone before you can use it in an ATM.

wikiHow Staff EditorStaff AnswerFirst, you’ll need to select a PIN. You may need to call or visit your bank to do this, or there may be instructions on the paperwork that came with your card. Typically, you can activate your new card by using it in an ATM and entering the PIN. If that doesn’t work, you may need to call the number on the card and activate it over the phone before you can use it in an ATM. -

QuestionWhich side of the card do I insert into the machine?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerThat depends on the machine. Most ATMs will have an image on the screen or next to the card reader showing which way to insert the card, especially if the card slot is vertical. For horizontally oriented card readers, the card is typically inserted face up, with the magnetic strip facing down and to the left.

wikiHow Staff EditorStaff AnswerThat depends on the machine. Most ATMs will have an image on the screen or next to the card reader showing which way to insert the card, especially if the card slot is vertical. For horizontally oriented card readers, the card is typically inserted face up, with the magnetic strip facing down and to the left. -

QuestionHow do you use a credit card at an ATM?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerFirst, you’ll need to check with your card provider to make sure your account is set up to allow cash withdrawals. They can help you set up a PIN for your credit card, if you didn’t already do so when you activated it. Once you have your PIN, you can use the credit card the same way you would use a debit card. However, be aware that you’ll probably need to pay a hefty cash advance fee.

wikiHow Staff EditorStaff AnswerFirst, you’ll need to check with your card provider to make sure your account is set up to allow cash withdrawals. They can help you set up a PIN for your credit card, if you didn’t already do so when you activated it. Once you have your PIN, you can use the credit card the same way you would use a debit card. However, be aware that you’ll probably need to pay a hefty cash advance fee.

Warnings

- Be sure to end your session. If you forget to then it is possible for the next person to withdraw money from your account without you knowing.⧼thumbs_response⧽

- Don't give your PIN number to a friend or relative, even if you do it as a gesture of trust and friendship.⧼thumbs_response⧽

- Never let anyone see your PIN. Put your other hand around the keypad when you enter your number, and don't enter your number if anyone is standing too close.⧼thumbs_response⧽

- Know what charges will be involved with ATM usage. If you are using a bank not connected with your account or using your ATM to get money while traveling abroad, you may have to pay an additional fee.⧼thumbs_response⧽

- Never write your PIN on your card or in your wallet or purse.⧼thumbs_response⧽

- Always remember to take your card back from the machine. Do this as soon as it pops out. If it remains in the slot for more than 30 seconds after the transaction has been completed, the machine will suck it back up to prevent it from being stolen. If the ATM you are using isn't at your bank, it's unlikely that they will return the card to you - you will have to get your bank to issue a new one.⧼thumbs_response⧽

- If your card gets sucked in as soon as you insert it, examine the slot very closely: some burglars insert a plastic sleeve that prevents the card from being read, and when you go inside the bank, they will quickly pull it and withdraw as much money as they can.[7]⧼thumbs_response⧽

- Some ATMs have a slot where you insert and pull the card rather than just inserting it. If this is the case, examine it very closely to make sure it's all part of the ATM; otherwise, it might be a card cloning device![8]⧼thumbs_response⧽

- When entering your PIN, be aware of any people that may be standing around you attempting to look over your shoulder.[9]⧼thumbs_response⧽

Things You'll Need

- A helper or bank employee if you've never used an ATM before

- ATM

- ATM card

- PIN

References

- ↑ https://bettermoneyhabits.bankofamerica.com/en/credit/what-is-a-credit-card-cash-advance

- ↑ https://handsonbanking.org/youngadults/getting-started/learn/how-to-use-an-atm/

- ↑ https://midpennbank.com/make-sure-dont-get-scammed-atm/

- ↑ https://www.bankofamerica.com/deposits/atm-fees-faqs/

- ↑ https://www.nerdwallet.com/blog/banking/deposit-cash-atm/

- ↑ https://handsonbanking.org/articles/mobile-banking/

- ↑ https://midpennbank.com/make-sure-dont-get-scammed-atm/

- ↑ https://midpennbank.com/make-sure-dont-get-scammed-atm/

- ↑ https://midpennbank.com/make-sure-dont-get-scammed-atm/

About This Article

To use an ATM, first insert your debit card into the machine. Select your language if necessary, then enter your account’s secure 4-digit PIN number. For security, cover the number pad while typing to make sure nobody sees your PIN. Once the menu screen pops up, select whether you want to withdraw money, deposit money, transfer money, make a payment, or check your account balance. Then, follow the on-screen prompts to complete your transaction. To learn how to switch to mobile banking, read on!