Nikkei 225

The Nikkei 225, or the Nikkei Stock Average (日経平均株価, Nikkei heikin kabuka), more commonly called the Nikkei or the Nikkei index[1][2] (/ˈnɪkeɪ, ˈniː-, nɪˈkeɪ/), is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index, operating in the Japanese Yen (JP¥), and its components are reviewed twice a year. The Nikkei 225 measures the performance of 225 highly capitalised and liquid publicly owned companies in Japan from a wide array of industry sectors. Since 2017, the index is calculated every five seconds.[3] It was originally launched by the Tokyo Stock Exchange in 1950, and was taken over by the Nihon Keizai Shimbun (The Nikkei) newspaper in 1970, when the Tokyo Exchange switched to the Tokyo Stock Price Index (TOPIX), which is weighed by market capitalisation rather than stock prices.[4]

.svg.png.webp) | |

| Foundation | 7 September 1950 |

|---|---|

| Operator | Nihon Keizai Shimbun (The Nikkei) (Nikkei, Inc.) |

| Exchanges | Tokyo Stock Exchange (TSE) |

| Constituents | 225 |

| Weighting method | Price-weighted index |

| Related indices | Tokyo Stock Price Index (TOPIX) |

| Website | indexes.Nikkei.co.jp |

History

The Nikkei 225 began to be calculated on 7 September 1950, retroactively calculated back to 16 May 1949, when the average price of its component stocks was 176.21 yen.[5][6] Since July 2017, the index is updated every 5 seconds during trading sessions.[5]

The Nikkei 225 Futures, introduced at Singapore Exchange (SGX) in 1986, the Osaka Securities Exchange (OSE) in 1988, Chicago Mercantile Exchange (CME) in 1990, is now an internationally recognized futures index.[7]

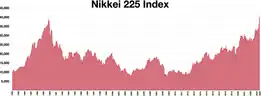

The Nikkei average has deviated sharply from the textbook model of stock averages, which grow at a steady exponential rate. During the Japanese asset price bubble, the average hit its bubble-era record high on 29 December 1989, when it reached an intraday high of 38,957.44, before closing at 38,915.87, having grown sixfold during the decade. Subsequently, it lost nearly all these gains, reaching a post-bubble intraday low of 6,994.90 on 28 October 2008 — 82% below its peak nearly 19 years earlier.[8] The 1989 record high held for 34 years, until it was surpassed in 2024 (see below).

On 15 March 2011, the second working day after the massive earthquake in the northeast part of Japan, the index dropped over 10% to finish at 8,605.15, a loss of 1,015 points. The index continued to drop throughout 2011, bottoming out at 8,160.01 on 25 November, putting it at its lowest close since 31 March 2009. The Nikkei fell over 17% in 2011, finishing the year at 8,455.35, its lowest year-end closing value in nearly thirty years, when the index finished at 8,016.70 in 1982.[9]

The Nikkei started 2013 near 10,600, hitting a peak of 15,942 in May. However, shortly afterward, it plunged by almost 10% before rebounding, making it the most volatile stock market index among the developed markets. By 2015, it had reached over 20,000 mark, marking a gain of over 10,000 in two years, making it one of the fastest growing stock market indices in the world. However, by 2018, the index growth was more moderate at around the 22,000 mark.

There was concern that the rise since 2013 was artificial and due to purchases by the Bank of Japan ("BOJ").[10][11] From a start in 2013, by end 2017, the BOJ owned circa 75%[12] of all Japanese Exchange Traded Funds ("ETFs"), and were a top 10 shareholder of 90% of the Nikkei 225 constituents.[13][14]

On 15 February 2021, the Nikkei average breached the 30,000 benchmark, its highest level in 30 years, due to the levels of monetary stimulus and asset purchase programs executed by the Bank of Japan to mitigate the financial effects of the COVID-19 pandemic.[15]

On 22 February 2024, the Nikkei reached an intraday high of 39,156.97 and closed at 39,098.68, finally surpassing its 1989 record high, an important milestone since the Japanese asset price bubble.[16] On 4 March 2024, the index surpassed 40,000 (intraday and closing) for the first time in history.[17]

Weighting

The index is a price-weighted index. As of early 2022, the company with the largest influence on the index is Fast Retailing (TYO: 9983).

Contract Specifications

The Nikkei 225 is traded as a future on the Osaka exchange (OSE). The contract specifications for the Nikkei 225 (OSE ticker symbol JNK) are listed below:

| Nikkei 225 (JNK) | |

|---|---|

| Contract Size: | Nikkei 225 Index X Y1,000 |

| Exchange: | OSE |

| Sector: | Index |

| Tick Size: | 10 |

| Tick Value: | 10000 JPY |

| Big Point Value (BPV): | 1000 |

| Denomination: | JPY |

| Decimal Place: | 0 |

Annual returns

The following table shows the annual development of the Nikkei 225, which was calculated back to 1914.[19][20][21]

| Year | Closing level | Change in Index in Points |

Change in Index in % |

|---|---|---|---|

| 1914 | 21.12 | ||

| 1915 | 32.10 | 10.98 | 51.99 |

| 1916 | 41.61 | 9.51 | 29.63 |

| 1917 | 41.40 | −0.21 | −0.50 |

| 1918 | 42.21 | 0.81 | 1.96 |

| 1919 | 53.63 | 11.42 | 27.06 |

| 1920 | 27.44 | −26.19 | −48.83 |

| 1921 | 28.88 | 1.44 | 5.25 |

| 1922 | 23.97 | −4.91 | −17.00 |

| 1923 | 22.83 | −1.14 | −4.76 |

| 1924 | 24.45 | 1.62 | 7.10 |

| 1925 | 27.96 | 3.51 | 14.36 |

| 1926 | 27.25 | −0.71 | −2.54 |

| 1927 | 25.82 | −1.43 | −5.25 |

| 1928 | 25.65 | −0.17 | −0.66 |

| 1929 | 21.32 | −4.33 | −16.88 |

| 1930 | 16.82 | −4.50 | −21.11 |

| 1931 | 16.28 | −0.54 | −3.21 |

| 1932 | 30.33 | 14.05 | 86.30 |

| 1933 | 34.12 | 3.79 | 12.50 |

| 1934 | 32.30 | −1.82 | −5.33 |

| 1935 | 33.76 | 1.46 | 4.52 |

| 1936 | 35.94 | 2.18 | 6.46 |

| 1937 | 37.33 | 1.39 | 3.87 |

| 1938 | 33.66 | −3.67 | −9.83 |

| 1939 | 44.96 | 11.30 | 33.57 |

| 1940 | 37.42 | −7.54 | −16.77 |

| 1941 | 42.44 | 5.02 | 13.42 |

| 1942 | 42.71 | 0.27 | 0.64 |

| 1943 | 42.11 | −0.60 | −1.40 |

| 1944 | 41.82 | −0.29 | −0.69 |

| 1945 | 40.53 | −1.29 | −3.08 |

| 1946 | 28.72 | −11.81 | −29.14 |

| 1947 | 39.31 | 10.59 | 36.87 |

| 1948 | 72.84 | 33.53 | 85.30 |

| 1949 | 109.91 | 37.07 | 50.89 |

| 1950 | 101.91 | −8.00 | −7.28 |

| 1951 | 166.06 | 64.15 | 62.95 |

| 1952 | 362.64 | 196.58 | 118.38 |

| 1953 | 377.95 | 15.31 | 4.22 |

| 1954 | 356.09 | −21.86 | −5.78 |

| 1955 | 425.69 | 69.60 | 19.55 |

| 1956 | 549.14 | 123.45 | 29.00 |

| 1957 | 474.55 | −74.59 | −13.58 |

| 1958 | 666.54 | 191.99 | 40.46 |

| 1959 | 874.88 | 208.34 | 31.26 |

| 1960 | 1,356.71 | 481.83 | 55.07 |

| 1961 | 1,432.60 | 75.89 | 5.59 |

| 1962 | 1,420.43 | −12.17 | −0.85 |

| 1963 | 1,225.10 | −195.33 | −13.75 |

| 1964 | 1,216.55 | −8.55 | −0.70 |

| 1965 | 1,417.83 | 201.28 | 16.55 |

| 1966 | 1,452.10 | 34.27 | 2.42 |

| 1967 | 1,283.47 | −168.63 | −11.61 |

| 1968 | 1,714.89 | 431.42 | 33.61 |

| 1969 | 2,358.96 | 644.07 | 37.56 |

| 1970 | 1,987.14 | −371.82 | −15.76 |

| 1971 | 2,713.74 | 726.60 | 36.57 |

| 1972 | 5,207.94 | 2,494.20 | 91.91 |

| 1973 | 4,306.80 | −901.14 | −17.30 |

| 1974 | 3,817.22 | −489.58 | −11.37 |

| 1975 | 4,358.60 | 541.38 | 14.18 |

| 1976 | 4,990.85 | 632.25 | 14.51 |

| 1977 | 4,865.60 | −125.25 | −2.51 |

| 1978 | 6,001.85 | 1,136.25 | 23.35 |

| 1979 | 6,569.47 | 567.62 | 9.46 |

| 1980 | 7,116.38 | 546.91 | 8.33 |

| 1981 | 7,681.84 | 565.46 | 7.95 |

| 1982 | 8,016.67 | 334.83 | 4.36 |

| 1983 | 9,893.82 | 1,877.15 | 23.42 |

| 1984 | 11,542.60 | 1,648.78 | 16.66 |

| 1985 | 13,113.32 | 1,570.72 | 13.61 |

| 1986 | 18,701.30 | 5,587.98 | 42.61 |

| 1987 | 21,564.00 | 2,862.70 | 15.31 |

| 1988 | 30,159.00 | 8,595.00 | 39.86 |

| 1989 | 38,915.87 | 8,756.87 | 29.04 |

| 1990 | 23,848.71 | −15,067.16 | −38.72 |

| 1991 | 22,983.77 | −864.94 | −3.63 |

| 1992 | 16,924.95 | −6,058.82 | −26.36 |

| 1993 | 17,417.24 | 492.29 | 2.91 |

| 1994 | 19,723.06 | 2,305.82 | 13.24 |

| 1995 | 19,868.15 | 145.09 | 0.74 |

| 1996 | 19,361.35 | −506.80 | −2.55 |

| 1997 | 15,258.74 | −4,102.61 | −21.19 |

| 1998 | 13,842.17 | −1.416,57 | −9.28 |

| 1999 | 18,934.34 | 5,092.17 | 36.79 |

| 2000 | 13,785.69 | −5,148.65 | −27.19 |

| 2001 | 10,542.62 | −3,243.07 | −23.52 |

| 2002 | 8,578.95 | −1,963.67 | −18.63 |

| 2003 | 10,676.64 | 2,097.69 | 24.45 |

| 2004 | 11,488.76 | 812.12 | 7.61 |

| 2005 | 16,111.43 | 4,622.67 | 40.24 |

| 2006 | 17,225.83 | 1,114.40 | 6.92 |

| 2007 | 15,307.78 | −1,918.05 | −11.13 |

| 2008 | 8,859.56 | −6,448.22 | −42.12 |

| 2009 | 10,546.44 | 1,686.88 | 19.04 |

| 2010 | 10,228.92 | −317.52 | −3.01 |

| 2011 | 8,455.35 | −1,773.57 | −17.24 |

| 2012 | 10,395.18 | 1,939.83 | 22.94 |

| 2013 | 16,291.31 | 5,896.13 | 56.72 |

| 2014 | 17,450.77 | 1,159.46 | 7.12 |

| 2015 | 19,033.71 | 1,582.94 | 9.07 |

| 2016 | 19,114.40 | 80.69 | 0.42 |

| 2017 | 22,764.94 | 3,650.54 | 19.10 |

| 2018 | 20,014.77 | −2,750.17 | −12.08 |

| 2019 | 23,656.62 | 3,641.85 | 18.20 |

| 2020 | 27,444.17 | 3,787.55 | 16.01 |

| 2021 | 28,791.71 | 1,347.54 | 4.68 |

| 2022 | 26,094.50 | −2,697.21 | −9.37 |

| 2023 | 33,464.17 | 7,369.67 | 28.24 |

Components

As of October 2023, the Nikkei 225 consists of the following companies: (Japanese securities identification code in parentheses)[22]

Air transport

- ANA Holdings Inc. (TYO: 9202)

- Japan Airlines Co., Ltd. (TYO: 9201)

Automotive

- Hino Motors, Ltd. (TYO: 7205)

- Honda Motor Co., Ltd. (TYO: 7267)

- Isuzu Motors Ltd. (TYO: 7202)

- Mazda Motor Corp. (TYO: 7261)

- Mitsubishi Motors Corp. (TYO: 7211)

- Nissan Motor Co., Ltd. (TYO: 7201)

- Subaru Corp. (TYO: 7270)

- Suzuki Motor Corp. (TYO: 7269)

- Toyota Motor Corp. (TYO: 7203)

- Yamaha Motor Company, Ltd. (TYO: 7272)

Banking

- Aozora Bank, Ltd. (TYO: 8304)

- The Chiba Bank, Ltd. (TYO: 8331)

- Concordia Financial Group, Inc. (TYO: 7186)

- Fukuoka Financial Group, Inc. (TYO: 8354)

- Mitsubishi UFJ Financial Group, Inc. (TYO: 8306)

- Mizuho Financial Group, Inc. (TYO: 8411)

- Resona Holdings, Inc. (TYO: 8308)

- Shizuoka Financial Group (TYO: 5831)(Holding company for Shizuoka Bank)

- Sumitomo Mitsui Financial Group, Inc. (TYO: 8316)

- Sumitomo Mitsui Trust Holdings, Inc. (TYO: 8309)

Chemicals

- Asahi Kasei Corp. (TYO: 3407)

- Denki Kagaku Kogyo K.K. (TYO: 4061)

- DIC Corporation (TYO: 4631)

- Fujifilm Holdings Corp. (TYO: 4901)

- Kao Corp. (TYO: 4452)

- Kuraray Co., Ltd. (TYO: 3405)

- Mitsubishi Chemical Holdings Corp. (TYO: 4188)

- Mitsui Chemicals, Inc. (TYO: 4183)

- Nissan Chemical Industries, Ltd. (TYO: 4021)

- Nitto Denko (TYO: 6988)

- Showa Denko (TYO: 4004)

- Shin-Etsu Chemical Co., Ltd. (TYO: 4063)

- Shiseido Co., Ltd. (TYO: 4911)

- Sumitomo Chemical Co., Ltd. (TYO: 4005)

- Tokuyama Corporation (TYO: 4043)

- Tosoh Corp. (TYO: 4042)

- Ube Industries, Ltd. (TYO: 4208)

Communications

Construction

Electric machinery

- Advantest Corp. (TYO: 6857)

- Alps Electric Co., Ltd. (TYO: 6770)

- Canon Inc. (TYO: 7751)

- Casio Computer Co., Ltd. (TYO: 6952)

- Denso Corp. (TYO: 6902)

- FANUC Corp. (TYO: 6954)

- Fuji Electric Co., Ltd. (TYO: 6504)

- Fujitsu Ltd. (TYO: 6702)

- GS Yuasa Corp. (TYO: 6674)

- Hitachi, Ltd. (TYO: 6501)

- Keyence Corp. (TYO: 6861)

- Kyocera Corp. (TYO: 6971)

- Lasertec (TYO: 6920)

- MinebeaMitsumi, Inc. (TYO: 6479)

- Mitsubishi Electric Corp. (TYO: 6503)

- Murata Manufacturing Co., Ltd. (TYO: 6981)

- NEC Corp. (TYO: 6701)

- Nidec (TYO: 6594)

- Oki Electric Industry Co., Ltd. (TYO: 6703)

- Omron Corp. (TYO: 6645)

- Panasonic Corp. (TYO: 6752)

- Renesas Electronics(TYO: 6723)

- Ricoh Co., Ltd. (TYO: 7752)

- SCREEN Holdings (TYO: 7735)

- Seiko Epson Corp. (TYO: 6724)

- Sharp Corporation (TYO: 6753)

- Sony Corp. (TYO: 6758)

- Taiyo Yuden Co., Ltd. (TYO: 6976)

- TDK Corp. (TYO: 6762)

- Tokyo Electron Ltd. (TYO: 8035)

- Yaskawa Electric Corporation, Limited (TYO: 6506)

- Yokogawa Electric Corp. (TYO: 6841)

Electric power

- Chubu Electric Power Co., Inc. (TYO: 9502)

- The Kansai Electric Power Co., Inc. (TYO: 9503)

- Tokyo Electric Power Company Holdings, Incorporated (TYO: 9501)

Foods

- Ajinomoto Co., Inc. (TYO: 2802)

- Asahi Group Holdings, Ltd. (TYO: 2502)

- Japan Tobacco Inc. (TYO: 2914)

- Kikkoman Corp. (TYO: 2801)

- Kirin Holdings Company, Limited (TYO: 2503)

- Meiji Holdings Company, Limited (TYO: 2269)

- Nichirei Corp. (TYO: 2871)

- NH Foods, Ltd. (TYO: 2282)

- Nisshin Seifun Group Inc. (TYO: 2002)

- Sapporo Holdings Ltd. (TYO: 2501)

- Takara Holdings Inc. (TYO: 2531)

Glass & ceramics

Insurance

- Dai-ichi Life Insurance Company, Limited (TYO: 8750)

- MS&AD Insurance Group, Inc. (TYO: 8725)

- Sompo Holdings, Inc. (TYO: 8630)

- T&D Holdings, Inc. (TYO: 8795)

- Tokio Marine Holdings, Inc. (TYO: 8766)

Land transport

- Nippon Express Holdings Inc. (TYO: 9147)(Holding company for Nippon Express)

- Yamato Holdings Co., Ltd. (TYO: 9064)

Machinery

- Amada Co. Ltd. (TYO: 6113)

- Daikin Industries, Ltd. (TYO: 6367)

- Ebara Corp. (TYO: 6361)

- Hitachi Construction Machinery Co., Ltd. (TYO: 6305)

- Hitachi Zōsen Corporation (TYO: 7004)

- IHI Corp. (TYO: 7013)

- The Japan Steel Works, Ltd. (TYO: 5631)

- JTEKT Corp. (TYO: 6473)

- Komatsu Ltd. (TYO: 6301)

- Kubota Corp. (TYO: 6326)

- Mitsubishi Heavy Industries, Ltd. (TYO: 7011)

- NSK Ltd. (TYO: 6471)

- NTN Corp. (TYO: 6472)

- Okuma Holdings, Inc. (TYO: 6103)

- Sumitomo Heavy Industries, Ltd. (TYO: 6302)

- SMC Corporation (TYO: 6273)

Marine transport

- Kawasaki Kisen Kaisha, Ltd. (TYO: 9107)

- Mitsui O.S.K. Lines, Ltd. (TYO: 9104)

- Nippon Yusen K.K. (TYO: 9101)

Nonferrous metals

- Dowa Holdings Co., Ltd. (TYO: 5714)

- Fujikura Ltd. (TYO: 5803)

- The Furukawa Electric Co., Ltd. (TYO: 5801)

- Mitsubishi Materials Corp. (TYO: 5711)

- Mitsui Mining & Smelting Co., Ltd. (TYO: 5706)

- SUMCO Corp. (TYO: 3436)

- Sumitomo Electric Industries, Ltd. (TYO: 5802)

- Sumitomo Metal Mining Co., Ltd. (TYO: 5713)

Other financial services

Other manufacturing

- Bandai Namco Holdings, Inc. (TYO: 7832)

- Dai Nippon Printing Co., Ltd. (TYO: 7912)

- Toppan Printing Co., Ltd. (TYO: 7911)

- Yamaha Corporation (TYO: 7951)

Petroleum

- Eneos Holdings (TYO: 5020)

- Idemitsu Kosan Co., Ltd (TYO: 5019)

Pharmaceuticals

- Astellas Pharma Inc. (TYO: 4503)

- Chugai Pharmaceutical Co., Ltd. (TYO: 4519)

- Daiichi Sankyo Company, Limited (TYO: 4568)

- Eisai Co., Ltd. (TYO: 4523)

- Kyowa Hakko Kirin Co., Ltd. (TYO: 4151)

- Otsuka Holdings Co., Ltd. (TYO: 4578)

- Sumitomo Dainippon Pharma Co., Ltd. (TYO: 4506)

- Shionogi & Co., Ltd. (TYO: 4507)

- Takeda Pharmaceutical Company Limited (TYO: 4502)

Precision instruments

Pulp & paper

- Nippon Paper Industries Co., Ltd. (TYO: 3863)

- Oji Holdings Corporation (TYO: 3861)

Railway/bus

- Central Japan Railway Company (TYO: 9022)

- East Japan Railway Company (TYO: 9020)

- Keio Corp. (TYO: 9008)

- Keisei Electric Railway Co., Ltd. (TYO: 9009)

- Odakyu Electric Railway Co., Ltd. (TYO: 9007)

- Tobu Railway Co., Ltd. (TYO: 9001)

- Tokyu Corp. (TYO: 9005)

- West Japan Railway Company (TYO: 9021)

Real estate

Retail

Rubber

- Bridgestone Corp. (TYO: 5108)

- The Yokohama Rubber Co., Ltd. (TYO: 5101)

Securities

- Daiwa Securities Group Inc. (TYO: 8601)

- Nomura Holdings, Inc. (TYO: 8604)

Services

- Cyberagent Inc. (TYO: 4751)

- Dena Co., Ltd. (TYO: 2432)

- Dentsu Inc. (TYO: 4324)

- Japan Post Holdings Co., Ltd. (TYO: 6178)

- Konami Corp. (TYO: 9766)

- LY Corporation (TYO: 4689)

- Mercari Inc. (TYO: 4385)

- M3 Inc. (TYO: 2413) (Parent company for MDLinx)

- Nexon Co., Ltd. (TYO: 3659)

- Nintendo Co., Ltd. (TYO: 7974)

- Oriental Land Co., Ltd. (TYO: 4661)

- Rakuten Inc. (TYO: 4755)

- Recruit Holdings Co., Ltd. (TYO: 6098)

- Secom Co., Ltd. (TYO: 9735)

- Toho Co., Ltd. (TYO: 9602)

- Trend Micro Inc. (TYO: 4704)

Shipbuilding

- Kawasaki Heavy Industries, Ltd. (TYO: 7012)

Steel

- JFE Holdings, Inc. (TYO: 5411)

- Kobe Steel, Ltd. (TYO: 5406)

- Nippon Steel Corp. (TYO: 5401)

- Pacific Metals Co., Ltd. (TYO: 5541)

Trading companies

See also

- S&P/TOPIX 150

References

- "the Nikkei (index) definition, meaning – what is the Nikkei (index) in the British English Dictionary & Thesaurus". cambridge.org. Cambridge Dictionaries Online.

- "Nikkei 225". Yahoo.com. Yahoo. Archived from the original on 12 December 2011.

- "指数情報 - 日経平均プロフィル". indexes.nikkei.co.jp. Retrieved 23 April 2024.

- "TOPIX". Japan Exchange Group. Retrieved 23 April 2024.

- "FAQ (Nikkei Stock Average)" (PDF). Nikkei Inc. 4 April 2022. Retrieved 24 February 2024.

- "The World's Wildest Market and 2 Television Milestones". The Motley Fool. 7 September 2013. Retrieved 24 February 2024.

- Nikkei Net interactive Archived 22 December 2008 at the Wayback Machine

- "Nikkei Futures | About". 7 January 2014.

- "Finfacts: Irish business, finance news on economics". FinFacts.com. Archived from the original on 28 October 2019.

- "Japan Central Bank's ETF Shopping Spree Is Becoming a Worry". Bloomberg. 18 July 2017.

- "Japan's Central Bank Is Distorting the Market, Bourse Chief Says". Bloomberg. 19 July 2017.

- "Bank of Japan's $150 Billion ETF Binge Looks Likely to Slow Next Year". Bloomberg. 10 December 2017.

- "BoJ Now A Top 10 Shareholder In 90% Of Nikkei 225". Barrons. 24 April 2017.

- "What Happens When The Bank Of Japan Owns Everything?". Forbes. 27 April 2016.

- "Nikkei index hits 30,000 for first time in three decades". The Nikkei. 15 February 2021. Archived from the original on 15 February 2021.

- Hasegawa, Kyoko (22 February 2024). "Japan's Nikkei breaks bubble-era record". Yahoo News. AFP. Retrieved 24 February 2024.

- "Japan's Nikkei Stock Average tops 40,000 for first time". Nikkei Asia. Nikkei Asia. Retrieved 4 March 2024.

- "Historical Nikkei 225 Intraday Futures Data (JNK)". PortaraCQG. Retrieved 28 October 2022.

- "Finfacts: Irish business, finance news on economics". www.finfacts.com. Archived from the original on 28 October 2019. Retrieved 19 January 2020.

- "Historical Data (Nikkei 225) - Nikkei Indexes". indexes.nikkei.co.jp. Retrieved 19 January 2020.

- "NIKKEI 225 Index (Japan) Yearly Stock Returns". www.1stock1.com. Archived from the original on 17 July 2019. Retrieved 19 January 2020.

- "Components:Nikkei Stock Average (Nikkei 225)". Nikkei Indexes. 13 October 2023.

External links

- Nikkei 225 Components — official website at indexes.Nikkei.co.jp

- Index detail: Nikkei Stock Average 225 — at Reuters

- Nikkei 225 page – NKY:IND — on Bloomberg Markets

- Nikkei 225 index — on Google Finance

- Nikkei 225 index — on Yahoo! Finance

- Nikkei 225 index — on Hargreaves Lansdown

- Nikkei 225 profile — at Wikinvest