This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 20,525 times.

Secured credit cards offer those with little or damaged credit a way to build or repair their credit scores. To get a secured credit card, you need to make a cash deposit and the deposit acts as collateral for your credit limit. In addition to building credit, having a secured credit card allows you to do things that you couldn’t do without a credit card, such as booking an airplane ticket or renting a car. Before you try to get a secured credit card, you will want to take some time to choose a good card. If you are approved, then you can start using your secured credit card to improve your credit rating.

Steps

Choosing a Secured Credit Card

-

1Find a secured credit card issuer. Not all banks issue secured credit cards, but many credit unions offer secured credit cards to their members. If you are a member of a credit union, then you may want to check with them first. Secured credit cards from credit unions often offer lower interest rates and do not have annual fees.

- If you are not a member of a credit union, you may be able to get one from your bank. Some major banks like Wells Fargo, Bank of America, and Capital One offer secured credit cards.[1]

-

2Compare secured credit cards. Not all secured credit cards have the same terms. Some have high interest rates and others charge annual fees or other fees that eat away at your available credit limit.[2]

- Major banks and credit unions offer lower interest rates and fees on secured credit cards and some even offer rewards.

- Avoid secured cards that charge high interest rates compared to other cards, or that come with annual and/or maintenance fees. The high interest and fees can cost you hundreds of dollars per year.

Advertisement -

3Choose an issuer who reports to the three credit bureaus. If you are getting a secured credit card in order to build or improve your credit score, make sure you choose one that reports to the three credit bureaus. Otherwise, the secured credit card doesn’t help you with your credit score.[3]

- If you are applying online, read the card benefits page on the application website to find out whether the issuer reports to the credit reporting agencies. This is also the section that tells about interest rates, fees, required security deposit and credit line options.

- If you already have a secured card, you can tell if the issuer reports to the credit agencies by checking your credit report. Also, if you are receiving unsolicited offers for unsecured credit cards in the mail, chances are your credit score is improving.

- Some issuers report to the credit bureaus as “secured.” Having a card reported as “secured” does not lower your FICO credit score, but some credit reviewers may see it as a reason to deny you credit. However, if you have a good payment history, then having a secured credit card may have a positive effect on your credit score over time.

Getting a Secured Credit Card

-

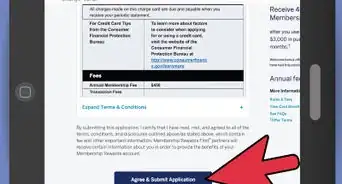

1Apply for a secured credit card. You can apply for a secured credit card in person at a local branch of your bank or credit union, but most major banks allow you to apply online as well. The card issuer will review your application to determine if you meet their requirements for approval. You will need to provide your:[4]

- Name

- Address

- Social Security number

- Income

- Employment information

-

2Wait for approval. The approval process takes several days. Even though secured credit card companies cater to customers with credit problems, they may still look at your credit report to see if you have any unpaid debts. Increase your chances of getting approved by paying off any unpaid balances, even if they’ve been sent to collections. This will repair your credit enough to qualify for a secured card.[5]

- You can be denied for a secured credit card if you do not meet all of the requirements for approval. For example, you will be denied if you do not have a bank account, if you do not have enough income to make the required initial deposit, or if your credit score is extremely low because of a long history of delinquent accounts or accounts in collections.[6]

-

3Make a deposit. A secured credit card requires you to make a deposit that acts as collateral for your line of credit. In general, the amount of your deposit equals your credit limit. For example, if you deposit $500, you will have a credit limit of $500.[7]

- The amount of your initial deposit will depend on the credit limit for which you are approved.

- You can make the deposit in person, online, or over the phone.

- You will need to provide your checking account number and your bank’s routing number.

- Some issuers allow you to pay the deposit in installments. This is convenient if you don’t have enough money to make the minimum deposit all at once.

- Once you make your security deposit, your account will be open and your card will be mailed to you. You should receive it in two to three weeks.

Using a Secured Credit Card

-

1Expect a low credit limit. Credit limits for secured credit cards are often low. For example, if you can only deposit $300 as collateral, then your credit limit may only be $300. Plan to use the secured credit card for small purchases and pay the balance off each month to start building better credit for yourself.[8]

- Keep in mind that even if your credit limit is low, you can still use the card to build your credit.

-

2Rebuild your credit rating. The main reason you would want to get a secured credit card is to build your credit. Making regular monthly payments on your secured credit card will help to raise your credit score over time.

- If your credit is damaged due to a divorce, medical problem or loss of a job, a secured credit card offers you an opportunity to rebuild credit.

- If you have no credit history because you have never had a credit card in the past, a secured credit card allows you to establish a positive payment history, which builds your credit score.[9]

-

3Work towards getting an unsecured card. Once you have established a pattern of paying on time, many secured credit card issuers will allow you to transfer to an unsecured credit card. This may take several months or a year.

- If your lender does not offer this benefit, consider applying for an unsecured credit card with the same lender. They may approve your credit card application because of your positive payment history with the secured card.[10]

- When you graduate to an unsecured card, you get your deposit back. Some lenders will even have allowed your deposit to earn interest. In that case, you will get your deposit back plus interest.

-

4Try to pay your balance off every month. Some secured credit cards come with a high interest rate, which can make it hard to pay off your debt if you do not pay the balance off every month. If you do not pay your balance off each month, you may end up with hundreds of dollars in interest payments.

- Secured credit cards also often charge higher fees for late payments, returned checks, missed payments, or for going over your credit limit.

- Keep in mind that if you allow interest expenses and fees to build, you may not be able to pay off your debt and this can make your credit rating even worse.[11]

-

5Enjoy the convenience of a credit card. Having a secured credit card allows you to make purchases that you would not be able to make with cash or a debit card. For example, hotels, airlines and car rental agencies require a credit card. You can also use your secured card to pay for unforeseen emergency expenses if you don’t have enough cash.[12]

References

- ↑ http://www.moneycrashers.com/best-secured-credit-cards-bad-credit/

- ↑ http://www.bankrate.com/finance/credit-cards/secured-credit-cards-vs-prepaid-cards.aspx

- ↑ http://www.bankrate.com/finance/credit-cards/10-questions-before-getting-a-secured-credit-card-1.aspx

- ↑ http://www.choose.net/money/guide/faqs/how-long-application-time-credit-cards.html

- ↑ http://bucks.blogs.nytimes.com/2011/04/20/secured-credit-cards-not-everyone-qualifies/?_r=0

- ↑ http://www.bankrate.com/finance/credit-cards/what-to-do-if-turned-down-for-secured-card.aspx

- ↑ http://www.bankrate.com/finance/credit-cards/10-questions-before-getting-a-secured-credit-card-1.aspx

- ↑ http://www.moneycrashers.com/secured-credit-card/

- ↑ http://www.moneycrashers.com/secured-credit-card/

About This Article

To get a secured credit card, apply for one at a local bank or credit union either in person or online. For the application process, you’ll need to provide your name, address, social security number, income, and employment information. If your application is approved, you’ll need to make a deposit that acts as collateral for your line of credit. For example, if you deposit $500, you will have a $500 credit limit. Once you make your deposit, your account will be open and your card will be issued to you. To learn how to use a secured credit card, keep reading!