X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 9,172 times.

Learn more...

EFTPS is the Electronic Federal Tax Payment System and it allows you to make payments towards your taxes free of charge, (depending on if your bank charges you or not). Read this article to learn how to use the system.

- Note: If you are a business entity, you need to pay an estimated quarterly tax. This system simplifies the entire process.

Steps

-

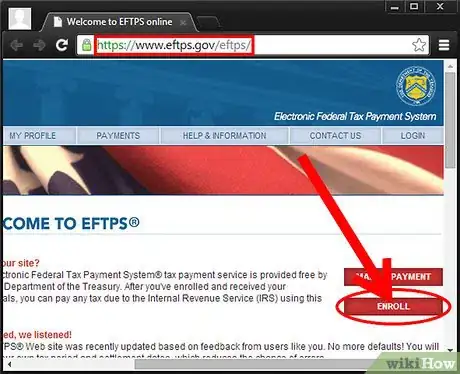

1Go to the website. Click on Enrollment.

-

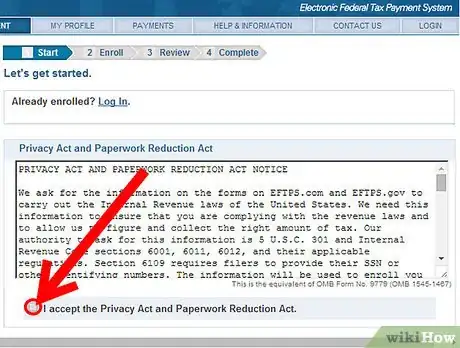

2Check the box beside the "I accept the Privacy Act and Paperwork Reduction Act."Advertisement

-

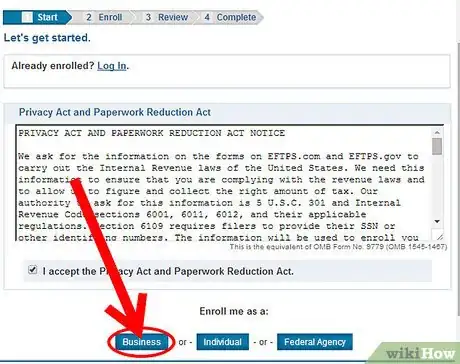

3Choose between Business, Individual, or Federal Agency. (For the purposes of this article, the Business option will be used).

-

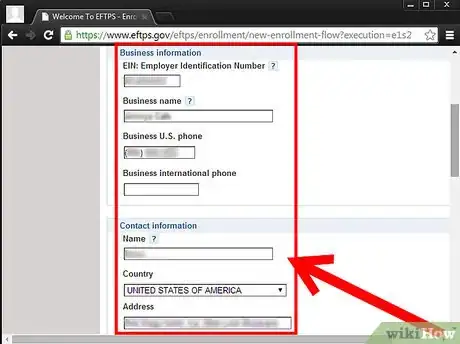

4Fill out the form. This system is as, or more, secure than banks, so you won't have to worry about the safety of the information.

-

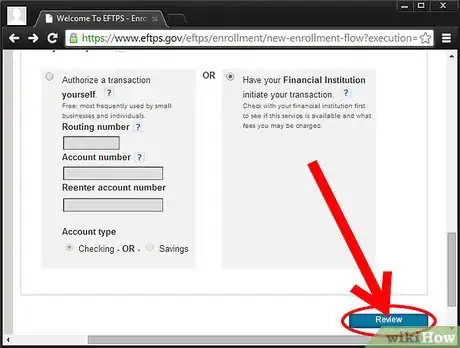

5Click on "Review."

-

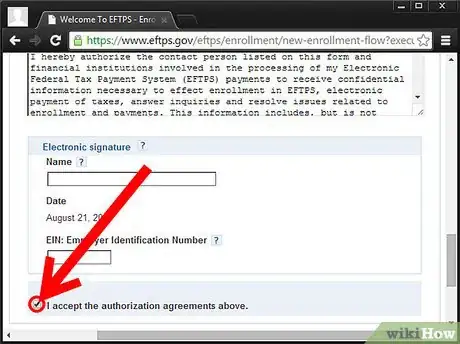

6Scroll down and check the box beside "I accept the authorization agreements above.".

-

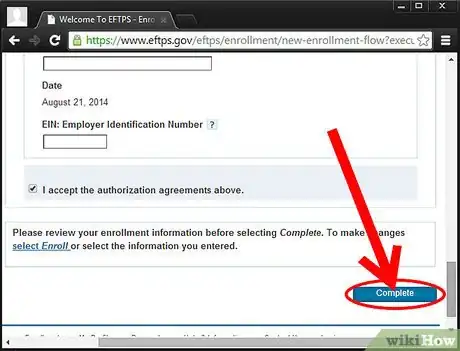

7Click on Complete.

-

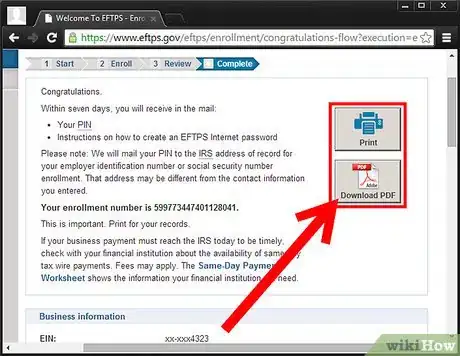

8Check the information out and print it. It is a good idea to save it as a PDF as well, in case you lose your hard copy. Note the enrollment number for further reference.

-

9Wait for your required documents. You will receive a PIN in the mail, as well as instructions on receiving a password.

Advertisement

About This Article

Advertisement

-Step-13.webp)

-Step-9.webp)